Public spending rise may become catalyst

|

| Public spending rise may become catalyst, illustration photo |

On August 18, Prime Minister Pham Minh Chinh ordered all ministries, sectors, and localities to push up public investment disbursement until the year’s end, when over 95 per cent of the year’s disbursement plan must be achieved.

“The state budget must be used effectively with high-quality infrastructure development. This will facilitate the country’s attraction of more investment and generation of employment,” PM Chinh said, adding that though the government is now trying to boost public investment, some works have been implemented ineffectively.

He sent a related telegram to ministries and localities, stating that efforts are to be made to quicken the speed of site clearance and construction, with all obstructions in land and natural resources to be solved.

“There must be strict sanctions under the law on investors, project management units, organisations, and individuals who intentionally cause difficulties, impede projects’ implementation, and delay disbursement of state funding,” it said.

“Any cadres, officers, and officials with poor qualification and performance must be removed, and all negative activity and corruptions in public funding management must be tackled,” the telegram said. “Plans for disbursement for each project must be made in details.”

|

According to the World Bank, a full implementation of the planned budget would bring public investments to 7.1 per cent of GDP in 2023, up from 5.5 per cent planned in 2022, providing a fiscal impulse of 0.4 per cent of GDP to support aggregate demand. In its updated report on Vietnam’s economy released this month, the World Bank said that while higher investment is necessary, the country also needs better funding and there is scope to increase the efficiency of public investment.

Fresh calculations from the World Bank showed that between 2011 and 2019, it took more than $6 in investment to generate one $1 in output. The country’s public investment is now under recovery following strict pandemic policy measures since the data was collected.

The incremental capital output ratio (ICOR) data from Vietnam General Statistics Office also showed that the ratio was 6.25 for the 2011-2015 period, 6.13 for the 2016-2019 period, and 7.04 for the 2016-2020 period. In 2022, the ICOR was 6, which is expected to be below 6 in this year.

“Vietnam achieved much less growth per US dollar of investment than China, Malaysia, South Korea, Singapore, and Thailand when they were at comparable levels of per capita income and development,” the World Bank stated.

The International Monetary Fund estimated that the output efficiency of public investment in Vietnam could be 23 per cent higher than reality, if the efficiency of public funding management reached the global frontier.

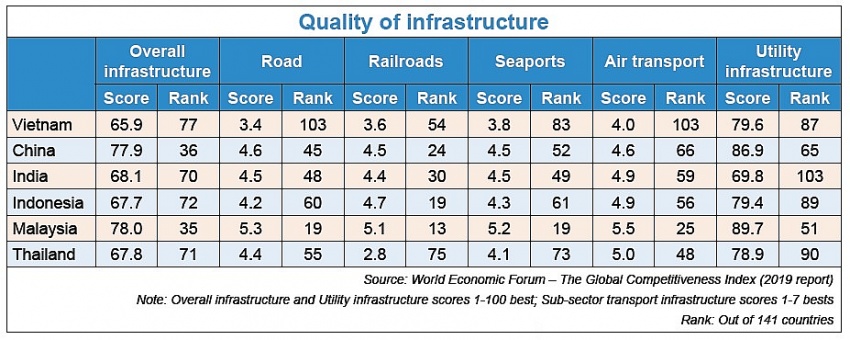

Increased public spending efficiency could have a major impact on aggregate productivity growth and GDP levels. Policy research suggests that a one percentage point rise in public investment through efficiency improvements lifts growth rates by 0.1-0.2 percentage points over the next few years. “Vietnam’s infrastructure quality lags that of many Asian countries and could impact its attractiveness as a foreign direct investment destination and potential growth in the long term,” said Dorsati Madani, senior economist at the World Bank in Vietnam.

The Global Quality Infrastructure Index 2021 ranked Vietnam 51st out of 184 economies, below Indonesia (28th), Malaysia (29th), and Thailand (33rd). Such an index for 2022 remains unavailable.

One example of infrastructure quality is the expressway density, which is one of the lowest in the region, while road transport costs are the highest regionally. The infrastructure investment gap will constrain Vietnam’s ability to attract and retain overseas funding, including those looking to relocate from China.

Vietnam currently has 47 seaports of all sizes across provinces, but 95 per cent of cargo goes through three ports invested and operated by the Ministry of Transport in Haiphong city in the north and Ho Chi Minh City and Ba Ria-Vung Tau province in the south. The remaining 44 ports account for only 5 per cent of cargo volume. Also, while there are 22 airports nationwide, only eight are considered international and the remainder can only accept smaller, narrow body aircraft, according to the International Civil Aviation Organization. There is a concentration of airports in the central coastal region, home to 14 provinces, with an average distance of around 100km between nine of the 22 airports.

Only six airports have experienced passenger growth, while the remainder have hit just 40 per cent of projected volumes. Most airports are loss-making and unable to even cover operations and maintenance costs.

According to Vietnam’s Ministry of Planning and Investment, public funding will be the key driver for economic recovery and growth in 2023. A considerable amount of public investment is scheduled to be disbursed in 2023. The government is committed to disbursing $30 billion in the year, of which almost all capital has been allocated to disbursing ministries and provinces so far.

The government has reported that in the first seven months of this year, total public investment nationwide hit about $11.3 billion, up 34.5 per cent or $3.4 billion on-year, but reaching only 37.85 per cent of the initial plan.

“Along with the continued implementation of the stimulus initiative endorsed in January 2022, this spending will generate substantial multiplier effects, creating strong motivation for the whole economy,” the Asian Development Bank commented.

The National Assembly approved the public investment plan with a total capital of nearly $30 billion in 2023, which is $6.01 billion higher than the plan in 2022 and nearly $11 billion higher than 2021.

| Bright future for Vietnam’s foreign investment attraction: insiders Vietnam's foreign direct investment (FDI) attraction has seen signs of recovery after continuous declines over the past six months, becoming a driving force for the country’s economic growth in the medium and long term, said insiders. |

| Hanoi tops country in FDI attraction in first eight months Hanoi got over 2.34 billion USD of foreign direct investment (FDI) in the first eight months of this year, topping the whole country in FDI attraction during the period. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version