Advanced search

Search Results: 837 results for keyword "State Bank of Vietnam".

Credit tweak opens door for economic rejuvenation

08-09-2022 09:00

Credit institutions with ample financial buffers, sound risk management, and participation in weak banks’ restructuring journey would gain an upper hand in terms of higher-than-average loan ceilings.

Charter capital boost offers new credit room

31-08-2022 09:00

A handful of credit institutions are raising their charter capital in a bid to strengthen their financial buffer and competitiveness, while maintaining their capital adequacy ratio as required by regulators.

Lenders juggle with tax info obligations

30-08-2022 09:00

Cybercriminals and the exposure of account information remain significant barriers for all stakeholders, with commercial banks now required to identify and collect holding information of customers to relevant authorities in a bid to fulfil tax obligations.

Firm grasp of rules crucial in handling customer info

29-08-2022 08:00

The State Bank of Vietnam has issued a formal request to credit institutions and foreign bank branches for cooperation and information sharing with tax administration organisations. Le Khanh Lam, tax partner at RSM, discussed with VIR’s Le Luu how banks and tax agencies can harmonise the fresh legislation, and how barriers can be overcome without compromising customers’ rights.

Inflation risks pose questions for exchange rate policy

24-08-2022 10:59

In response to the recent Fed’s interest rate hike, the State Bank of Vietnam is predicted to tighten its monetary policy in an attempt to curb inflation, with a focus on controlling the exchange rate.

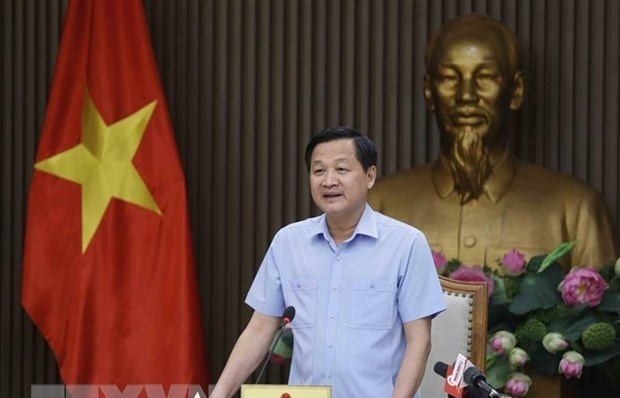

Deputy PM’s conclusions on interest rate support package

22-08-2022 19:47

The Government Office has issued an announcement on Deputy Prime Minister Le Minh Khai’s conclusions at a meeting on interest rate support package in accordance with the Government’s Decree No.31/2022/ND-CP dated May 20.

Banks should tighten assessment control of their corporate bonds investments: experts

18-08-2022 20:48

Banks must tighten their assessment control of corporate bond investments to avoid excessive risk and the misuse of funds raised by firms, experts said.

SHB to increase its charter capital

15-08-2022 13:33

Saigon-Hanoi Commercial Joint Stock Bank (SHB) has received approval from the State Bank of Vietnam to increase its charter capital to $1.16 billion.

Squeeze in allotted credit room for commercial banks

10-08-2022 10:56

The rapid expansion of credit and lending activities in the first few months of this year have prompted commercial banks to run out of credit lines, which had been temporarily allotted by the State Bank of Vietnam at the start of the year.

Tightening management of virtual currencies to prevent money laundering: SBV

04-08-2022 15:54

The State Bank of Vietnam (SBV) has given timely instructions to banks in order to prevent risks and acts that take advantage of virtual currencies in transactions, Deputy Governor Dao Minh Tu has said.

Gap between domestic and global gold prices is reasonable: SBV Governor

02-08-2022 14:26

Though the gap between domestic and global gold prices is significant, Governor of the State Bank of Vietnam (SBV) Nguyen Thi Hong said it is reasonable due to restricted supply.

Petrolimex to divest 40 per cent stake from PG Bank this quarter

19-07-2022 18:52

Vietnam fuel distributor Petrolimex has officially received the State Bank of Vietnam’s approval to divest a 40 per cent stake in PG Bank.

Central bank sells greenback to stabilise forex market

19-07-2022 10:31

The State Bank of Vietnam (SBV) has so far this year sold about 12-13 billion USD to stabilise the domestic forex market, according to Viet Dragon Securities Corporation (VDSC).

Vietnam in good stead as Fed takes big action

20-06-2022 08:00

The US Federal Reserve has raised interest rates by 75 basis points, the most aggressive increase since 1994, to combat rising inflation – but in Vietnam, a return to normal monetary policy is perhaps on the horizon for the State Bank of Vietnam.

Credit growth of banking system expands by over 17 per cent

18-06-2022 22:55

Hanoi - Credit of the Vietnamese banking system as of June 9 surged by 17.09 per cent against the same period last year, deputy governor of the State Bank of Vietnam (SBV) Dao Minh Tu said.

Mobile Version

Mobile Version