More citizens see fitness benefits

Health blogger Hana Giang Anh is a well-known name among Vietnamese women who dream of having better health and a shapely body. She usually livestreams to share her tips and experiences about health and fitness to help other women stay healthy.

Her lovely smile and physical beauty have impressed thousands of people and gathered a tremendous follower base for her on social networks. This popularity has allowed her to leave her long time occupation as a fitness trainer and start her own gym called Inspire Boutique Fitness.

All know that health is the most important thing in life as well as the key to open the doors to success in each individual’s career, and Vietnamese people are becoming more aware of protecting and improving their health.

Anh and her content about health serves as proof that Vietnamese people are gradually becoming more interested in improving their own health, creating a demand for the fitness market.

|

A boom in fitness chains

Indeed, Vietnam is seeing more interest in gyms and other health-related services as eating habits change and signs of obesity emerge. The country now accounts for the largest portion (30 per cent) of all fitness facilities among the six major members of the ASEAN.

California Fitness & Yoga, a local chain of gyms founded by an American, boasts some 100,000 members, mainly in Ho Chi Minh City and Hanoi, while other facilities are springing up around the country.

Randy Dobson, founder and chairman of CMG.ASIA, the owner of California Fitness & Yoga, told VIR that Vietnam has positively been transformed over the last decade from a culture that did not see exercise and nutrition as a critical aspect of life, to now leading the world in healthy lifestyle values and fitness-related activities.

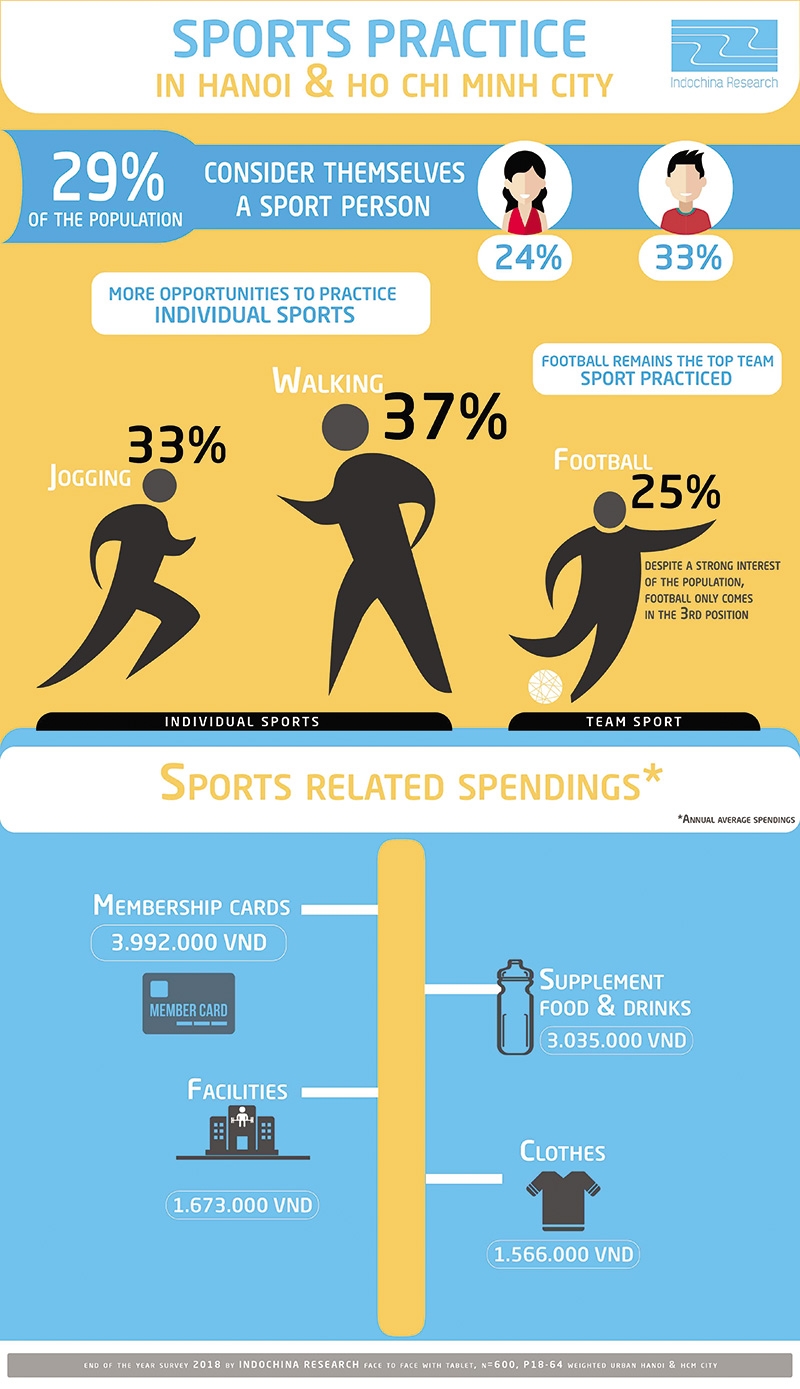

“In Southeast Asia, Vietnam has the highest percentage of household GDP spent annually on health and fitness. Nearly one in three Vietnamese people now identify as fitness fanatics, which places the country as the most health-conscious in the world, and at nearly double the rate of the United States,” he noted.

The other well-known names in the Vietnamese fitness market include Elite Fitness under Lifestyle Vietnam JSC, Fit24 originating from EuroFit, a fitness and yoga group based in Germany, and Curves Vietnam under Curves International, also known as Curves for Women, an international fitness franchise.

Sean T. Ngo, CEO of VF Franchise Consulting, told VIR, “In recent years, we have seen a boom in the fitness industry, from health fitness gyms to fitness apparel, shoes, tech products, and even health supplements. Staying healthy and fit is increasingly important for both the young and old in Vietnam. Rising disposable incomes and awareness of the benefits of a healthy lifestyle continue to drive the industry forward.”

Data from Germany-based market research firm Statista showed that the revenue in the Vietnamese fitness segment could amount to $60 million in 2019 and is expected to show an annual growth rate of 7.4 per cent, resulting in a market volume of $80 million by 2023. The fitness market’s largest segment is wearables with a market volume of $49 million in 2019.

Competitive landscape

It is obvious that Vietnam’s fitness market is attractive to new players. According to Ngo, niche players like Curves normally appear in markets where the fitness industry is nearer to the maturity stage, and when consumers are looking for something different.

“For example, Curves is a women-only gym that offers fitness and meal programmes for women to meet their health and fitness needs. It is because of this clear distinction that it is able to differentiate itself from the typical gyms that try to cater to all,” he said.

Meanwhile, the Vietnam-based fitness platform WeFit has been around since 2016 to serve the rising demand. WeFit is a mobile application which allows users to look for and sign up for training sessions at hundreds of gyms located in Hanoi and Ho Chi Minh City.

In January, WeFit announced that it has just closed a pre-Series A funding for $1 million from CyberAgent Capital. In 2017, WeFit received investment from the Vietnamese venture capital firm ESP Capital and accelerator and seed-stage fund VIISA.

According to Khoi Nguyen, founder and CEO of WeFit, beauty care is believed to be the second-most competitive segment behind food delivery. “We are lucky as there are no rivals in the fitness segment yet, but the beauty care sector is very competitive with a high number of service providers,” he said.

According to Ngo of VF Franchise Consulting, as competition increases, all players must renovate and adapt to the changes in the competitive landscape. This may raise gym membership prices, but consumers are becoming more knowledgeable and demanding, and most understand that better products and services come with higher fees.

He added that current players are constantly trying to offer more products and services that appeal to consumers who seek a slightly different type of fitness programme like boxing, kickboxing, UFC-style classes, yoga, competitive cycling, and zumba. Products may include various health supplements and other merchandise.

Moving forward

The big names in the Vietnamese fitness market which have invested in facilities and coaches attract the most trainees. However, the price of training has also become a problem, creating a niche market in the fitness industry for small private gyms and yoga studios.

Small gyms and yoga studios in residential areas are also becoming more popular. Public parks and playgrounds in residential areas are also equipped with exercise machines for residents to use. This shows that people are gradually paying more attention to improving their health.

The latest report by India-based market research company Ken Research points out that unorganised fitness centres strongly dominated the Vietnamese fitness services market, which contributes more than half of the market revenue as of 2018.

Meanwhile, organised fitness centres hold a small share in terms of the number of fitness outlets, with their major foothold in urban areas only, whereas unorganised fitness centres are strong across the overall market.

According to the report, the Vietnamese fitness market is expected to register a positive compound annual growth rate of 19.5 per cent in terms of revenue in the 2018-2023 period. The market is at a growing stage with high potential in future expansion in both urban and suburban areas.

The total addressable market in Vietnam for fitness services has been expanding, supported by heavy expenditure by companies on brand promotion activities and marketing, increasing health consciousness in the population, and expanding disposable incomes.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- List of newly-elected members of 14th Political Bureau announced (January 23, 2026 | 16:27)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- List of members of 14th Party Central Committee announced (January 23, 2026 | 09:12)

- Highlights of fourth working day of 14th National Party Congress (January 23, 2026 | 09:06)

- Press provides timely, accurate coverage of 14th National Party Congress (January 22, 2026 | 09:49)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- Minister sets out key directions to promote intrinsic strength of Vietnamese culture (January 22, 2026 | 09:16)

- 14th National Party Congress: Renewed momentum for OVs to contribute to homeland (January 21, 2026 | 09:49)

- Party Congress building momentum for a new era of national growth (January 20, 2026 | 15:00)

Tag:

Tag:

Mobile Version

Mobile Version