The state of play in healthcare M&As

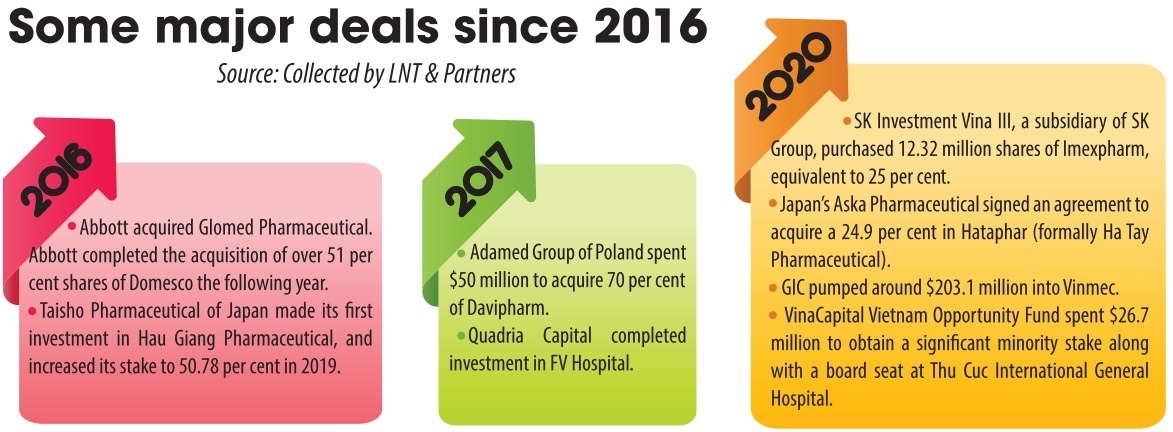

While foreign drugs account for half of the market demand, domestic brands have seen their annual growth rate decline in recent years. Thus, the implementation of mergers and acquisitions (M&As) with foreign enterprises becomes an opportunity for domestic pharmaceutical businesses to increase their scale and capacity. Foreign investors such as VOF Fund, SK Group, and Aska from Japan have been observed purchasing shares in hospitals and pharma companies; and Sanofi from France has invested significantly in the construction of pharmaceutical and medical factories.

|

| Top foreign groups are investing significantly into pharma and medical facilities in Vietnam, Photo: Le Toan |

According to market research firm IBM, the pharmaceutical market in Vietnam was valued at around $5 billion in 2015, $10 billion in 2020, and is expected to reach up to $16.1 billion in 2026. Foreign pharma companies typically engage in M&A to take advantage of available resources in order to reduce costs and accelerate time to market. There have been numerous significant M&A cases that have been formed, especially since the effectiveness of the Law on Pharmacy 2016 (see box).

|

Eco-social and legal factors

The M&A situation in the sector over recent years is the consequence of both eco-social factors and legal ones. Regarding the eco-social factor, Vietnam was considered one of the least developed nations in the world in 2000, but by 2020 it was categorised as a middle-income nation.

As a result, Vietnamese are willing to spend more on healthcare and up to 30 million of the population can afford costly medicines and healthcare service. The increase in healthcare spending will create new opportunities for the foreign investors to access the domestic market.

Most local businesses are unfamiliar with M&A in the pharmaceutical and healthcare industries. Local businesses are unfamiliar with the process, and only a handful of pharma companies in Vietnam currently meet international standards. Few local businesses have GMP compliant facilities or meet international standards. Therefore, foreign financiers mostly target big Vietnamese companies.

The nation’s demand for pharma raw materials is dependent on imports mainly from China and India. Due to the effects of the pandemic, numerous Chinese factories producing active ingredients suspended operations or exports to Vietnam, resulting in an increase in the price and a shortage of quantity of medicine produced locally during the pandemic period. The shortage of materials for producing medicine is an unfavourable condition for investors during the pandemic. In addition, the crisis also led to a backlog of a significant number of extension applications of marketing authorisation (MA) that needs to be resolved while the human resources for application appraisal are seriously lacking, which pose an inevitable risk of serious medicine shortage for at least the next two years.

In terms of legal factors, under Vietnam’s World Trade Organization commitments on services, the minimum capital for a commercial presence in hospital services must be at least $20 million for a hospital, $2 million for a policlinic unit, and $200,000 for a speciality unit. For members of the ASEAN Framework Agreement on Services and the EU-Vietnam Free Trade Agreement, there is no limitation on market access and no minimum capital is required.

The current law requires compulsory extending of the MA. As mentioned, Vietnam faces a risk of medicine shortage due to delay in extending the MA. This extension barely affects the quality, safety, or efficacy of the medicine because the medicines have been registered for circulation in Vietnam and other countries. However, such procedures are a compulsory requirement under the laws. Therefore, this can be considered an unfavourable mechanism in the view of foreign investors.

Foreign investors are not entitled to participate in or invest in the distribution and retail of pharmaceutical products as provided under Decree No.54/2017/ND-CP. Therefore, they tend to choose to acquire domestic manufacturers to take advantage of cheap production costs and the distribution system from local partners.

Under the current regulations, foreigners or overseas Vietnamese directly providing medical examination and treatment for Vietnamese people must be proficient in the language, which impedes the ability of highly qualified foreign doctors to work and practice here. Foreign investors may consider this as a limitation when joining an M&A transaction in the healthcare sector.

Regulations in bidding price of medicines and medical equipment to be supplied to public health is paradoxical. In particular, the law requires that when developing a plan to select a contractor, the employer must use the no-higher-price of the winning medicines/medical equipment from the previous 12 months as announced by the Ministry of Health (MoH) to formulate prices.

This is inconsistent with market fluctuations, as it disregards the factor of high inflation, large exchange rate differences, and emergencies such as the pandemic. Consequently, hospitals face a dilemma when bidding, leading to the existing and future shortage of medicines and medical equipment.

Incomplete mechanisms for telemedicine is another legal factor. The MoH has issued Circular No.49/2017/TT-BYT on telemedicine, and the digital health market is expected to experience strong growth in Vietnam. In particular, the regulations on this issue will be included in the new Law on Medical Examination and Treatment.

In 2020, the MoH approved a telehealth development scheme for 2020-2025. A further important milestone in the sector’s digital transformation path was marked in September that year when 1,000 healthcare facilities were announced to have been equipped with telehealth centres.

However, currently, Circular 49 is the only regulation governing telemedicine activities in Vietnam. Therefore, the application of telemedicine in practice is hampered by a number of regulatory gaps. It is anticipated that the integration and development of comprehensive telemedicine regulations into the legal system will take considerable time. As a result, if foreign investors intend to enter the Vietnamese healthcare market, they may encounter a legal barrier for now.

Investors from abroad should be informed that healthcare and pharmaceutical business combinations, as well as the combination of other sectors, are subject to the notification of combination to the National Competition Commission if they fall within the scope of the notifications required by the new law on competition.

Overcoming obstacles

One of the major barriers is the changing of laws to keep up with current trends. As Vietnam follows a civil law system which has a highly generalised and stable nature, the laws may not keep up with the change of social relationships. Thus, promoting the revision of important legal documents is very urgent to attract funding in the healthcare sector.

Particularly, there should be complete and specific regulations to deploy telemedicine here. For instance, it has yet had the mechanism to use national health insurance for payments through telemedicine, or how to process and share data among the hospitals/polyclinics, or how to make electronic medical records or electronic prescriptions.

Another obstacle to overcome is the inefficient use of public resources and information technology. In particular, the licensing procedures can be improved if available resources and information technology can be utilised. For instance, the licensing authority can use support from universities, hospitals, and research institutes to accelerate the testing process for the MA issuance or renewal.

Besides, IT can be used for filing dossiers, document classification, updating status, and issuing results. The e-signatures should also be applied to execute the documents. For example, online submission may have a classification system, and may reject the majority of invalid applications – then, the expert’s appraisal will be faster and easier.

It can be seen that there are many factors affecting an M&A deal in the healthcare sector. To save time and money, and prevent the risk of violating regulations, it is vital to have a good consultant to advise on solutions to meet the requirements of capital, or assess the possibility of conducting the merger filing before entering into the latter stages of a deal.

| M&A Vietnam Forum 2022: 'Igniting new opportunities' The 14th Vietnam M&A Forum 2022 organised by Vietnam Investment Review under the auspices of the Ministry of Planning and Investment took place in Ho Chi Minh City on November 23. |

| Experts look to 2023 for top M&A deals Although the merger and acquisition market in Vietnam has been slow going in 2022, opportunities next year should be abundant even despite concerns from prolonged global economic storms, according to various insiders. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Cool Japan Fund transfers shares of CLK Cold Storage (January 28, 2026 | 17:16)

- Nissha acquires majority stake in Vietnam medical device maker (January 26, 2026 | 15:40)

- BJC to spend $723 million acquiring MM Mega Market Vietnam (January 22, 2026 | 20:29)

- NamiTech raises $4 million in funding (January 20, 2026 | 16:33)

- Livzon subsidiary seeks control of Imexpharm (January 17, 2026 | 15:54)

- Consumer deals drive Vietnam’s M&A rebound in December (January 16, 2026 | 16:08)

- Southeast Asia tech funding rebounds on late-stage deals (January 08, 2026 | 10:35)

- DKSH to acquire Vietnamese healthcare distributor Biomedic (December 24, 2025 | 15:46)

- Central Retail refocuses Vietnam strategy with Nguyen Kim exit (December 24, 2025 | 15:01)

- RongViet Securities wins sixth consecutive M&A advisory award (December 22, 2025 | 17:30)

Tag:

Tag:

Mobile Version

Mobile Version