Bad bank debts cast shadow over profit outlook

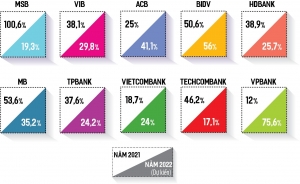

The Q1 financial statements of several banks reflect a spike in their bad debts from NPLs, with some lenders even experiencing a 50-70 per cent increase in such loans.

At Orient Commercial Bank, bad debt volumes jumped 51 per cent in Q1 to exceed $174 million, of which those in the high-risk Group 5 category spiked by 54 per cent.

The bank's bad debt ratio rose from 2.2 per cent to 3.3 per cent during the same period, while rising pre-tax profit was reportedly largely due to the reduced sum it had put into its provisioning fund.

|

Military Bank (MB) is also facing a similar situation. The bank’s bad debt volume reached $367 million last quarter, soaring by 68 per cent on-year, with debts categorised as subprime Group 3 and doubtful Group 4 witnessing a sharp increase.

MB’s bad debt ratio stood at 1.75 per cent for Q1, compared to the 1.09 per cent ratio in Q4/2022. Of note are the bank's Group 2 debts, considered in need of attention, which have swollen to $725 million, a more than two-fold increase compared to the previous quarter. Despite soaring bad debts, the sum put into the bank's provisioning fund was reduced by 13 per cent. This has been suggested as one of the reasons why MB still posted profit growth of over 10 per cent in Q1.

Similarly, total bed debt volume at Eximbank inched up 30 per cent in Q1, rising from 1.8 per cent in Q4/2022 to 2.3 per cent. The bank’s profit growth was also reportedly due to the reduced sum put into provisioning, which was cut by 42 per cent during the period.

At ABBank, total bad debt in Q1 was close to $140 million, up 35 per cent from Q4/2022, with subprime debts rising the most. Consequently, its bad debt ratio swelled from 2.88 per cent to 4.03 per cent in the same period.

VPBank bad debt ration for Q1 came to 2.6 per cent from just 2.19 per cent in the previous quarter and is expected to rise further. A spike in the provisioning sum is one of the factors leading to a 77 per cent drop in the bank’s profit during this period.

Despite this, VPBank CEO Nguyen Duc Vinh expects the diverse measures the bank has taken to aid its customers will reduce the bad debt volume in the second half to around 2.2 per cent.

Analysts at VNDirect Securities predict that banking sector profit could grow by as much as 11 per cent this year, while those at Viet Dragon Securities forecast profits could grow as much as 13.7 per cent.

| Soaring compensation costs cast shadow on insurer business Despite a spike in premiums, many insurers suffered in terms of performance in 2022 on the back of soaring compensation costs. |

| Retail segment brightens bank profit picture Many banks have unveiled their third-quarter business results, showing a spike in their profits, leveraging well-conceived retail lending development strategy amid restricted credit line. |

| Dampening bank profit picture in coming months Interest rates trending higher and vulnerabilities in the corporate bond and real estate markets are expected to dampen banks' profit prospects in the coming time. |

| State Bank asks for extension to bad debt programme The Government has asked for an extension to a pilot programme designed to handle bad debt from domestic financial institutions during a meeting with the National Assembly yesterday in Hanoi. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Banking sector targets double-digit growth (February 23, 2026 | 09:00)

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

Tag:

Tag:

Mobile Version

Mobile Version