Softening demand to limit 2024 trade

|

The Asian Development Bank (ADB) last week said that Vietnam’s trade declining due to continued global woes will affect the country’s current account in 2024.

“Softening global demand will limit the trade recovery in the rest of 2024,” the ADB said in its update on Vietnamese economic performance. “Global growth is expected to bounce back slower than expected, which could slow Vietnam’s export recovery.”

Vietnam’s exports in the first quarter of 2024 are estimated to have grown by 17 per cent on-year to reach $93.06 billion, while imports were estimated to have increased by 13.9 per cent on-year to hit $85 billion. This led to a trade surplus of $8.06 billion, according to Vietnam’s General Statistics Office.

However, according to the ADB’s projections, Vietnam’s imports and exports will climb modestly by 4-4.5 per cent this year and next as external demand gradually recovers.

This would be lower than the government’s expectation of an on-year rise in export and import turnover of 6.4 and 10.2 per cent, respectively.

“Renewed manufacturing activity would push up imports of production inputs. As a result, the current account surplus is projected to be 1.5 per cent of GDP in 2024,” the ADB stated.

Meanwhile, the International Monetary Fund has also projected that Vietnam’s current account balance this year would be 0.7 per cent of GDP.

Last year, Vietnam’s GDP hit $430 billion, and the growth rate for this year is expected to be 6.5 per cent, meaning about $457.95 billion. Thus, if the forecasts materialise, Vietnam’s current account surplus in 2024 will be $6.87 billion and $3.2 billion, respectively.

In 2023, the trade surplus sat at a record $28 billion as imports declined faster than exports. Exports receipts totalled $355.5 billion (83 per cent of GDP), down 4.4 per cent from 2022, while imports fell to $327.5 billion (76 per cent of GDP), an on-year drop of 8.9 per cent.

Shipments of mobile phones, computers, and electronic products, which accounted for 30 per cent of total exports, decreased by 3.6 per cent on-year. Meanwhile, machinery and equipment, which was responsible for 12 per cent of total exports, fell by 5 per cent on-year.

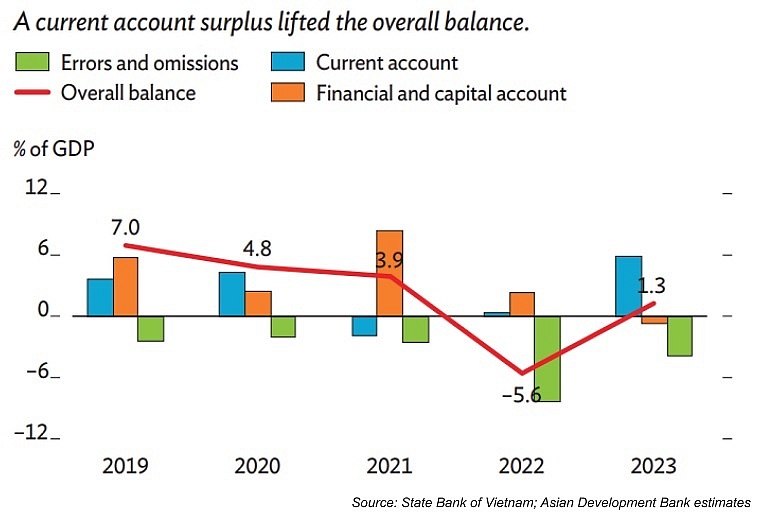

“The sizable trade balance supported the current account surplus estimated at 5.9 per cent of GDP from a modest surplus of 0.3 per cent a year ago,” the ADB commented. “Higher remittances also supported the current account balance. The wide differentials with global interest rates led to a capital and financial account deficit estimated at 0.7 per cent of GDP in 2023.”

However, the ADB underlined that the substantial current account surplus last year “turned Vietnam’s overall balance of payments to an estimated surplus of 1.3 per cent of GDP in 2023 from a deficit of 5.6 per cent of GDP in 2022 (see Figure). By the end of 2023, foreign reserves had improved to 3.3 months of imports from 2.8 months at the end of 2022.”

The government has set a target that in 2024, the total export and import turnover will reach $380 billion and $365 billion, respectively. The total trade surplus will be $15 billion.

In order to realise this target, it is clear that bigger efforts must be made in amplifying production and expanding exports, but the task is not so easy given difficulties escalating in the global economic landscape. In fact, declines in demand in Vietnam’s key markets reduced significantly last year, including the US (11.6 per cent), South Korea (3.4 per cent), ASEAN (4.1 per cent), the EU (5.9 per cent), and Japan (3.2 per cent).

However, in Q1 this year, these rates climbed 26, 12.9, 9.5, 16.3, and 6.4 per cent, respectively.

“Risks are titled towards the downside. Softened global demand and continued geopolitical tensions would slow the full recovery of Vietnam’s export-led growth,” the ADB warned.

At present, there has been a rising trend in protection barriers in many foreign markets. For instance, as of November 2023, Vietnam’s exports faced 238 trade remedies probes from 24 markets. Among them, the leading cases are anti-dumping investigations (132 cases), followed by trade remedies (48 cases), anti-circumvention of trade remedies (35 cases), and anti-subsidies (23 cases).

Moreover, Vietnam’s domestic industrial production sectors are currently mainly export-oriented, highly contingent on the global market because domestic supply far exceeds the demand of the local market, especially for industries such as textiles and garments, footwear, and electronics. Only 10 per cent of products produced in Vietnam are consumed domestically, and the remaining 90 per cent are for export.

In the first three months of this year, 24,700 enterprises left the market monthly.

| VAT overhaul to boost agriculture prospects Vietnam is set to revise its existing Law on Value-Added Tax with a reclassification of products in areas like agriculture and fisheries, with the hopes of making them more favourable in performance. |

| Current VAT rate may remain for foreseeable future The government is to ask the National Assembly to continue with its current VAT rate of 8 per cent until the year’s end as part of the country’s efforts to assist enterprises currently facing operating obstacles. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version