Advanced search

Search Results: 19 results for keyword "Buy Now Pay Later".

Buy now pay later service launched on LOTTE Mart app

30-09-2024 18:18

LOTTE C&F, the deferred payment service known as "Buy Now, Pay Later" (BNPL) under LOTTE Group, officially launched in the Vietnamese market on September 27.

Tech-driven embedded finance disrupting Vietnam’s financial landscape

04-05-2023 08:00

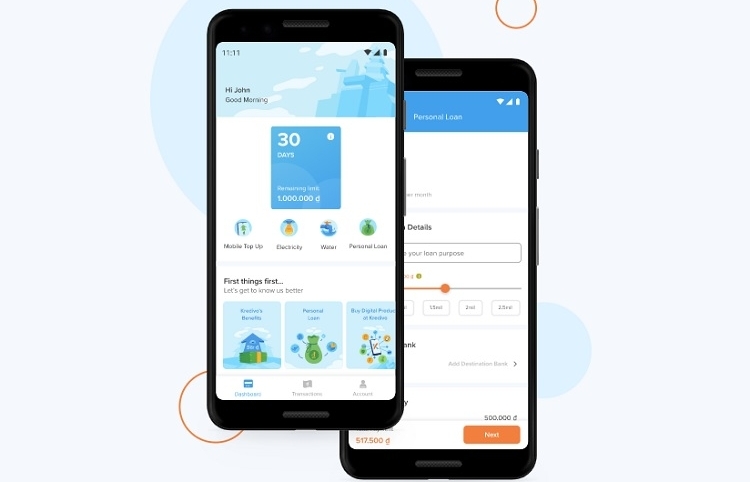

As technology evolves and the Vietnamese economy matures, more innovative fintechs are embracing the benefits of next-generation technology and unique business models to reach underserved populations and provide them with the means to access banking and financial services quickly and conveniently. Pham Quang Minh, general manager at Mambu Vietnam, digs into such fresh business models, as well as the outlook for the country's digital technology.

Home Credit teams up with OnePay to promote Home PayLater expansion

02-11-2022 15:31

Home Credit is working with OnePay on the buy now pay later (BNPL) model to promote digital payment habits in Vietnam.

Fundiin raises $5 million investment in Series A round

18-10-2022 13:55

Buy now pay later (BNPL) fintech Fundiin has successfully raised $5 million in a Series A funding round co-led by Trihill Capital and ThinkZone Ventures. The new round of funding will help Fundiin to expand at a faster pace and expand to Indonesia in the upcoming series B round.

BNPL services open up e-commerce options

26-09-2022 08:00

While the market for buy now, pay later services in Vietnam is still in its infancy, more users are opting for this payment method as the technology for both the credit rating process and other logistical aspects is refined.

Buy Now Pay Later - The future of retail payment?

21-09-2022 15:34

Foreign and Vietnamese companies are placing large bets on the buy now, pay later approach in Vietnam, thanks to a significant increase in the use of the payment method, but the sector still presents certain dangers.

Acquisitions fuelling buy now, pay later trends

24-08-2022 11:40

Buy now, pay later is often an interest-free way for consumers to defer payments on purchases. For retailers that subsidise the offering, it is a way to encourage conversion and higher average ticket sizes.

Home Credit invests VND200 billion into Buy Now Pay Later service

17-08-2022 15:42

Home PayLater – a digital financial product with a VND200 billion ($8.7 million) investment – is set to enhance the convenience of consumers’ online shopping experiences.

Home Credit partners with Tiki to launch Home PayLater

19-07-2022 17:30

Home Credit announced on July 15 that the company has signed a cooperation agreement with Tiki – one of Vietnam’s top e-commerce platforms – to launch Home PayLater, a Buy Now Pay Later product.

Kredivo introduces its newest Buy Now Pay Later offer

29-06-2022 12:23

Kredivo – Indonesia’s leading digital credit platform and one of the most valuable fintech unicorns in Southeast Asia – in partnership with VietCredit JSC, has just announced the launch of its premium product in Vietnam, enabling users to access a credit limit of up to VND25 million ($1,075).

"Buy now, pay later" on the rise in Vietnam

13-05-2021 15:22

The trend of buy now, pay later solutions is projected to gain traction in Vietnam with many players unveiling new services to tap into this fast-growing segment.

Assessing the potential of buy now, pay later services

26-09-2022 11:00

Home Credit is betting on the prospects of buy now, pay later services in Vietnam. Michal Skalicky, chief customer officer of Home Credit Vietnam, shared with VIR’s Thanh Van his insight into the growth potential in Vietnam’s e-commerce market.

Buy now, pay later offering unique, substantial value

22-08-2023 09:55

The buy now, pay later fintech segment is attracting strong attention of businesses and consumers and is considered the new piece of the financial market pie. Nguyen Anh Cuong, co-founder and CEO of Fundiin, told VIR’s Nguyen Thu about the advantages and potential barriers in Vietnam

Buy now, pay later model ripe for explosion across Vietnam

26-08-2021 14:00

The burgeoning e-commerce penetration amid the pandemic is paving the way for ‘buy now, pay later’ options to gain traction in Vietnam, particularly targeting those with insufficient credit history.

Buy now, pay later transactions to reach $3.33 billion in 2024

12-04-2024 09:59

Buy now, pay later (BNPL) payments in Vietnam are expected to grow by 41.8 per cent on an annual basis to reach $3.33 billion in 2024, according to an industry report released by ResearchAndMarkets on April 11.

Mobile Version

Mobile Version