Rough waters remain in fuel price pressure

The Government Office last week issued Dispatch No.4648/VPCP-KTTH to the Ministry of Finance (MoF) requiring it to continue proposing a reduction of taxes and fees related to fuel and consumption, especially those that can cause an increase in input costs for production and business.

|

| Rough waters remain in fuel price pressure |

“This aims to help reduce costs and selling prices of products in service of exports, production, and business, contributing to controlling inflation and supporting the government’s monetary policy in the short and medium term,” the dispatch stated.

The MoF has also proposed to the government a plan to halve the preferential import tax for petrol and oil from the existing 20 to 10 per cent, in order to help reduce the prices of these items in the local market.

Meanwhile, the Vietnamese government has also submitted to the National Assembly a plan on reducing the special consumption tax and VAT for October.

According to the General Statistics Office (GSO), the cost of fuel currently occupies 3.52 per cent of the economy’s total production costs. If the fuel price rises 10 per cent, for example, it raises inflation by another 0.36 per cent and causes a 0.5 per cent reduction in the economy’s growth. The total taxes and fees currently account for 44 per cent of the selling price of fuel. In the structure of the price of petrol and oil, each litre sold on the market includes some types of taxes on average – VAT (10 per cent), special consumption tax (10 per cent), and environmental protection tax (4.3 US cents for petrol and 2.1 US cents for diesel).

Deputy Minister of Planning and Investment Tran Quoc Phuong said a reduction in fuel prices would come from both the country’s policy monitoring and global fuel prices. “However, though the fuel price can reduce, the prices of many items in the market still cannot be reduced or even increased. To successfully lower products’ prices in the market, many policies must be implemented in concert,” Phuong said.

The GSO warned that in the coming months, a series of headwinds will affect Vietnam’s production including a rise in producer price index (PPI) and import price index (IPI) which comes from global geopolitical tensions.

The PPI of the manufacturing and processing sector products escalated 4.44 per cent on-year in Q2, and 4.14 per cent on-year in the first half of the year. Many items saw high price hikes on-year, such as coke and refined oil (up 61.87 per cent largely due to the Russia-Ukraine conflict), metal (up 16.37 per cent mostly due to a reduction in global metal supplies), and chemicals (up 8.86 per cent by dint of high increases in prices of input materials such as resin and fuel, and rising logistics costs).

Meanwhile, the IPI is forecast to continue growing due to global supply disruptions caused by factors including the Russia-Ukraine clash. The IPI rose 11.43 per cent on-year in Q2 – including that of agro-foodstuffs (up 11.23 per cent), fuel (52.16 per cent, and manufacturing and processing products (9.77 per cent).

The on-year IPI for the first six months ascended 11.21 per cent – that of agro-foodstuffs (up 11.09 per cent), fuel (44.61 per cent), and manufacturing and processing products (9.81 per cent). All these hikes are expected to continue in the coming time, undermining the government’s efforts to control inflation, which is set to be about 4 per cent this year.

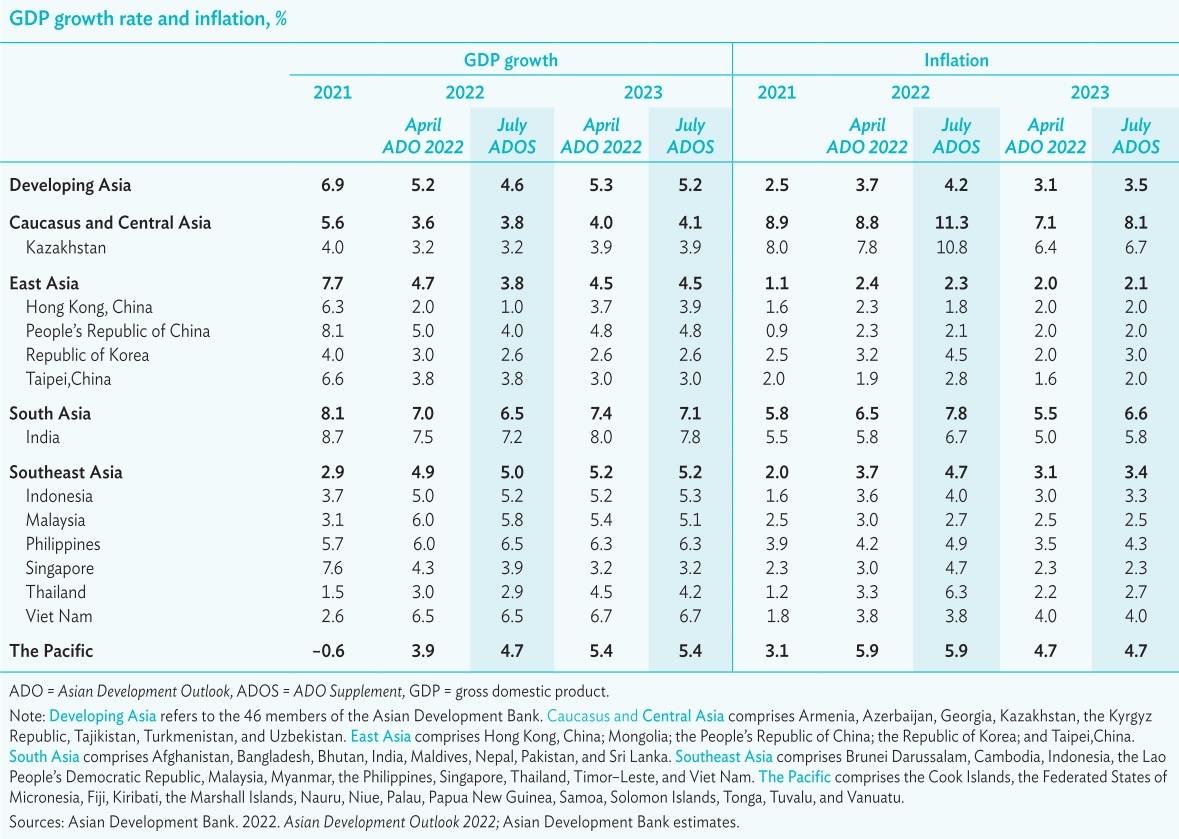

Vietnam’s 7-month consumer price index increased 2.54 per cent on-year, the GSO reported. And, according to the World Bank, global trade growth is forecast to slow down in 2022, at about 4 per cent.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Mobile Version

Mobile Version