Level of risk appetite the name of the game for new financial transactions

Is this a good time to invest in digital assets or consider other investment channels?

|

| Hanh Nguyen, country business development manager at Exness Vietnam |

The market made a bottom before experiencing a recession about six months ago, and investors with a bottom-fishing mentality staggered in the past year when many asset groups underperformed. Important groups of indicators should be observed. Crypto performance tends to be highly correlated with the economic situation, with the dominant issue being cash flow.

What is more attractive in advanced technology over traditional investment?

Flexible investment lines create investment opportunities 24/7, while technology contributes to investors. The new investment channels that use advanced technology gives fast transaction speed and larger liquidity. Besides that, transaction costs are cheaper. The advanced technology gives many fast and efficient deposit and withdrawal methods with low cost.

In the Industry 4.0 environment where most techniques and technologies are developing strongly, sources of knowledge are diverse. Each individual investor needs to spend time improving their skills, to figure out the level of risk in the portfolio before starting looking for opportunities in 2023.

Due to the numerous options they have when selecting information sources, brokers, and quality assets, the aforementioned advantages can also be barriers for investors. What is more, the state of the economy as a whole will worsen in 2023, posing problems for both new and existing investors in terms of how to allocate their portfolios and employ resources.

Investors need to determine the risk appetite and level of risk in the field of financial transactions. Based on capital and knowledge, each person needs to build their own risk management strategy. The risk strategy must determine the risk tolerance level is approximately how much money and which investment segment.

In the financial sector, there are opportunities in both new and classic trade. I must decide on the degree of risk strategy as well as how much risk I am willing to take.

How do you evaluate investment opportunities this year?

The market is forecasted to remain gloomy. Last year the world witnessed changes in economic policy, monetary tightening, geopolitical instability, and other volatile factors. The US Federal Reserve shows no sign of stopping interest rate hikes at least in the first half of the year. But by the end of 2023, the Fed is likely to ease policy. I believe the economy will be brighter by the end of 2023 and enter good shape by early 2024.

| Financial groups step up quality drive to improve operations Financial companies in Vietnam are scrambling to adapt to socioeconomic changes in order to survive and thrive. |

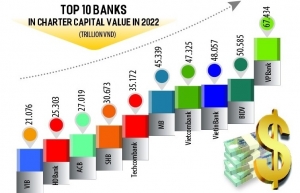

| Banks bolster financial strength via M&As and capital hikes Since the start of the year, several banks have been busy with mergers and acquisitions (M&A) and capital hike ventures to bolster financial health and keep up with ever-increasing development needs. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- MAE names big 10 policy wins in 2025 (February 06, 2026 | 08:00)

- US firms deepen energy engagement with Vietnam (February 05, 2026 | 17:23)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Site clearance work launched for Dung Quat refinery upgrade (February 04, 2026 | 18:06)

- Masan High-Tech Materials reports profit: a view from Nui Phao mine (February 04, 2026 | 16:13)

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

Tag:

Tag:

Mobile Version

Mobile Version