Investment activity hinging on fresh US policy direction

Singapore-based United Overseas Bank anticipates an expansion pace of 6.6 per cent for Vietnam’s economy in 2025 in its report published last week.

It noted that Vietnam’s economy is on a solid growth path and will end the year on a positive note, possibly reaching 6.4 per cent in 2024.

However, it is necessary to note that the VND’s depreciation pressure comes from many external factors.

“With the forecast of global trade tensions continuing to increase and the strength of the USD, which is a growing concern, the State Bank of Vietnam is expected to pay attention to the depreciation pressure on the VND. Therefore, we expect the main refinancing rate to remain at 4.5 per cent,” said the report.

|

| The pieces of the US monetary policy puzzle will not be clear until the new administration takes office |

In addition, the VND has gone through a volatile period in the past few months. After recording its largest quarterly gain (3.5 per cent) since 1993 in the third quarter of this year, the VND reversed all gains in October and November. Despite its solid foundation, the VND was held back by external factors such as a recovering USD as the market re-priced the scenario of fewer Fed rate cuts in the next US presidential term

Tran Hoang Son, director of Market Strategy at VPBank Securities, said the tense exchange rate could cause foreign investors to increase net selling in the Vietnamese stock market.

“For capital flows to shift back to the domestic market, the Donald Trump effect needs to pass and the performance of US bonds needs to cool down,” Son said.

However, he believed that the exchange rate could stabilise by the end of the year because the Fed has lowered interest rates and is expected to reduce them by another 25 basis points several more times in 2025. The USD will likely decrease next year and the Vietnamese exchange rate may be more stable.

Ho Quoc Tuan, senior lecturer at the University of Bristol, said that Vietnam’s macro story was still stable, but the uncertainty came from outside, with factors such as the increased strength of the USD or the increased interest rates of US government bonds. International capital flows will flow to where interest rates are expected to be higher.

“When interest rates in the US increase, international capital flows tend to shift to markets with more attractive interest rates, which creates pressure on other markets, including Vietnam. Therefore, the instability from trade policies and changes in the international financial environment will be factors that need to be carefully calculated,” Tuan said.

“There are other stories such as gold, crypto, and real estate that are all in a certain state of heating up.”

Le Duc Khanh, analysis director at VPS Securities, said that 2024 was a difficult period for the stock market, but it still increased by 11.7 per cent. However, this is still a foundation for accumulation. The market has not increased significantly yet, possibly due to many reasons, such as investors’ vision and unresolved issues.

“But 2025 is a year with more expectations. On the low base of 2023, this year has increased, which is already a positive thing,” Khanh said.

“In 2025, the market may be better because of factors such as improved macroeconomics, foreign investment recovery, and the government’s promotion of public investment. With those foundations, the stock market can surpass 1,300 and move towards beating 1,400 points,” he said.

| The global economy continues to face many risks and uncertainties. In that context, investors have to find ways to adapt and develop, transforming governance and business methods. That creates new profitable opportunities for many investment channels. To grasp the investment environment in Vietnam to flexibly respond, and turn problems into progress in 2025, VIR is to host “Investing 2025: Decoding Variables - Embracing Opportunities” in Hanoi on December 12. At the conference, economic experts will evaluate existing and potential investment channels, making recommendations to the business community and investors about both the opportunities and the risks. |

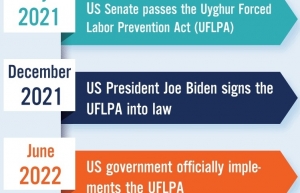

| Facilitating recovery of Vietnam’s yarn sector in midst of US policy enforcement The Vietnam Textile and Apparel Association has held a meeting with the US partners to discuss the enforcement of the Uyghur Forced Labor Prevention Act. Association chairman Vu Duc Giang shared with VIR’s Ky Anh the impact of the act on Vietnam’s garment exports to the United States. |

| US policy concerns can still be navigated Vietnam’s economic resilience will be tested in 2025 as it navigates risks of US trade protectionism under the “Trump 2.0” administration, allegations of currency manipulation, and global economic recovery, while leveraging its strong trade surplus and recovering domestic sectors. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

- Haiphong welcomes long-term Euro investment (February 16, 2026 | 11:31)

- VIFC in Ho Chi Minh City officially launches (February 12, 2026 | 09:00)

- Norfund invests $4 million in Vietnam plastics recycling (February 11, 2026 | 11:51)

- Marico buys 75 per cent of Vietnam skincare startup Skinetiq (February 10, 2026 | 14:44)

- SCIC general director meets with Oman Investment Authority (February 10, 2026 | 14:14)

- G42 and Vietnamese consortium to build national AI infrastructure (February 09, 2026 | 17:32)

Mobile Version

Mobile Version