Vietnam soon implementing mobile money

The draft decision is slated to be submitted to the prime minister this month. Previously, Directive No.11/CT-TTg dated March 4, 2020 on further actions to fight against COVID-19 also implied that mobile money should be put into practice as soon as possible.

|

| Mobile money will be piloted for small payments across Vietnam |

Following a well-conceived cashless payment trajectory and ensuring its effective implementation is crucial in reaching the Vietnamese government’s target of building a cashless economy.

Mobile money has transformed the landscape of financial inclusion in developing and emerging market economies, leapfrogging the provision of formal banking services.

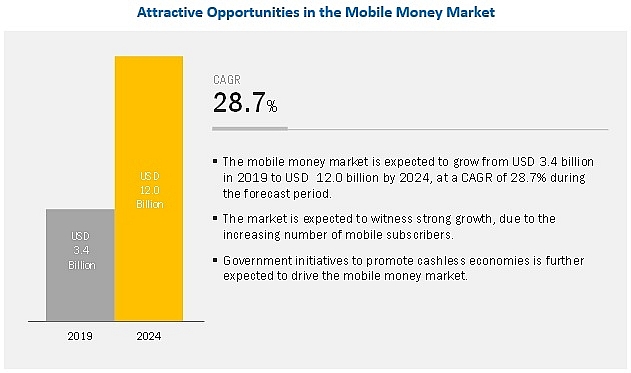

The size of the global mobile money market is expected to grow from $3.4 billion in 2019 to $12 billion by 2024, at a compound annual growth rate (CAGR) of 28.7 per cent during the forecast period, cited from a MarketsandMarkets report.

|

| The global mobile money market is expected to grow from $3.4 billion in 2019 to $12 billion by 2024. Source: MarketsandMarkets |

Experts also state that mobile money could facilitate transactions, enable savings, credit products, and even simplify taxation for governments – all at scale and much faster than brick-and-mortar financial networks.

The adoption of mobile money and an adequate regulatory framework in Vietnam is getting extra support from the Vietnamese government. Minister of Information and Communications Nguyen Manh Hung has also encouraged financial inclusion, saying that the application of mobile money could generate economic growth of up to 0.5 per cent for countries.

|

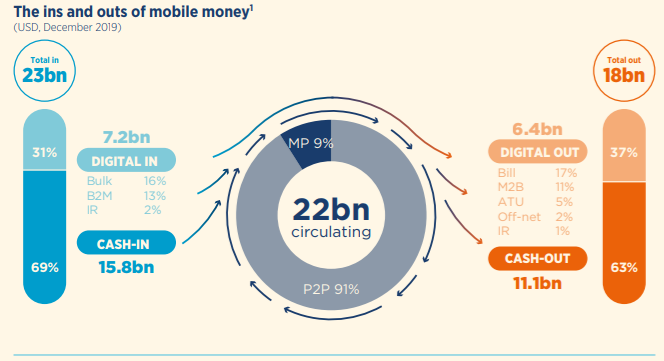

| The ins and outs of mobile money as of December 2019. Source: GSMA |

According to the 2019 State of the Industry Report on Mobile Money by the Global System for Mobile Communications Association (GSMA), digital transactions represented the majority of mobile money flows.

Here’s a particularly interesting statistic from the GSMA report: for every 100,000 adults in today’s world, there are 11 banks, 33 ATMs, and 228 mobile money agents.

With 290 live services across 95 countries and 372 million active accounts, mobile money is entering the mainstream in most markets where access to financial services is low. Also, 77 deployments worldwide have over a million active accounts (90-day) compared to 27 in 2014.

According to the report, mobile money services are especially available in 96 per cent of countries where less than a third of the population has an account at a formal financial institution.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Tag:

Tag:

Mobile Version

Mobile Version