New tax law stymies business

The National Assembly last week adopted the Law on amendments and supplements to some articles of the Law on Value Added Tax, the Law on Special Consumption Tax (SCT), and the Law on Tax Administration which will take effect on July 1, 2016.

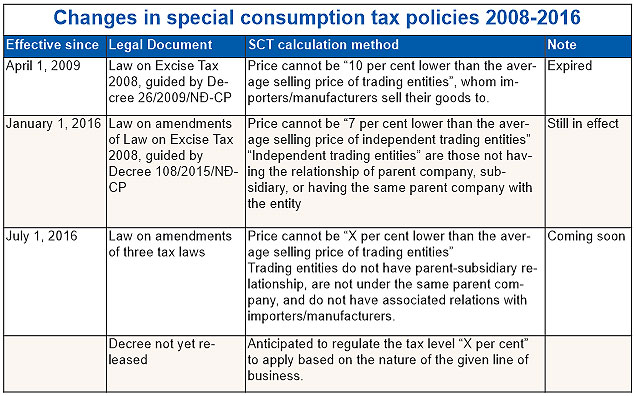

The adopted version of the law regulating excise tax sets the price at which importers/manufacturers can sell goods to trading entities, which do not have a parent-subsidiary relationship, or are under the same parent company, or have associated relations with importers/manufacturers.

The “associated relations” condition, added in the final draft, is defined under Article 3, Circular 66/2010/TT-BTC as including but not exclusive to those “directly or indirectly participating in the management or control of another party” or those “contributing capital or making investment in any form”.

The taxable price is prescribed as “not X per cent lower than the average selling price of trading entities”. The “X per cent” will be set at a later date by the government based on the nature of the given line of businesses.

This means that businesses whose goods are subject to the SCT calculation will have to wait until details of the tax level applicable to their line of business are finally decided upon. The timeframe for this, however, has yet to be announced.

Understanding that the new regulation is intended to tackle tax dodging by companies that use their spider web of subsidised trading agents for such purposes, members of the business community have stated that it is impossible to declare their tax liability in compliance with these requirements.

In the case of imported automobiles, Piaggio Vietnam said that calculating the average retail price that trading agents apply was quite challenging, since they changed upon the given market conditions.

Vietnam Beverage Association (VBA) is of the same view, claiming that they could not control the retail price of independent trading companies.

“Retail price depends on regions and agents, and time matters too. It would be a burden for manufacturers to collect data and calculate the average price,” said VBA deputy chairman Nguyen Tien Vy.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Latest News

More News

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

Mobile Version

Mobile Version