Scale-up imperative in wind energy future

A new report released by the Global Wind Energy Council and Global Wind Organisation (GWO), in partnership with the Renewables Consulting Group, finds that the global wind industry will need to train upwards of 480,000 more people to GWO standards over the next five years to meet global wind power market demand in line with health and safety standards.

|

These workers will need to be trained to construct, install, operate, and maintain the world’s growing onshore and offshore wind fleet, and represents only a fraction of the job opportunities available in the growing wind industry.

Currently, the GWO training market, considered the global standard for wind workforce training, has the capacity to support the training needs of 150,000 workers by the end of 2021 and 200,000 by the end of 2022. But analysis in the Global Wind Workforce Outlook 2021-2025 finds that we will need at least 280,000 more trained workers to install the forecast 490GW of new wind power capacity coming online over the next five years.

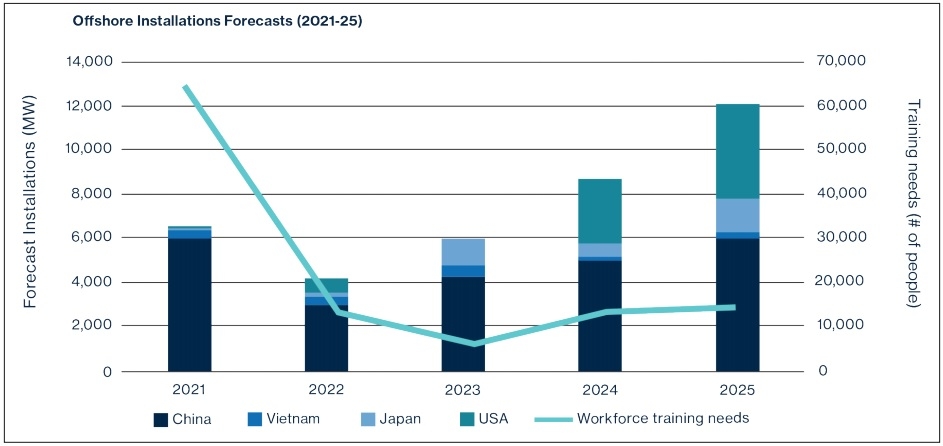

Of the 480,000 GWO-trained workers required worldwide, 308,000 will be deployed to construct and maintain onshore wind projects and 172,000 for offshore wind.

Over 70 per cent of the new global workforce training demand will come from the 10 markets analysed in the report, which includes Vietnam. The markets analysed in the report were selected for regional diversity, as well as spanning the largest onshore wind markets globally, high-growth markets for onshore and offshore wind, and emerging wind markets.

The wind industry needs to scale up at an unprecedented rate over the next decade to put the world on track to meet net zero. If ambition is scaled up to what it needs to be – three or four times current market forecasts – the workforce training requirements will be far higher than what was found in this report.

To meet this challenge, we need to prepare now for the workforce of the future, and this means training hundreds of thousands of workers across the world to be part of one of the fastest-growing industries.

The growth in onshore and offshore wind in all the target countries represent a significant opportunity for GWO and its global network of training providers. The volume of expected activity in the next five years is expected to require a significant ramp up in skilled personnel in each target market and provides justification for the expansion of the GWO network and the establishment of local training centres to support local supply chains and the development of skilled local workforces.

It is clear that the wind industry is in prime position to make a significant contribution to social and economic development in each of the target countries, helping to deliver benefits through the energy transition.

Vietnam is poised for more than 5.7GW of onshore and offshore wind growth over the next five years. While it shares strong fundamentals with its Southeast Asian neighbours, including rapidly rising power demand and industrialisation, Vietnam’s excellent wind resource potential gives it an edge in the region. Wind power currently comprises around 1 per cent of Vietnam’s electricity production but is set to take off under the Power Development Plan VIII (PDP8) for 2021-2030 with a vision to 2045.

Along with a high growth scenario for onshore and nearshore wind exceeding 16GW total installed capacity by 2030, the draft PDP8 includes targets for true offshore wind for the first time, with a high growth scenario of at least 3GW of offshore wind by 2030.

There are over 60 GW worth of offshore wind projects under development or consideration in Vietnam following applications for PDP8, but the first true offshore wind projects are not expected to come online before the middle of the decade. It remains unclear whether an extension of the current feed-in tariff (FiT) will be granted to projects commissioned beyond November 2021. Clarity on the FiT extension will be needed to enable the most developed projects to reach a financial investment decision.

Altogether, total wind installations are set to exceed solar photovoltaic capacity by 2045 under the draft PDP8, reflecting the strengthening commitment from the government to growth of the wind industry. Other growth drivers include Resolution 55, which aims to open up opportunities for private sector participation in the energy sector, and Document No.828/BCT-DLL detailing implementation of long-term energy planning including wind targets and interconnection strategies.

To deliver this scale of growth, Vietnam will need to expand and modernise its heavily burdened transmission network, where grid congestion and the threat of curtailment are primary concerns for renewable energy developers. Improving power purchase agreement bankability will also be key, particularly as policymakers have expressed aims to transition from a FiT scheme to competitive bidding. Sufficient lead time and consultation with industry and investors will be needed for a smooth and transparent transition to auctions in the future.

For already large wind markets like the US and China, scaling up training capacity can provide new job prospects and increase productivity through recognition of GWO standards. Emerging economies will need to develop their safety and technical training networks from the ground up to ensure alignment with global safety systems to ensure the long-term sustainability of the industry.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

- Bac Ai hydropower works stay on track despite holiday period (January 16, 2026 | 16:19)

- Fugro extends MoU with PTSC G&S to support offshore wind growth (January 14, 2026 | 15:59)

- Pacifico Energy starts commercial operations at Sunpro Wind Farm in Mekong Delta (January 12, 2026 | 14:01)

- Honda launches electric two-wheeler, expands charging infrastructure (January 12, 2026 | 14:00)

Tag:

Tag:

Mobile Version

Mobile Version