Advanced search

Search Results: 837 results for keyword "State Bank of Vietnam".

Which banks are allowed to increase their credit growth?

16-11-2021 20:02

11 of 13 Vietnamese commercial banks have been given permission to increase their credit lines by the State Bank of Vietnam.

SBV promotes two new deputy governors

15-11-2021 14:32

Prime Minister Pham Minh Chinh signed two directives appointing two deputy governors for the State Bank of Vietnam (SBV) last week.

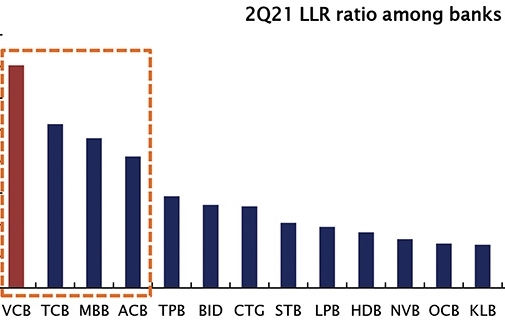

Banks raise provisions in anticipation of bad debt

10-11-2021 21:41

In the face of rising bad debt amid the ongoing COVID-19 pandemic, commercial banks have been forced to write up their loan loss provisions, according to industry sources.

Govt' to consider zero-interest loans for all airlines

07-10-2021 23:05

The Government Office has instructed the Ministry of Planning and Investment, the Ministry of Finance, the Ministry of Transport and the State Bank of Vietnam to study a proposal by the Vietnam Aviation Business Association (VABA), in which the airline industry is to gain access to 25 trillion VND (over 1.1 billion USD) of zero-interest loans.

SeABank raises charter capital to nearly $590 million

06-10-2021 10:48

Following the approval of the State Bank of Vietnam, SeABank has increased its charter capital from $531 million to nearly $590 million by paying dividend in shares and issuing shares to employees under the Employee Stock Option Program.

Private airlines ask for zero-interest loans

01-10-2021 13:43

Private airlines have requested access to 0 percent interest loans, similar to the support Vietnam Airlines (VNA) - the country's flag carrier - is entitled to, heard a meeting among the State Bank of Vietnam (SBV), commercial banks and the airlines.

Buyers seek loan help

19-09-2021 08:00

The pandemic as a force majeure event has crippled people’s ability to meet loan repayment requirements, but while the real estate sector also appears susceptible to the crisis, the State Bank of Vietnam and commercial lenders have taken measures to deal with worrisome property assets.

Creating credit mechanism essential for banks to support the aviation industry

17-09-2021 08:02

The government has directed the State Bank of Vietnam to set forth a credit support scheme within this month to help local air carriers bolster liquidity.

MSB to increase its charter capital to nearly $664 million

15-09-2021 08:18

The State Bank of Vietnam has approved MSB to increase its charter capital by VND3.525 trillion ($153.26 million) to VND15.275 trillion ($664.13 million) through stock issuance to pay dividends.

More bank support given to businesses affected by COVID-19

11-09-2021 13:59

Credit institutions and businesses can now relax after the State Bank of Vietnam enacted Circular No.14/2021/TT-NHNN to extend the time and scope of debt rescheduling for enterprises suffering from COVID-19.

Eximbank appoints Tran Van Loc as new CEO

09-09-2021 08:51

The Board of Directors of Eximbank has just appointed Tran Van Loc as CEO, pending approval by the State Bank of Vietnam.

COVID-19: SBV issues new document on rescheduling of debt payments

08-09-2021 12:47

The State Bank of Vietnam (SBV) on September 7 issued a circular amending and supplementing a number of articles of Circular No. 01/2020/TT-NHNN issued by the SBV Governor directing foreign credit institutions and bank branches to reschedule debt payments, waive and reduce borrowing interest and fees, and maintain the groups in order to support customers affected by the COVID-19 pandemic.

Perspectives on SBV’s debt rescheduling alterations

02-09-2021 21:36

The current wave of COVID-19’s Delta variant has pushed the Vietnamese government into implementing strict social distancing measures and lockdowns, which also significantly impedes the domestic economy. So, it should come as no surprise that the State Bank of Vietnam (SBV) has proposed amendments to Circular No.03/2021/TT-NHNN dated April 2 that would extend the circular’s effectiveness while widening the protections it provides for pandemic-impacted borrowers.

Banks struggle to snap up distressed domestic lenders

02-09-2021 21:30

Financially sound local and foreign banks are turning a deaf ear to acquire distressed and insolvent Vietnamese banks as they find it hard to access better equipment to address a range of adverse outcomes under a widely accepted supervisory regime.

Controversies arise as realtors feel left out amid health crisis

02-09-2021 16:17

The economic downturn has affected almost all industries, including real estate. However, the State Bank of Vietnam and other financial institutions are still keeping a tight rein on this capital-intensive sector.

Mobile Version

Mobile Version