Promoting cross-border BOT partners

|

| Ngo Thanh Hai and Le Nguyen Quoc Sy, lawyers at LNT & Partners |

Build-operate-transfer (BOT) investment in transport infrastructure started in Vietnam more than 20 years ago. As of 2016, 68 road traffic projects featured funding in the BOT form under the supervision of the Ministry of Transport, with the total investment approximating VND208 trillion ($9.04 billion).

BOT investments, especially in transport infrastructure ventures, have contributed to the changing appearance of road traffic in Vietnam. While these projects are of only middling success, considerable problems abound. Excessive imposition of maintenance fees and unreasonable positioning of toll booths, amongst others, are major sources of conflict between users and investors.

The process destabilised the balance of the interests between the state, investors, and users. For example, the tolling policy of BOT projects has encountered fierce opposition from the public, as witnessed in BOT Ben Thuy 1 Bridge (Nghe An province), Cau Rac BOT station (Ha Tinh province), BOT Tan De (Thai Binh province), Quan Hoa (Quang Binh province) and the infamous BOT Cai Lay hotspot (Tien Giang province). One thing these projects all have in common is that existing roads were renovated and some bypass routes erected, but there were relatively few new ones. Some experts maintained that BOT investments in traffic infrastructure should prioritise new road construction projects.

According to statistics by the Ministry of Planning and Investment, most of the current public-private partnership (PPP) projects in Vietnam selected investors via direct appointment. While public bidding is the preferred method in many countries, in Vietnam, investors are often selected through direct appointment. Investors participating in bidding when it does take place are further concerned about currency exchange, profitability, or a complicated bidding procedure.

Article 37 of Decree No.63/2018/ND-CP issued in May 2018 on investment in the form of PPP states that the selection of investors shall be carried out in accordance with the Law on Bidding. Accordingly, Article 22 of this law concerning direct appointments shall apply to certain cases such as urgent procurements with an aim to protecting national sovereignty, national borders, and islands. This condition is not specified in any other supporting legal documents and can thus be interpreted by the authority in different ways. The result is a reduction in competition and transparency in the selection of investors, an increase in potential wastage, and the risk of selecting substandard investors.

|

Sticking issues

Another problem is that BOT projects in Vietnam, along with other PPP projects, are considered under the public procurement concept. Because of that, PPP projects involve countless bureaucracies. An example is BOT Vinh Tan 1, a $1.7 billion thermal power plant. Its construction commenced in 2015 and was completed last year. But the project had been underway since 2007, and the negotiation process lasted from 2009 to 2012. The project also recently ran into the problem of generating excessive coal waste which has not been satisfactorily dealt with.

Another area in which the investor may face trouble is the interest of the loan, as interest rates between regulation and reality are different. According to Circular No.75/2017/TT-BTC dated July 21, 2017 providing certain contents of financial management of investment projects in the form of PPP and costs of investor selection, the lending interest rate applied to the project is about 4 per cent lower than the actual lending rate of commercial banks. Specifically, the interest rate under Circular 75 is about 6.77 per cent, while the real interest rate is 10.83 per cent. This issue occurred due to the provision of Article 1 of Decree 75, in which interest rate calculated in the financial plan of PPP projects will not exceed 1.5 times the government bond interest rate.

In addition, to conduct transactions and transfer profits abroad, investors must resort to foreign currencies. However, since there is no clear commitment of the state guarantee on currency conversion, overseas investors would further refrain from BOT investment.

The model of BOT transport projects is crucial given the tight state budget, as numerous experts and management agencies have affirmed. The key to success lies in the ability of the state to select investors and appropriate management measures to ensure transparency and efficiency. If done well, not only will efficiency be improved and harmonisation of interests guaranteed, but much needed capital would also be attracted into different developing areas of the country.

Key success factors for PPP projects and BOT in particular are quality, time, and cost. Therefore, a PPP proposal will only be considered if there is a need for the project on the part of the government after taking into account the benefits as a whole in terms of several factors. These include socio-economic impacts, value for money and cost savings to the government, quick delivery of the project and service enhancement, and increased level of accountability, efficiency, and effectiveness.

The issues facing Vietnam were successfully dealt with in other countries many years ago. The success stories of BOT in other countries may be used as suitable benchmarks for Vietnam.

For example, between 1999 and 2009 the government of South Korea offered guarantees to PPP toll road contractors under which the government would, in various circumstances, make payments to the contractors if toll revenue fell below certain levels. On the other hand, the government would redeem the difference should the revenue exceed the upper limit.

This regulation may encourage the private sector participation in PPP, and BOT projects in particular. However, this method may lead to higher fiscal risks for the government since it is difficult to estimate the costs and benefits.

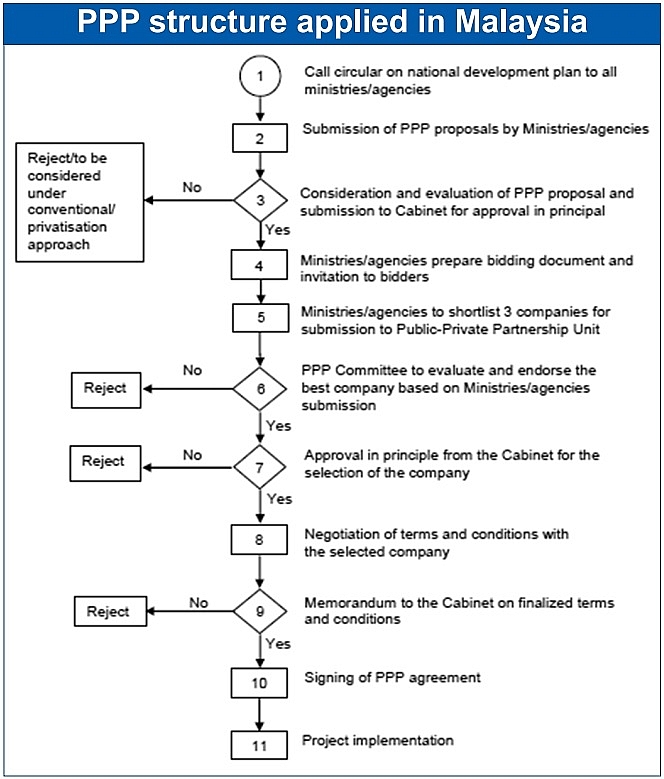

A PPP structure was also applied in Malaysia (see chart). The chart shows that the PPP procedure is very simple: the competent authority is defined, and the bidding procedure is simple but effective.

|

Recommendations

Vietnam should emulate Malaysia’s simplified but effective PPP procedures. The bidding for BOT projects should be transparent and must have a shortlist of three companies (for the first round), then the best among the finalists will be chosen to construct the BOT project. Lessons from South Korean could also be applied, so that investors could be encouraged by being guaranteed a guarantee on minimum revenue. On the other hand, the government may also retain the extras should the revenue exceed an upper limit.

To further attract international investors, the Vietnamese government needs to ensure that they are not prevented from exchanging their revenue into foreign currency. In addition, the government should not control the interest rate calculated in the financial plan of the PPP projects and share the interest risks with investors.

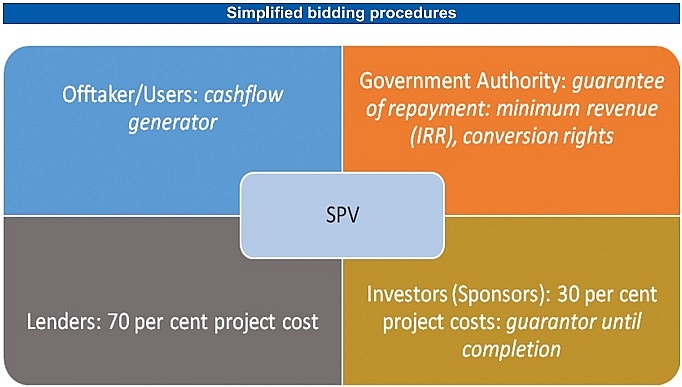

From the investors’ side, they should be contributing at least 30 per cent capital so as to secure their performance for the BOT venture. This guarantee must be sustained throughout the project. Besides, the investor must truthfully clarify the costs when bidding, with no double counting or bidding with false valuations (see graphic).

However, to make a transparent and simplified procedure, it is of utmost importance to have a third independent auditor evaluate the budget of the project, so as to forecast the minimum revenue, or to cross-check with the budget proposed by the investor.

The audit should be conducted throughout the life-cycle of the BOT project – at the feasibility study stage, during construction, and at the time of completion, as well as regular audits during operation.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Kurz Vietnam expands Gia Lai factory (February 27, 2026 | 16:37)

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

Mobile Version

Mobile Version