Advanced search

Search Results: 38 results for keyword "cashless payments".

Viettel ready to provide Mobile Money service to all customers

11-03-2021 11:19

In line with the prime minister’s approval of the two-year trial of the Mobile Money service, state-owned telecommunications giant Viettel is ready to roll out the new service for its customers.

Prime Minister approves Mobile Money pilot programme for two years

10-03-2021 10:39

The prime minister has approved the pilot application of Mobile Money, which allows the use of mobile phone accounts to pay for small-value goods and services. The decision takes effect from March 9, 2021.

Bold new approach for digital banking

06-03-2021 10:00

The State Bank of Vietnam (SBV) in late 2020 issued Circular No.16/2020/TT-NHNN amending Circular No.23/2014/TT-NHNN guiding the opening and use of payment accounts at payment service providers, which is one of the prominent legal documents issued to promote the transformation and development of cashless payments.

Banks launch domestic credit chip cards

28-01-2021 17:16

The National Payment Corporation of Vietnam (Napas) and seven domestic banks recently launched domestic credit chip cards with unified standards to promote cashless payments and tackle black credit.

Banks to introduce domestic credit chip cards to promote cashless payments

25-01-2021 09:40

The National Payment Corporation of Viet Nam (Napas) last week said it would work with seven banks to introduce domestic credit chip cards with unified standards to limit cash payments and tackle black credit.

Mastercard lending momentum to unfolding digital payments landscape

10-12-2020 08:00

Cashless payments are undoubtedly on an upward trajectory globally and regionally, highlighted by COVID-19 and governors expediting digital transformation. Safdar Khan, division president of Mastercard’s emerging markets in Southeast Asia department, shared with Celine Luu what key trends will shape the payment industry and how Mastercard creates a secure and convenient ecosystem to deliver seamless, top-notch contactless services to their customers.

Vietnam to allow banks to use foreign e-wallets for int’l payments

02-11-2020 09:09

The State Bank of Vietnam is drafting a circular regarding cashless payments which might allow domestic commercial banks and domestic intermediary payment companies to co-operate with foreign intermediary payment companies to provide international payment services.

Shopping habit focus for new Visa initiative

21-09-2020 19:09

With a significant rise in e-commerce and cashless payments during the COVID-19 pandemic, global digital payment leader Visa has launched the “Where You Shop Matters” initiative through partnerships with Shopee and Now to provide a seamless online shopping experience.

Consumers beware of e-swindlers preying on fledgling cashback apps

04-09-2020 14:17

While cashback is considered a strong method to encourage cashless payments, numerous websites and apps are taking advantage of uninformed consumers with untransparent and illegal multi-level marketing models.

Visa contactless payments set record growth as Vietnamese embrace cashless payments

03-08-2020 13:42

Visa, the world’s leader in digital payments, today announced that Visa contactless transactions grew more than 500 per cent from the first half of 2019 to the first half of 2020. The total value of Visa contactless transactions increased more than 600 per cent over the same period.

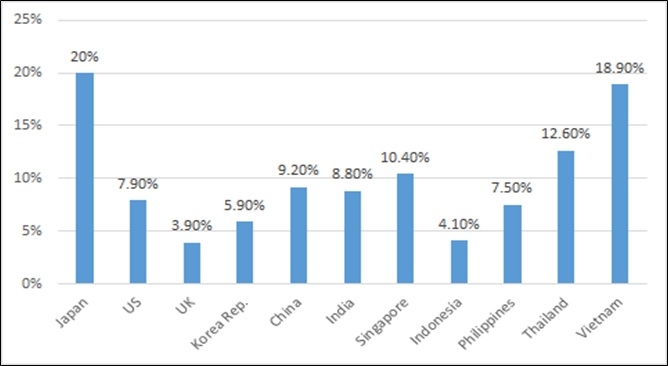

Vietnam leading the regional pack in embracing a cashless society

15-06-2020 15:18

The Vietnamese government is looking to take the country towards relying less on cash when making purchases. Dang Tuyet Dung, Visa country manager for Vietnam and Laos, talked to VIR’s Hoang Anh about the potential future of a cashless society for the country.

Cashless payments beginning to gain traction across the country

01-06-2020 08:44

Visa, the world’s leader in digital payments, recently published the Consumer Payment Attitudes 2019 study, showing a marked drop in cash usage in Vietnam as consumers embrace new ways to pay. Dang Tuyet Dung, country manager for Visa Vietnam and Laos, told VIR’s Thanh Van about the company’s plan to help Vietnam achieve a cashless economy.

Vietnamese take increasingly to cashless payments

29-05-2020 09:48

Non-cash payments have increased sharply, especially through mobile devices and the internet, according to the State Bank of Vietnam.

Vietnam soon implementing mobile money

12-04-2020 16:55

The State Bank of Vietnam is is urgently working with relevant ministries to finalise the pilot programme of utilising telephone subscription accounts to make small payments, or mobile money.

Encouraging mobile money to stem the spread of COVID-19

02-04-2020 10:19

As the number of COVID-19 cases increases, many are opting for cashless payments to avoid direct contact and potential hygiene issues arising with banknotes which may help the spread of the COVID-19. This boosts the appeal of digital payments, particularly mobile money – a service in which the mobile phone is used to access financial services – to those who have not considered this form of transaction.

Mobile Version

Mobile Version