Renewable energy to dispel outages

|

| The government is turning the problem of energy shortage into an opportunity for renewable power projects |

The Ministry of Industry and Trade (MoIT) said in its latest report on the implementation of power projects in the revised Power Development Plan VII (PDP7), that 47 of the 62 approved plants are behind schedule to various degrees, going from a few months to as long as five years. Delays in many electricity projects threaten the south of Vietnam with power shortages from as soon as next year.

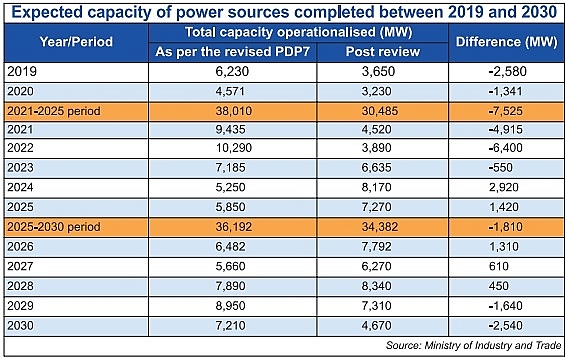

The total capacity of all power sources likely to be operationalised over the course of 15 years (2016-2030) is expected to reach about 80,500 megawatts (MW), around over 15,200MW less than the figure forecasted in the revised PDP7.

Power shortages will be primarily observed between 2018 and 2022, with the total capacity of 17,000MW.

Many power projects in this period, mostly power plants in the south, were postponed to the 2026-2030 period. Consequently, from keeping 20-30 per cent as backup in the 2015-2016 period, and almost no backup during 2018-2019, the power network will suffer from supply deficiencies in the 2021-2025 period.

The MoIT warned of factors influencing power supply in the period leading up to 2030, including delayed power projects, especially thermal power projects in southern provinces, as well as limited coal supply, gas supply, and transmission capacity.

There are 23 projects undertaken by state-run Electricity of Vietnam (EVN) providing a total capacity of 14,809MW, including 12 projects in the 2016-2020 period and 11 projects during 2021-2030. Ten projects are on track, while 13 are behind schedule or delayed.

Meanwhile, state-owned Vietnam Oil and Gas Group (PetroVietnam) was assigned as the project owner of eight key power projects with a total capacity of 11,400MW, including three during 2016-2020 and five during 2021-2025. So far, all these eight projects have encountered challenges, and are unlikely to be completed on the schedule outlined in the revised PDP7.

Similarly, all four projects assigned to state-run Vietnam National Coal-Mineral Industries Group (Vinacomin) for the 2021-2030 period are two years or more behind schedule.

The MoIT report outlined that there are 15 build-operate-transfer (BOT) power projects, of which one is for 2016-2020, while the rest will be implemented for 2021-2030. According to the ministry’s evaluation, only three projects are on schedule, while the remaining 12 are either behind schedule or their progress cannot be determined because of problems in the negotiation phase.

The situation of independent power projects (IPP) is not quite rosy either, as from the eight projects with a set capacity of 7,390MW, only one is on schedule and two are likely to be on schedule. The remaining projects have not determined their completion time.

In response to delays in coal-fired and thermal power projects, as well as tightening finances for coal-fired projects, the Vietnamese government is turning towards renewables to fill in the gap between supply and demand.

|

Encouraging capital access

At the Accelerating Wind Project Financing in Vietnam workshop last week in Hanoi, Oliver Behrend, principal investment officer at the International Finance Corporation (IFC), said Vietnam is one of the most exciting wind power markets in Southeast Asia, but faces many challenges, particularly regarding the power purchase agreement (PPA) and the lack of a wind energy supply chain in Vietnam.

He added that local Vietnamese banks appear to lack the financial capital, knowledge, and trust to finance wind energy projects. This means that foreign investors and banks must finance a large part of the required capital of wind energy projects from their pockets.

Meanwhile Hoang Phuong, an investment representative at Techcombank, told the workshop, “Through the government’s open-door policy, the private sector is now investing more in renewable energy, adding to their main business lines such as real estate. But they don’t have the experience to develop such projects.”

Long-term policies are also a matter of concern. “The country needs to simplify the investment registration process and determine how to build a master plan for wind power in the future,” said Bruce Weller, head of Power and Project Finance, Asia-Pacific at BNP Paribas.

The MoIT said that domestic corporations and project owners have been struggling to finance projects since the government put the loan guarantee policy on hold. There is only a limited source of official development assistance and concessional loans available for power projects. Sometimes, although loan commitments had been obtained from international banks and financial institutions, disapproval from state management authorities put an end to initiatives. It is very difficult to mobilise local financing because most local banks have exceeded their credit limits to project owners and relevant stakeholders.

Mobilising the private sector

Vietnam will need around $150 billion to invest in developing the national electricity grid and resources by 2030.

Previously, Deputy Minister of Industry and Trade Dang Hoang An told VIR that among the necessary measures, the country should first attract private sector investment into the energy sector. The question remains on how the private sector can take a more integral part in power sector financing. Previously, the power sector was mostly invested by state-owned companies such as EVN, PetroVietnam or Vinacomin.

Besides increasing the power supply, the demand needs to be more closely controlled to ensure energy savings. The policies and instruments, including the incentive and sanctioning mechanisms, should be customised to promote energy efficiency.

“Vietnam sets the efficiency rate of 8-10 per cent relative to the business-as-usual scenario of total national commercial energy consumption for the 2019-2030 period,” said An. “The current two prevailing trends in the global energy industry are ensuring energy efficiency and conservation, and applying environmentally friendly technologies, looking to develop a low-carbon economy, green industries, and changing current production and consumption models for sustainable ones.”

| Peter Brun - Global Offshore Wind Segment leader DNV GL - Energy

For Vietnam to harvest its wind power potential, the government must make its wind power plans an integrated part of the nation’s energy policy, and it must be supported with grid enforcement plans to limit curtailment risk. Vietnam can get inspiration and support from international institutions and independent private actors on this. First and foremost, Vietnam needs to declare official ambitions and targets for offshore wind. The government must also establish a supportive regulatory environment. This includes detailed wind resource mapping, marine spatial planning, geotechnical studies, and transmission planning for example. The new feed-in tariff is a step forward but the timeframe of 2021 is too short as offshore wind projects take more time to prepare. In respect to project bankability, often lenders look for quality projects with low risk that are made based on international technical standards, quality technology, quality wind resource assessment, and low curtailment risk. Government and international investment guarantees along with currency insurance will also be helpful. Patrick Architta - Business development director, K2 Management Vietnam

The wind and solar power sector in Vietnam has been developing for several years now and little by little I can see progress. The first challenge to further progress is financing, which is still a problem because the power purchase agreements are still not bankable for international institutions. We are trying to find solutions, but support from Electricity of Vietnam (EVN) and the government is important. The second challenge is the complexities in developing a project. To obtain a permit, we need to ask many different departments at different levels. The third challenge is that the grid is not strong enough in certain areas in Vietnam and must be improved. The rest is up to the technology and local contractor capacity, and Vietnam leveraging international support and experience. Based on those above factors I have a trust that Vietnam in this area can grow much larger. I think the current feed-in tariff for wind power projects in Vietnam is fairly attractive to foreign investors. The difficulties will be selecting a good site, as locations with less wind or those further away from the grid would see bigger investment costs. To bolster wind power project bankability, I think EVN has been doing a good job as I have seen much improvement in terms of regulations compared to three years ago. Joost Siteur - Investment mobilisation lead USAID Clean Power Asia

The policy framework is key to support the long-term development of the sector and Vietnam has made good efforts with the introduction of regulations and incentives over the last few years. However, it’s well known in the sector that there are certain aspects that can be improved, especially given the need to bring in long-term international finance. Local banks don’t have the ability to provide all the capital that is needed to achieve the medium and long-term targets for wind power that the government has set. The current feed-in tariff in Vietnam is quite attractive as we can tell from the number of local and international developers. Compared to other countries in the region, it’s fairly high, but tariffs are not the only factor. What matters more is the confidence that a project will get paid that tariff for all the electricity generated during the entire lifetime of the project. Currently, that confidence is still low among international banks and lenders, largely due to grid constraints and the curtailment risk. Ivan Klohna - Project manager E-Group

I think the potential for wind energy in Vietnam is very high but projects still face some problems – for example, there are some legislative and technical problems like weak connections. I think everybody is working on it to get everything done and finish the project because the potential and conditions are very good in Vietnam. We are also looking for another project for the future in this country. In my opinion, there are two reasons why investors refuse to finish projects here. The first is the economy of the project. Every venture has a specific risk and this leads to, second, the financial risk for the company. It must be determined if the project is suitable for them to take this risk. I am here to find out what the situation is for project financing from the banks. In other countries, we work with banks to get finance for the project. I believe that it is much easier to make financing from other banks abroad and that local banks are not very open for in this regard at the moment. However, we hope this will soon change, as we are looking for a ready-to-build project in solar and also in wind power. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

Tag:

Tag:

Mobile Version

Mobile Version