Preparing for the equitisation rush

|

| Due diligence is a vital part of the equitisation process, but many SOEs are wary of revealing information to overseas investors Photo: Le Toan |

Equitisation and divestment are important tools that the government employs to re-arrange, restructure, and drive innovation of state-owned enterprises (SOEs). The equitisation programme began to be tested by Vietnam 30 years ago, being officially implemented in 1992 and actively promoted from 1996 until today.

|

| Huynh Cong Tam |

The government issued Decree No.126/2017/ND-CP in 2017 on conversion from SOEs and single-member limited liability companies with 100 per cent of charter capital invested by SOEs into joint-stock companies.

It provides an equitisation plan and the process to be followed. Importantly, it provides conditions for investors, including foreign investors, to purchase shares of SOEs through the equitisation process.

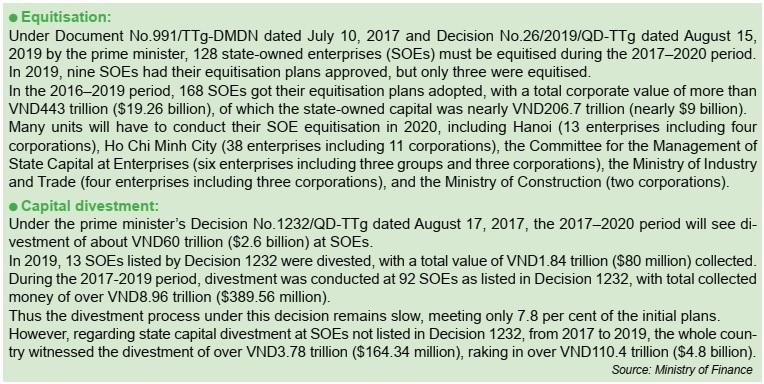

But based on a report issued by the Ministry of Finance in December 2019, since 2017 the equitisation and divestment of SOEs has only achieved 7.8 per cent of its target. This is in stark contrast to the plan approved by the prime minister in 2017 under Decision No.1232/QD-TTg giving approval on the list of SOEs that must undergo divestment in the 2017-2020 period.

Other targets over many years in this area have similarly not been met. The objective of selling shares to strategic investors, especially overseas ones, remains little more than the target. The fact is that strategic investors have not been included to participate in the equitisation of SOEs.

As part of the government’s new efforts to hasten the process of state equitisation and divestment, in August 2019 the prime minister issued Decision No.26/2019/QD-TTg approving the amended list of SOEs that will be equitised through the end of 2020. According to Decision 26, 128 such enterprises have been scheduled for equitisation for the period, with many of them carried forward from the previous list. A number of circulars and decisions have also been issued by the competent state authorities in 2019 for such purposes.

Adding attraction

So how can foreign investors participate in SOE equitisation?

Looking at the results over the past few years, a report from the State Securities Commission stated that the participation rate of outside investors in SOE equitisation reached only 9.5 per cent, with participation of strategic investors hitting 7.3 per cent. In particular, only four among 46 SOEs sold shares to foreign strategic investors by equitisation, accounting for 8.7 per cent. These statistics are based on a report by the Central Institute for Economic Management.

There are a number of reasons why international investors view equitisation of SOEs as unattractive. A key reason is a lack of public and transparent information as it relates to the SOE target. Although the regulations on disclosure and transparency of SOEs which have to be equitised are relatively adequate, the reality is that lack of transparency remains a major hurdle. For example, it is a common practice prior to an acquisition for the buyer to conduct a due diligence appraisal of the target company. In such process, the potential buyer wants to review and have assurances on important aspects of the target company including legal, financial, operational, and commercial. In practice, few SOEs are aware of the importance of conducting such due diligence investigations by strategic international investors.

They may, therefore, be unwilling to grant investors full access to delve into the target company’s books, licenses, certificates, business, operations, and other significant details. Without acceptance and well-considered preparation and planning, SOEs may not meet the expectations of foreign investors. The reality explains, in part, the reason for a low percentage of foreign investment in equitised SOEs.

The valuation of SOEs is another issue which creates obstacles to strategic foreign investors. According to an aforementioned report by the Ministry of Finance (MoF), the process of equitisation of SOEs normally takes a long time for the authorities to deal with financial, land use rights, and labour issues.

Most of the delay comes from problems with valuation of the SOE’s assets, especially the value of land use rights and intangible assets. Relevant regulations under Decree 126, 2017’s Circular No.122/2017/TT-BTC on promulgating Vietnamese Valuation Standard 12, and Decree No.91/2015/ND-CP released in 2015 on state capital investment in enterprises and financial management in state enterprises, require the involvement of various relevant authorities during the SOE’s valuation.

There are also other obstacles. Assets including land are frequently valued quite differently from a government standpoint compared to a commercial standpoint.

Determining the selling price of shares to strategic investors is also an area where a large difference often exists. Limits on the ownership ratio of foreign investors as well as the ownership ratio of the state in the SOE post-equitisation is a key factor. In addition, generally, overseas investors prefer to own a majority but not a minority, and without controls.

|

New business options

Although hurdles exist for foreign investors, the process of SOE equitisation can bring opportunities too. This is especially true for those that become strategic shareholders of equitised SOEs. Sabeco, Vinamilk, and PV Oil are examples of reasonably successful equitisations. The process opens the door for investors to enter into certain business areas which were historically out of reach because they were within the state’s monopoly. SOEs have other distinct advantages, such as access to resources which private enterprises simply do not possess.

Under Decision 26, there are notable SOEs which have been put into the equitisation and divestment plan - among them are Agribank, Vinacomin, VNPT, MobiFone, Vinachem, Saigontourist, and many others.

According to the Steering Committee for Enterprise Innovation and Development, the biggest goal of SOE equitisation is to renovate the governance model, modernise technology, and call for investment which will promote operational efficiency. Accordingly, SOE equitisation and divestment must meet legal requirements and be fully transparent in order to bring the highest benefits.

The government continues to improve the legal framework of SOE equitisation, divestment, and restructuring. Specifically, the MoF’s Circular No.21/2019/TT-BTC dated April 2019 provides a framework for book building for the purposes of determining the price for an initial public offering. This is particularly helpful when it comes to major auctions that involve foreign investors as it raises efficiency and effectiveness of the initial public offer of the enterprises.

Circular No.03/2019/TT-NHNN issued by the State Bank of Vietnam in May 2019 is supportive as it provides a legal mechanism for foreign investors to make deposits in overseas currencies when they agree to participate in SOE auctions. Circular 03 is aimed to amend and supplement a number of articles of 2013’s Circular No.32/2013/TT-NHNN guiding the implementation of regulations on restricting the use of such currencies across the Vietnamese territory. Equitisation and divestment are increasingly becoming valuable tools for the government. Vietnam has taken necessary steps to ensure that the SOE equitisation objective can be achieved. Proper execution will increase the likelihood that foreign investors will participate in the process as strategic shareholders.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

- DKSH to acquire Vietnamese healthcare distributor Biomedic (December 24, 2025 | 15:46)

- Central Retail refocuses Vietnam strategy with Nguyen Kim exit (December 24, 2025 | 15:01)

- RongViet Securities wins sixth consecutive M&A advisory award (December 22, 2025 | 17:30)

- Kido Group divests from ice cream and frozen foods (December 18, 2025 | 16:49)

- Insurtech startup Saladin wraps up Series A funding round (December 17, 2025 | 09:10)

Tag:

Tag:

Mobile Version

Mobile Version