Prudent policy the key for recovery

|

| Economic researcher Linh Bui and Prof. Dr. Andreas Stoffers, country director of the Friedrich Naumann Foundation for Freedom Vietnam |

With Resolution No.01/NQ-CP from January, the government was very determined and set the economic growth target in 2021 higher than the National Assembly’s 6 per cent goal, at 6.5 per cent. If the growth target remains unchanged, this would be the most optimistic figure compared to financial institutions, which update their data regularly and base it on actual fluctuations.

Standard Chartered’s forecast is currently optimistic and states that economic growth will reach 6 per cent, however, only if the COVID-19 wave is controlled soon, but it seems impossible now. The Asian Development Bank was more cautious when lowering Vietnam’s GDP forecast to 5.8 per cent from 6.7 per cent in April. The International Monetary Fund forecasts that the five largest developing economies in Southeast Asia – Indonesia, Malaysia, the Philippines, Thailand, and Vietnam – will grow by 4.9 per cent in 2021 despite unchanged global economic growth.

The mutation of the Delta variant could drive economic growth in very unpredicted ways, but mostly worse. Some macro indicators signal unpleasant scenarios for the economy, which governments should update and be realistic about. Along with the decrease in the total number of new orders, the number from abroad also reduced. Confidence of entrepreneurs and consumers both decline. In addition, the number of dissolved and temporary deactivated enterprises increased rapidly.

Little room for stable growth

The current wave, along with social distancing in large cities, affects the implementation of public investment projects. Particularly, the realised public investment capital in July decreased by 1.7 per cent compared to the previous month and by 12.4 per cent compared to the same period last year. However, for the first seven months of 2021, the realised public investment was estimated around $9.2 billion, equal to 44.3 per cent of the year’s plan and 5.6 per cent more over the same period last year. Public investment was considered a key element in growth, but in comparison to last year, this indicator has not much improved and can hardly be a driver for economic growth in 2021.

The total foreign investment capital registered in Vietnam as of July 20 reached $16.72 billion, down 11.1 per cent over the same period last year. This is the lowest level among the three recent years, implying the hesitation of foreign investors in the Vietnamese market, although recent reports from some chambers of commerce reflect optimistic views of overseas investors. Currently, all foreign direct investment (FDI) destinations such as Long An, Binh Duong, Ho Chi Minh City, and Hanoi are all in social distancing, which will definitely affect FDI inflows.

Looking back at 2020, when China immersed in troubles and geopolitical conflicts, some hoped that Vietnam could get the benefits from overseas enterprises escaping China, but the recent report of the United Nations Conference on Trade and Development portrays this as a broken dream. While the upward trend of FDI inflows still exists in China – with growth of 6 per cent mainly towards tech-related industries – large recipients in attracting FDI like Vietnam and Indonesia recorded drops. For example, Vietnam experienced a decline by 2 per cent to $16 billion.

As for individual investors, COVID-19 brought many uncertainties. But in business, investors always think that in danger there will be opportunities. The portfolio of companies and individuals have had many changes such as a sudden increase in the number of new players entering the stock market. Moreover, there was an increase in demand in the real estate despite the scarcity of mid- and low-end apartments in large cities.

This was accompanied by a land fever in many areas and the rise of virtual currency, as well as foreign exchange investments, in fraudulent exchanges. The pandemic created a turning point for the government to recognise the weaknesses in investment information transparency and the lack of a legal corridor for new activities such as in digital currency. They are obstacles to Vietnam’s economic rise, whether there is a pandemic or not.

|

| Vietnam is offering some strong solutions to help struggling businesses stay afloat. Photo: Le Toan |

|

Effective relief packages

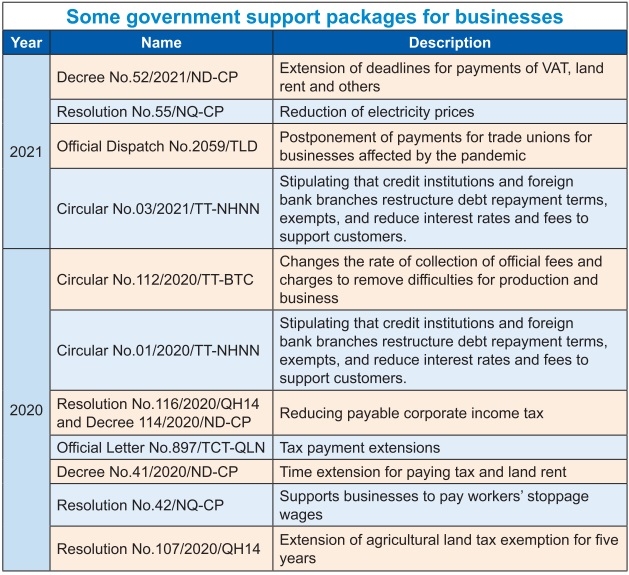

The government support packages (see table) have been launched to maintain business survival and access to finance. However, many businesses suspended their operation and dissolved in the first seven months of the year, and the persistence and optimism of business owners are both low. This raises the question of how effective the support policies are.

In the first seven months of the year, nearly 79,700 enterprises suspended their operation for a definite time, waiting for dissolution procedures, an increase of 25.5 per cent over the same period last year. Nearly 40,300 enterprises temporarily suspended their operation, up 23 per on-year. On average, nearly 11,400 businesses withdrew from the market every month.

Enhancing the private sector is thus one of the long-term targets of the economy. However, it remains to be seen how effective the support packages are. In any case, this development signals a downward trend of the economy.

Vietnam could hope to recover the economy as the government works well on micro levels. For example, prices are controlled well – no matter the panics sometimes triggered in large cities. The packages for vulnerable individuals were also relaunched with fewer requirements, and efforts to maintain the production chain are made.

Trade is still the highlight in the economy. For the first seven months of 2021, export turnover of goods was estimated at $185.33 billion, up 25.5 per cent on-year, despite depending heavily on FDI with nearly 30 per cent growth. The free trade agreement with the EU repositioned Vietnamese products in that market, even in difficult areas like organic and fresh fruit.

As a result, organic agricultural products from Vietnam exported to the EU in 2020 increased by more than 20 per cent. Efforts to bring lychee and mango to Europe also reflect Vietnam’s improved production and distribution procedures.

However, Vietnam should continue on the path of liberalisation and integrate in free trade agreements, while improving the investment environment for businesses. There is a need for prudent monetary and fiscal policy at this moment, and no zero-interest rates.

In the battle against the pandemic, it is good to weigh health of the people against the health of the economy. Some provinces like Quang Ninh are doing very well, while economic activities remained nearly normal. The strategy to let provincial authorities decide appropriate schemes at this time seems to be a good choice, and not only in Vietnam.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Themes: Together We Win

- Greater Mekong Subregion executives to discuss sustainable tourism

- TCPVN donates 1,200 medicine bags to COVID-19 patients in southwest

- AB InBev supports orphans with scholarships amid COVID-19

- Evaluating the reach of support in turbulent times

- Gamuda Land grants “Back to School” scholarships to support disadvantaged students

Related Contents

Latest News

More News

- Foreign executives assess Vietnam business outlook for 2026 (February 16, 2026 | 09:00)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

Mobile Version

Mobile Version