KIDO offensive to fill vacuum

|

| Golden Hope Nha Be was the latest meal in KIDO Group’s M&A bonanza in the cooking oil segment, Photo: Le Toan |

The Vietnamese cooking oil market is proving more challenging than several foreign investors had thought before taking the plunge, with intense competition and lower profits to go around. This makes foreign and domestic companies alike more accommodating of KIDO Group’s aggressive mergers and acquisition (M&A) strategy that aims to secure it the leading position in the market by securing new capacities.

KIDO Group (KDC) has wrapped up the purchase of 51 per cent stake in Golden Hope Nha Be which is a 51-49 joint venture company between Sime Darby Plantation from Malaysia and Vocarimex (a KIDO subsidiary). After the purchase, KIDO increased its holding in Golden Hope to 100 per cent and appointed three members of its personnel to the leadership of Golden Hope Nha Be for the positions of chairman (cum legal representative), chief executive officer, and chief operating officer.

Golden Hope Nha Be currently has the charter capital of VND69.26 billion ($3 million). It is one of the leading cooking oil producers in Vietnam with the Marvela and Ong Tao brands, with the annual revenue of around VND1.3 trillion ($56.5 million).

KIDO general director Tran Le Nguyen stated that the group will utilise its financial strength and management experience to restructure the operations of Golden Hope and turn profit. In late May 2017, KIDO completed the purchase of more than 32.8 million shares of Vocarimex, increasing its total stake to more than 62.1 million, equal to 51 per cent. This purchase opened the doors for KIDO’s Golden Hope M&A deal, while Vocarimex also holds capital in numerous other cooking oil producers, including a 17.84 per cent stake in Tan Binh Vegetable Oil JSC and 24 per cent in Cai Lan Oils and Fats Industries Company (Calofic) – the current holder of the largest market share in Vietnam.

In November 2016, KIDO also spent more than VND1 trillion ($43.5 million) buying 65 per cent of Tuong An Vegetable Oil JSC. After this acquisition, KIDO gained VND7.023 trillion ($305.3 million) in net revenue in 2017, up 214 per cent over the previous year, while pre-tax profit was VND569 billion ($24.7 million), far exceeding the plan set forth in 2017.

Discussing KIDO’s buying rampage with VIR, Le Phung Hao, former chairman of the Vietnam Marketing Association, said that cooking oil is an essential food product and the demand for it is always stable and large, so fierce competition is a given.

“With its available production lines and distribution channels, KIDO has numerous advantages and is a leading producer in the cooking oil market. Its recent acquisitions increasing its power in the market step-by-step are making opponents worried,” said Hao. “The dominator always gains certain advantages which are not available to the followers.”

Acquiring Golden Hope is a solution for KIDO’s sourcing problems as Golden Hope Nha Be’s factories are located near ports, so it could also facilitate importing materials from the US, Canada, and Europe to manufacture cooking oil. Golden Hope also has numerous brands such as Marvela, Ong Tao, and Super Olein, as well as soybean oil Delio and holds great potential to bloom.

However, KIDO is not the only one stepping on the gas in the market. Sao Mai An Giang, a real estate developer, spent VND500 billion ($21.7 million) building a plant that makes cooking oil from basa fish fat under the Ranee brand. Meanwhile, Vietnam’s Daso Group, specialising in providing logistics services, also launched two new vegetable brands, Ogold and Binh An. Quang Minh JSC also began marketing cooking oil products of the Mr Bean, Soon Soon, and Oilla brands.

In March 2013, Singaporean Musim Mas built a vegetable oil factory with the capacity of 1,500 tonnes per day in Vietnam with the total investment capital of $71.5 million. Meanwhile, Singapore’s Wilmar International made a deal to buy 45 per cent stake of Bunge Limited, which has a factory in the southern province of Ba Ria-Vung Tau with a capacity of 3,000 tonnes per day.

|

PROMISING MARKET…

Over time, Vietnamese concepts of food have evolved from simply a means of survival to something that needs to be safe, of high quality, and contain the right nutrients. The edible oils category has certainly been affected by this transition. In the past, animal fat-based oil was commonly used, but vegetable and seed oils now account for the largest share of sales. Numerous types of vegetable and seed oils are available in Vietnam, with the most common being blended oils. According to Euromonitor, Vietnamese people consume less than 10 kilogrammes of cooking oil per annum, less than the World Health Organization’s (WHO) recommended level of 13.5kg. However, the figure is expected to rise to 16.2-17.4kg by 2020 and to 18.6-19.9kg by 2025.

The Nielsen estimated the value of the Vietnamese cooking oil market at VND30 trillion ($1.3 billion), making it quite an attracting segment.

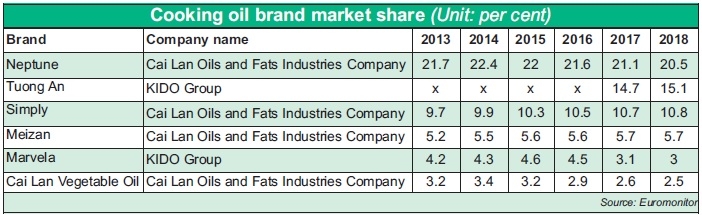

Telling VIR about the position and advantages of each player (statistics in the below table), Euromonitor’s representative said that Calofic remained the clear leader in edible oils thanks to its wide product portfolio catering to different consumer groups. For example, Neptune Gold is positioned in the premium segment, while Meizan is a mass brand, Simply targets health-conscious consumers, and Kiddy is a children’s brand.

The company also invests in regular advertisements and other marketing activities to maintain consumer awareness of its brands. It also benefits from an extensive distribution network thanks to subsidiaries in both the north and south of Vietnam, which help the company produce and deliver edible oils at competitive prices.

Nevertheless, after the acquisition of Tuong An and Vocarimex, KIDO Group is becoming an increasingly strong competitor. They have already diversified their product range in response to the changing consumer demand and are continuing to grow their market share – especially by holding indirect stakes in their main competitors like Calofic. Thus, competition between the two players is expected to intensify, Euromonitor assessed.

…WITH TIGHT PROFITS

Cooking oil is not a sector with easy profit to be made by just anybody. After five years spending $130 million to build a soybean oil processing facility (since 2011), Bunge Limited, an American agribusiness and food company, has failed to turn profit and decided to sell 45 per cent of its stakes to Wilmar in July 2016. Since then, a three-party joint venture has been created with Bunge and Wilmar as equal, 45 per cent shareholders, and soybean meal distributor Quang Dung (a majority owner of feed miller Green Feed) retaining its 10 per cent stake in the operations. Wilmar is also a major shareholder of Calofic.

Meanwhile, Acecook Vietnam (wholly owned by two Japanese firms) has exited the segment with the disappearance of De Nhat cooking oil brand, proving unable to weather competitive pressure and accompanying marketing and promotion expenses.

According to the Ministry of Industry and Trade, there are around 40 companies on the cooking oil market. Edible oil products are very easy to replace, along with the high elasticity of demand, so tiny price fluctuations are enough to make customers switch brands. Additionally, emerging trends have been affecting the cooking oil market. As obesity emerges with higher disposable incomes, consumers are growing more aware of the negative health effects of oil and grease. This brought a turn towards oil-free foods. Companies in this sector need more and more internal and financial resources in the race for market share and for building brands.

Of all, the Vietnamese cooking oil market is rather sizeable – with plenty of further growth expected – but is constricted by intense competition and profit figures that may be less impressive than what foreign investors might be used to. The resulting backpedaling by foreigners provided an ample opportunity for the rise of a local king of the hill: after all, even without landfall profits, there is still plenty to be had and KIDO was sharp enough to realise the opportunity.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

- Vietnam financial markets on the rise amid tailwinds (February 11, 2026 | 11:41)

- New tax incentives to benefit startups and SMEs (February 09, 2026 | 17:27)

- VIFC launches aviation finance hub to tap regional market growth (February 06, 2026 | 13:27)

- Vietnam records solid FDI performance in January (February 05, 2026 | 17:11)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- EU and Vietnam elevate relations to a comprehensive strategic partnership (January 29, 2026 | 15:22)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

Mobile Version

Mobile Version