New northern industrial parks attracting foreign investors

|

The report also showed that as of the third quarter of 2024, the average occupancy rate of industrial parks (IPs) in the north was 77 per cent, up 4 per cent on-year, with a focus on electronics, automobiles, packaging, and flooring.

According to the survey, next year should see additional facilities from BW Industrial, KCN Vietnam, Frasers Property, Mapletree, Thuan Thanh Xanh, HKBC, Vietnam Logistics and Wiin, among others.

Do Hong Quan, CEO of VNIC-Vietnam Investment Consulting, said, "According to our observations, the new facilities will focus on established industrial hubs, such as Bac Ninh, Haiphong, Bac Giang, and Thai Nguyen, bringing further overseas investment to the north."

"The industrial real estate market continues to show optimistic signs this year, continuing into 2025. However, there are still a few pending issues that need to be resolved. For example, the land clearance process is still slow, and the cost remains high. The cost for basic construction and land rent is also increasing," Quan said.

The average rent in IPs is $4.60 per square metre per month, up 2 per cent on-year. Meanwhile, the average land rent is approximately $156 per square metre, up 6 per cent on-year.

The geopolitical situation is also a factor potentially impacting the flow of foreign investment into the country, for example, the US presidential election.

"Many of our partners are paying attention to the US election. If Trump wins, they may invest in countries in Southeast Asia with more capital than they would if Vice President Kamala Harris wins. This is because Trump’s proposed tariffs will impact China's exports to the United States," Quan said.

"During the debates, Trump said he would impose tariffs of 60 per cent or higher on Chinese goods were he to win a second term in office. Therefore, we can forecast that there will be a shift in production facilities from China to other countries in Southeast Asia to avoid these tariffs," added Quan.

During Trump’s presidential term, the US imposed a 10 per cent tariff on $200 billion worth of Chinese goods. At the time, a series of foreign investors moved their operations from China to Vietnam, including Hanwha Group, Yokowo, Huafu, Goertek, and TCL.

In addition, those already present in Vietnam expanded their operations here, such as Foxconn, Luxshares, Nintendo, and Sharp.

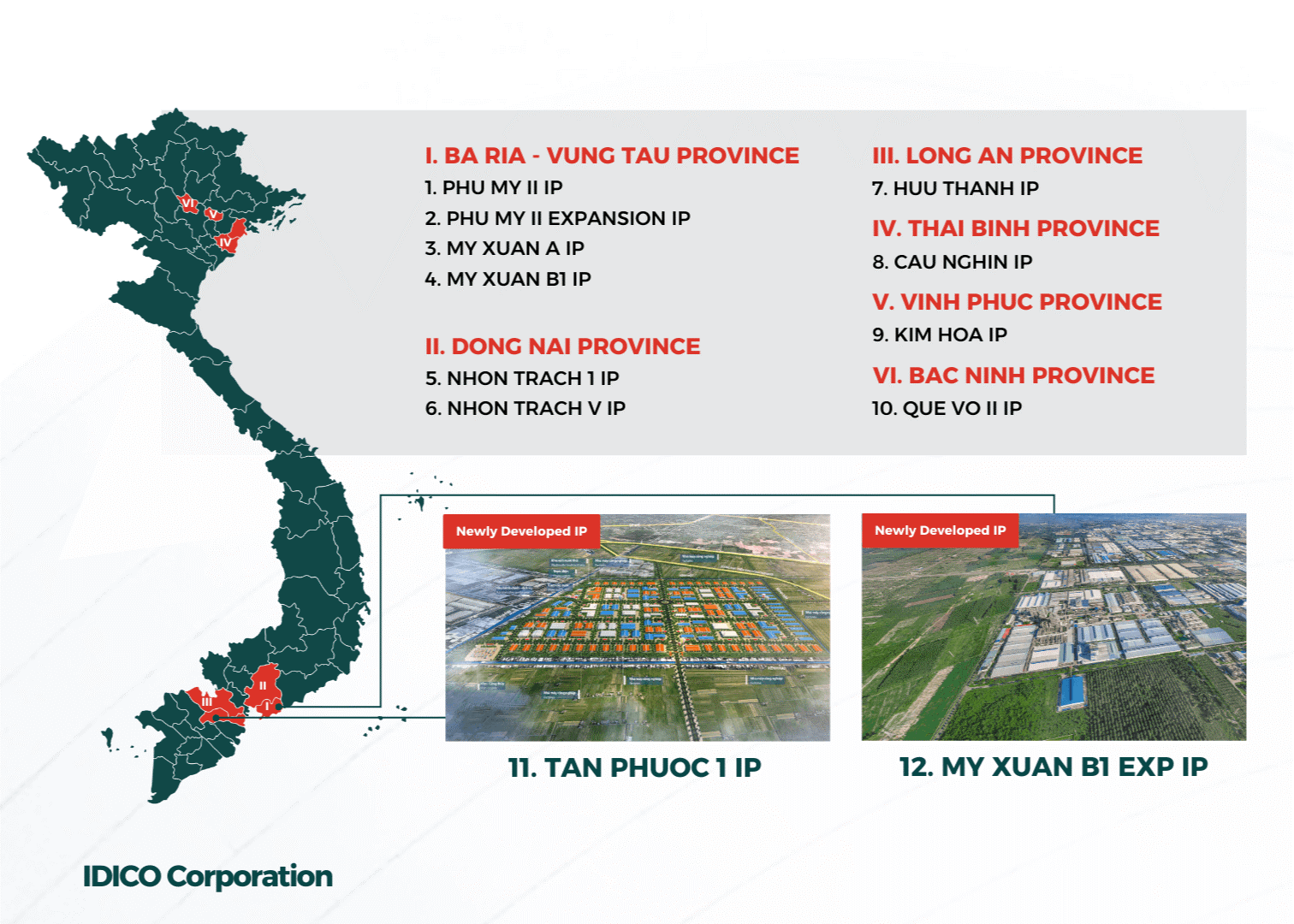

| IDICO Tan Phuoc 1 Industrial Park granted investment certificate IDICO Corporation received the investment registration certificate on September 4 for the IDICO Tan Phuoc 1 Industrial Park project in Tien Giang province. |

| IDICO's 12th industrial park granted investment approval IDICO Investment Construction Oil and Natural Gas JSC (IDICO-CONAC), a subsidiary of IDICO Corporation, has been granted investment approval for IDICO My Xuan B1 Expansion Industrial Park. |

| Ba Ria-Vung Tau poised for economic boost with million-dollar industrial park The project to expand the My Xuan B1 - Conac Industrial Park in Ba Ria-Vung Tau has been approved by Deputy Prime Minister Tran Hong Ha, with a total scale of 110 hectares and an investment of nearly $80 million. |

| Australia a source of support for electricity The similarities in the potential for renewable energy development and the commitment to a net-zero pathway by 2050 serve as part of the motivation for Australia to support Vietnam in achieving a reliable, affordable energy system with reduced carbon emissions. |

| Industrial park manufacturers press on after typhoon The operation of foreign-invested enterprises in industrial parks nationwide are assessing the impact of Typhoon Yagi, with the hopes of ensuring smooth export activity. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Sembcorp Development secures licence for VSIP in Khanh Hoa (December 31, 2025 | 18:54)

- Prodezi Long An advances towards integrated eco-centric industrial park model (December 26, 2025 | 11:16)

- Amata to develop $185 million Amata City Phu Tho (December 23, 2025 | 17:49)

- Work starts on Nhat Ban – Haiphong Industrial Zone Phase 2 (December 19, 2025 | 16:43)

- Becamex – Binh Phuoc drives sustainable industrial growth (November 28, 2025 | 15:22)

- South Korean investors seek clarity on IP lease extensions (November 24, 2025 | 17:48)

- CEO shares insights on Phu My 3 IP’s journey to green industrial growth (November 17, 2025 | 11:53)

- Business leaders give their views on ESG compliance in industrial parks (November 15, 2025 | 09:00)

- Industrial parks pivot to sustainable models amid rising ESG demands (November 14, 2025 | 11:00)

- Amata plans industrial park in Ho Chi Minh City (November 04, 2025 | 15:49)

Tag:

Tag:

Mobile Version

Mobile Version