Navigating legal challenges in healthcare partnerships

Public-private partnership (PPP) is a mechanism and common practice to mobilise and encourage investment in areas promoted by governments. The main characteristic of such projects is that both private investors and public authorities share the risks and responsibilities in construction and operation.

The public sector typically contributes only a small portion to these projects, with the private sector still in charge of construction and operation. The risks of these projects typically involve the phases of selection, approval, design, construction, financing, operation, and management phases.

Over the years, Vietnam issued several decrees before the new Law on Public-Private Partnership Investment was promulgated in 2020 and took effect from January 2021. The law and accompanying decree guiding the implementation of the law have overcome and limited barriers to investment in the form of PPP, creating favourable conditions for such investment.

PPP investment in health is one of the areas promoted by the government. Given that the state budget only meets 64 per cent of the capital needs for health infrastructure development, the law on PPP investment will bring investment potential for healthcare and improve a portion of the facilities of hospitals and clinics in Vietnam. The law also provides procedures for developing feasibility studies, approvals, and more.

According to the preceding condition, projects with a total investment of less than VND100 billion ($4.34 million) are not considered PPP ventures, and the rules governing such projects are regulations on mobilisation of private capital. Despite supportive mechanisms and regulations, there are still numerous impediments to the development of PPP healthcare facilities.

Most healthcare PPP projects, for example, lack specialised tools to guide technical issues, investor selection, and more. In health, if the PPP framework is applied, it will lengthen the time for formulation, selection, and implementation and limit the mobilisation of capital from private investors.

|

| Navigating legal challenges in healthcare partnerships-illustration photo, source: freepik |

The biggest challenge

Decree No.28/2021/ND-CP stipulates capital sources for PPP project implementation, including investor’s equity, loan mobilisation, and corporate bond capital. According to Doan Giang, PPP specialist of the United States Agency for International Development, 80 per cent of the capital of each PPP venture comes from banks. As a result, banks are concerned about regulations aimed at protecting the interests of banks and ensuring the ability to recover capital.

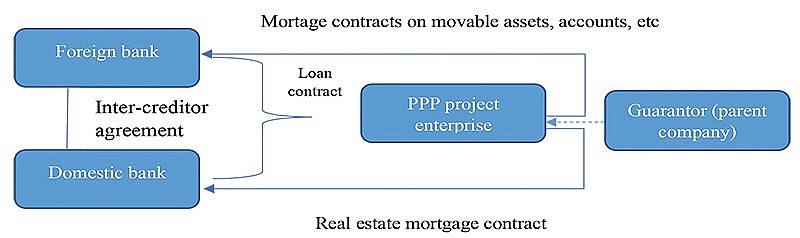

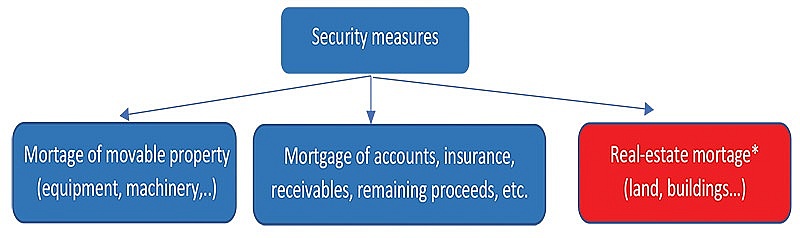

The law on PPP investment stipulates that enterprises may mortgage assets and land use rights to the lenders under the land law and civil law provisions. However, the land law does not allow mortgages of land use rights and properties attached to land to foreign banks. As a result, those banks are only allowed to mortgage the movable assets, whereas land use rights are often a significant asset of a PPP project. This regulation significantly restricts the source of loans from foreign banks. Thus, in order for the bank to agree to provide loans for them, it is necessary to solve the problem of how to reduce risks from the bank’s side. In the above measures, foreign banks can be the mortgagor of movable assets, accounts, insurance, receivables, and the remaining proceeds. Regarding real estate mortgages, foreign banks can cooperate with one or more domestic banks to jointly finance PPP projects and receive real estate mortgages.

Risks in prefeasibility

One of the procedures in PPPs is developing pre-feasibility study (pre-FS) and feasibility study (FS) reports. The pre-FS report is one of the documents that must be submitted to relevant authorities for investment approval. At the same time, FS is the authority to approve the project and continue the remaining steps, such as selecting investors, establishing enterprises, and signing contracts.

The law on PPP investment prescribes procedures for both the competent authority and the investor to exercise the right to propose projects in the health sector and other sectors. Most of the proposals come from the competent authorities and a few from investors due to the complicated procedures of the law and the lack of support from government agencies in supporting the proposals.

One question is how to encourage investors to propose and develop pre-FS, and FS reports, which need to be addressed in the approval process of health PPP projects.

Investors who foresee the benefits of healthcare projects in the form of PPPs can fund the development of pre-FS and FS. There are benefits they can claim from the local government. Firstly, investors may be eligible for incentives from the government regarding procedures for granting land-use rights. Most PPP projects follow the same procedures as other ventures, in that the investor can be granted or leased land to implement it after winning the bidding. The procedures for site clearance compensation are complex and may necessitate assistance from local authorities. Secondly, investors are quite confident in their ability to be selected during the bidding process because they meet the conditions specified in Circular No.09/2021/TT-BKHDT guiding the selection of investors in the form of PPP.

|

|

Which mechanism?

The development of a clear mechanism for state participation in PPP projects will demonstrate the government’s commitment to partnering with the private sector to implement the venture. There are several mechanisms that can be looked at for this.

Firstly, the state can contribute to PPP health projects through capacity, quality of personnel, and prestige (in hospital construction and operation). Hoan My Hospital is the oldest and largest private hospital in Vietnam. Therefore, it quickly attracted investment capital from major investment funds such as VinaCapital or DWS Vietnam Fund; then, Fortis Healthcare acquired 65 per cent of Hoan My’s shares for $64 million. However, after only a short time, Fortis had to part ways, despite the fact that this investment made them a profit of $16 million.

One of the reasons foreign investors divested early from Hoan My is that it is difficult for private hospitals in Vietnam to find good human resources, which makes it difficult to attract patients. Due to a lack of qualified human resources, private hospitals are forced to entice competent doctors from the public sector, resulting in relationships that are difficult to manage and can lead to unanticipated consequences.

Gia An 115 Hospital was also recently established as a public-private partnership hospital between People’s Hospital 115 and Hoa Lam Company. The PPP model here was a form of cooperation that optimises investment efficiency and provides high-quality public services, benefiting both the state and the people.

On the side of private investors, this model has the potential to address the previously identified shortage of high-quality and reputable human resources at private hospitals like Hoan My Hospital.

Secondly, the criteria for PPP in health could be lowered to attract investors. The scale of PPP projects is regulated from VND1.5 million ($65.21 million) or more for those in transportation, power transmission lines, power plants, irrigation and clean water supply, drainage, and wastewater. However, for schemes in the health sector, the state lowers regulations and requires a scale of only VND100 billion ($4.34 million) or more for projects in the health sector.

Particularly for projects under the operate-management contract, the regulations on the size of the minimum total investment mentioned above do not apply. This model can be applied to a healthcare PPP project in which the state plays the role of site clearance and construction, while private investors can manage, operate, and do business. This model assists in optimising the strengths of each party in order to maximise benefits for both parties while minimising the risks when one party lacks experience in some areas of the project.

The third factor is the mobilisation of private capital into of related projects. More than a decade ago, the state began to encourage organisations and individuals to participate in projects in education, training, healthcare, culture, sports, and the environment. This included provincial-level people’s committees using existing housing and infrastructure funds or building houses and infrastructure for socialisation for long-term rentals at preferential prices. Social establishments are also allocated or leased land by the state; and those that earn income from related activities are entitled to a corporate income tax rate of 10 per cent throughout the operation period and are exempt for four years from the date of generating taxable income.

The next mechanism relates to sharing the increasing and decreasing revenues. Enterprises and the state share in revenue increase/decrease when the actual revenue is higher than 125 per cent or less than 75 per cent of the revenue in the financial plan. The state will share 50 per cent of the difference between actual revenue and 125 per cent (if increased) or 75 per cent (if decreased) of revenue in the financial plan.

The share of increased revenue is counted as a direct reduction in revenue when determining the corporate taxable income of the PPP project enterprise. The share of reduced revenue is calculated as the revenue from providing public products and services of the enterprise.

A further consideration is the promotion of incentives. The current law on PPP investment provides additional bonuses for investors such as tax incentives, land use fees, land rents, and others. There are also guarantees for the right to access land, rights, and other public assets: enterprises are allocated land leased by the state, or allowed to use other public assets to perform PPP contracts. Enterprises can use public works and other ancillary works to implement the project.

Finally, contracting agencies and competent agencies are responsible for coordinating with local authorities where the projects are implemented to ensure the security, order, and safety of people and property.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Healthcare Platform

- PM outlines new tasks for healthcare sector

- Opella and Long Chau join forces to enhance digestive and bone health

- Hanoi intensifies airport monitoring amid Nipah disease risks

- Cosmetics rules set for overhaul under draft decree

- Policy obstacles being addressed in drug licensing and renewal

Related Contents

Latest News

More News

- Tactics for US to get ahead in real estate (May 12, 2022 | 13:00)

- The wider benefits of digital signatures in e-transactions (April 18, 2022 | 11:31)

- Interpreting new real estate statutes (August 23, 2021 | 09:20)

- Mitigating procedural delays in pharmaceutical market (July 12, 2021 | 13:00)

- Pros of sandbox regulation for fintech (July 09, 2019 | 13:36)

- Wind power barriers need removing (April 02, 2019 | 09:55)

- Advice for foreign home ownership (November 16, 2015 | 08:37)

- Revised legal framework benefits foreign investors (October 26, 2015 | 07:36)

- Important documents regulating bank guarantee (September 19, 2015 | 11:11)

- Law Changes Open up Opportunities in Property Sector But Questions Remain (September 04, 2015 | 11:27)

Tag:

Tag:

Mobile Version

Mobile Version