Advanced search

Search Results: 2,237 results for keyword "banks".

How bad debts influence lending rates

30-05-2023 18:38

Last week the State Bank of Vietnam continued reducing diverse regulatory interest rates in a bid to help remove impediments for borrowers, as well as support credit institution efforts to drive down input costs, and from there be able to reduce lending rates.

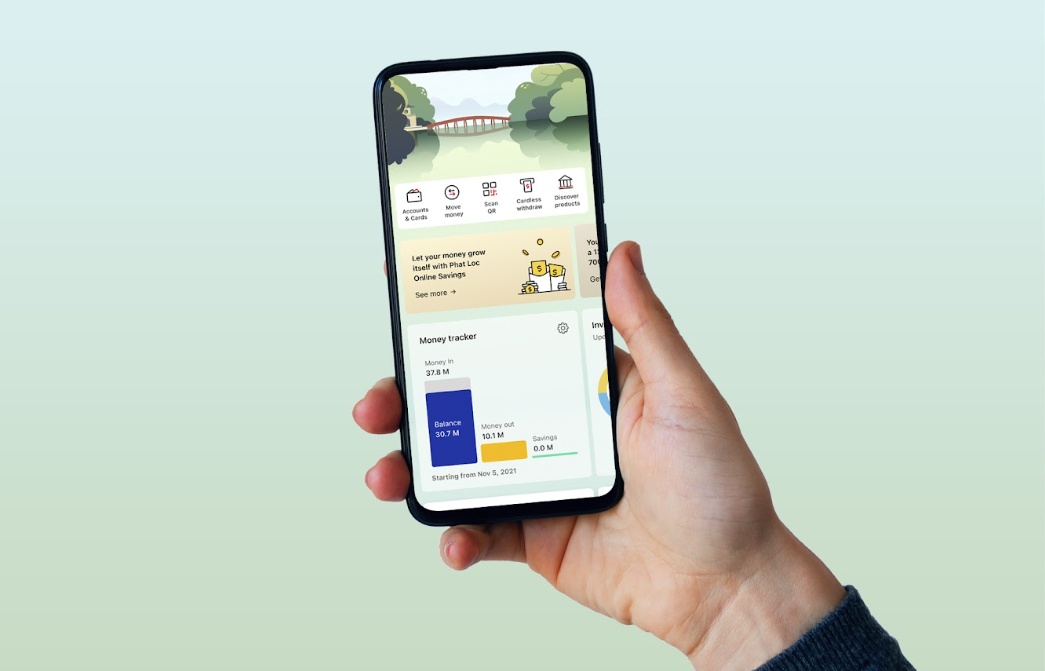

Techcombank partners with Personetics to revolutionise financial management with AI

26-05-2023 09:44

Techcombank and Personetics-a provider of data-driven personalisation and customer engagement tools for banks and financial services companies-are revolutionising financial management through the integration of AI technology to offer customers enhanced control over their finances.

Fund management acquisitions unlock new edge

23-05-2023 10:57

Vietnamese banks are increasingly expanding their investment in fund management and securities firms to diversify their services, unlock new revenue streams, and strengthen their competitive edge.

VPBank has received a 10 per cent deposit from SMBC

19-05-2023 15:59

At an investor-update meeting on May 18, Luu Thi Thao, deputy general director of VPBank, revealed that the bank has received a 10 per cent deposit from Japanese partner SMBC, as part of the $1.5 billion private placement agreement signed between the two banks.

Direction clearer in weak bank overhaul

16-05-2023 10:04

Decisive action taken by Vietnam’s central bank on restructuring failing banks signifies a considerable stride towards revamping and fostering a sound financial landscape.

Lenders adjust as real estate giants revive ventures

16-05-2023 09:55

Some banks are strategically adapting lending practices and risk management approaches to address the complexities and risks associated with real estate-related credit, particularly for large-scale property developers.

Charter capital of banks to increase sharply in 2023

15-05-2023 11:03

Many banks plan to increase their charter capital in 2023 in order to ensure operational safety and have more resources for business development.

Bank deposit interest rates keep falling

09-05-2023 15:22

Banks have been steadily cutting deposit interest rates, which have reached around 8%, a move aimed at reducing lending rates to support businesses.

Bad bank debts cast shadow over profit outlook

06-05-2023 12:10

Several banks have posted low profit growth in the first quarter (Q1) of this year, with some even seeing negative growth, mostly due to a spike in non-performing loans (NPLs), leading to soaring provisioning costs.

Banks get moving with fresh deals

04-05-2023 10:00

The Vietnamese banking sector continues to be characterised by a dynamic merger and acquisition landscape, driven by domestic consolidation and foreign investment.

Developers and banks make recovery efforts

03-05-2023 20:00

The real estate market has some signs of recovery with capital injected into the market, helping to create confidence and influence consumer behaviour.

Stunning Muong Lay town

25-04-2023 15:29

Muong Lay town in Dien Bien province boasts a very special position compared to other localities around Vietnam, as it is located on the banks of the Son La Hydropower Reservoir at the confluence of the Da River, the Nam Na River, and Nam Lay Stream. Muong Lay has long been dubbed a “jewel” atop the northwest skies thanks to its scenery that makes visitors fall in love.

Lenders manifest steady trajectory with profit figures

25-04-2023 13:00

Although first quarter business results of banks show deceleration compared to the final quarter of 2022, in the current macro context, this still is an encouraging growth.

Companies hold back from listing in exchange shake-up

25-04-2023 10:32

A number of companies have postponed or entirely cancelled plans to list in Vietnam due to current market volatility and economic uncertainties, while some banks signal their intention to tap into broader funds by switching to the Ho Chi Minh City bourse.

Wider recognition a top reason for upping bank activity abroad

05-04-2023 08:00

Vietnamese banks are proactively expanding their presence in the foreign markets in order to serve more customers. Kent Wong, chairman of the Legal Committee at the European Chamber of Commerce in Vietnam, discussed with VIR’s Celine Luu the positives and negatives associated with the practice.

Mobile Version

Mobile Version