Integration 2.0 - the future of the agri-food industry

|

Over the past decade, the agricultural industry has undergone rapid changes, defined at Ipsos Strategy3 as ‘Integration 1.0.’ During this phase, there has been significant expansion of the ‘integrators’ segment throughout the value chain, moving beyond the farming sector and towards downstream activities. The agribusiness industry’s dynamics have shifted, primarily due to the outbreak of African Swine Fever in 2019, which acted as a game-changer.

These changes, marked by several key events, have presented both challenges and opportunities for industry players. One of the main opportunities is for the integrators segment, which has aggressively expanded not only in the farming sector but also into the retail world. Integrators have seized the opportunity to promote branded and processed meat products, with a vision of changing the daily consumption habits of Vietnamese people.

Furthermore, there are opportunities for alternative protein, especially as a pork replacement. Pork, which has been an indispensable component of Vietnamese meals for a long time, has seen a significant decline in consumption due to diversification in Vietnamese tastes and the high retail price of pork. Due to the recent economic downturn, people are earning less, and as a result, there has been an increase in the consumption of cheaper alternative meats such as chicken.

While these opportunities emerge, they also present difficulties for various sectors in the industry. Among them, the backyard segment faces the greatest vulnerability and has witnessed a significant decrease and ongoing contraction. This decline can be attributed to the expansion of integrated companies as well as to the highly volatile pricing of animal feed. In 2019, the backyard segment held nearly half of the total market share, but as we near the end of 2023, their share has dwindled to just 23 per cent. This indicates a substantial struggle and loss of ground for the backyard segment.

The situation raises an important question for small-scale farmers in Vietnam: What is the path forward? Will these farmers be able to survive amidst this intense competition, or will they eventually disappear?

The exponential growth of integrator segments can be a ‘double-edged sword’. As integrators continue to increase their expansion in the value chain, it is expected that domestic meat supply will continue to improve and rapidly increase alongside the expansion of these integrators. However, the demand within the country is growing at a slower pace, with meat consumption per person experiencing a modest annual increase of 2-3 per cent due to economic challenges brought about by the pandemic and the global economic crisis. This slower growth raises concerns about the possibility of excess supply in the domestic market.

Another major challenge lies in the limited export volume of meat. One of the key reasons is Vietnam's heavy dependence on imported animal feed, resulting in higher livestock production costs compared to other countries. Higher farming costs result in higher prices for Vietnamese pork meat sold at retail, diminishing the attractiveness of Vietnamese pork among consumers, irrespective of its quality.

Stemming from these industry issues, we have identified seven key themes and trends for the next decade, which, we believe, have the potential to develop and shape a new era for the agribusiness industry. These are, export escalation, new organic livestock farming models, brand successes, a new era of clean and chilled meat, affordable pricing, new sources of animal feed ingredients, and the development of environmental, social, and governance policies.

Ipsos Strategy3 has delved deeper into the first three key trends of the next decade. The first is export escalation. Specifically, exporting is an inevitable trend for integrators on the pathway to sales expansion, especially considering the recent insignificant increase in domestic meat consumption and uncertainties around the growth of processed meat in the local market.

At the same time, figures also suggest that both domestic and export markets should be viewed simultaneously, serving as a protective buffer for players during the development process. While demand in Vietnam can grow concurrently, the expansion of export activities also holds promise for the future, with the key drivers of signed numerous Free Trade Agreements and government initiatives in exportation policies negotiated with other countries.

Second, a new business model for small-hold farmers could be organic livestock farming. Given the current circumstances, the structure of farming appears to be stable, and it is anticipated that there will be minimal changes in the next few years when integrators dominate the market. In addition, emissions from livestock production have long been a pressing concern, particularly for small farms that have limited hygiene and waste treatment processes.

Organic livestock farming, using a circular economic model, has emerged as a vital remedy for such issues. This approach allows farmers to simultaneously raise multiple livestock species and grow crops, utilising the waste generated as valuable resources for subsequent stages. By adopting this method, farmers can diversify their revenue streams, as income can be generated from various sources.

Third is retail competition, or brand success. As the upstream sector of farming remains stable, and considering the highly demanding farming environment over the next few years, we anticipate that the competition will now shift towards the downstream sector. In this sector, integrators, commercial farms, feed millers, animal health companies involved in slaughtering, and others will engage in a new process of integration to establish successful businesses. Integration is no longer limited to traditional integrators, but is open to all participants, including commercial farms that solely focus on the farming aspect.

|

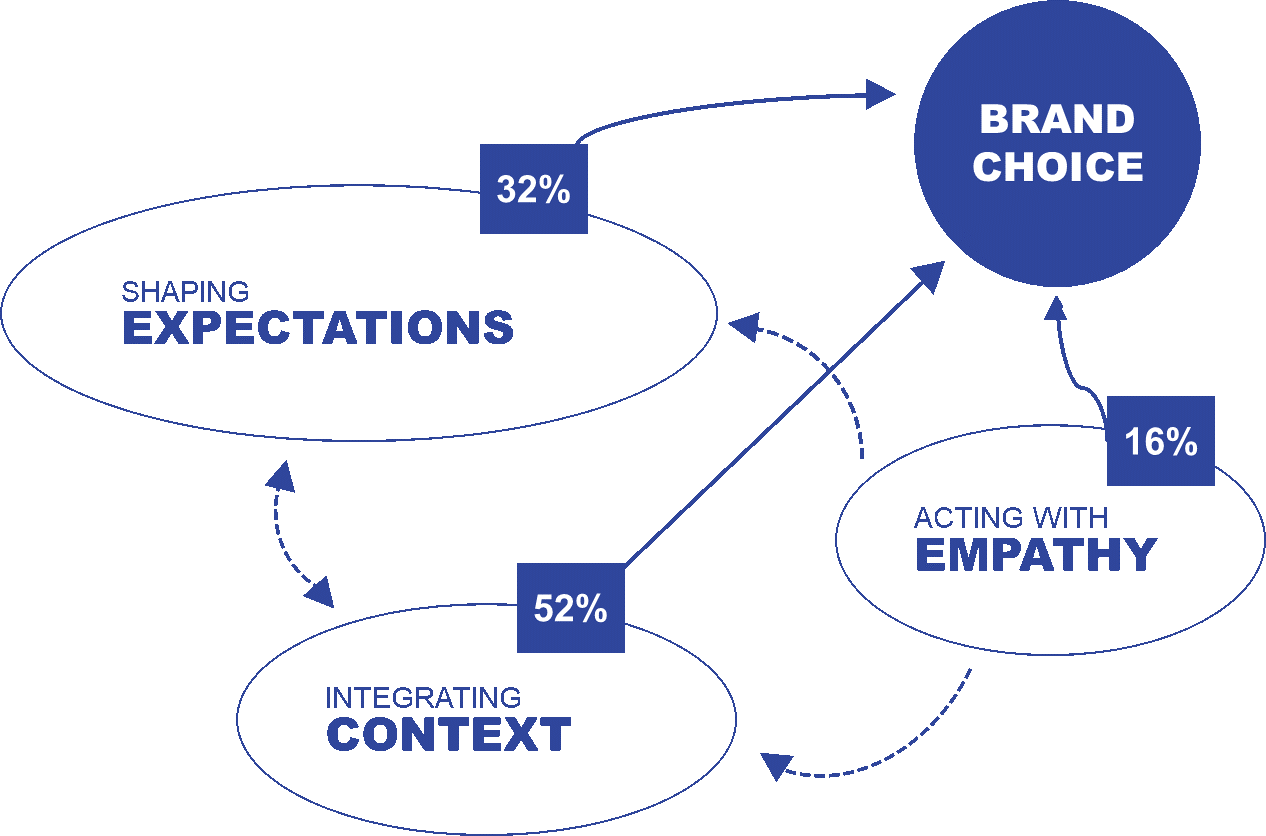

| Leading the downstream sector with the brand success model and the respective drivers of brand choice in the future |

| Ample opportunities for EU and Vietnamese agri-food producers following EVFTA The EU-Vietnam Free Trade Agreement (EVFTA) has opened up a wealth of opportunities for companies on both sides looking to profit from an already thriving trading partnership, particularly in the agri-food sector. |

| Vietnam’s potential to drive agri-food recovery ranks second highest in the region As a key pillar of the national economy, Vietnam’s agri-food sector remained resilient during the COVID-19 pandemic and has great potential to drive economic recovery, ranking second in the region. However, a report by Oxford Economics states that while the sector can be a significant driver of Vietnam’s post-COVID-19 economic recovery, supply and demand risks, fiscal policy measures, and a drawn-out pandemic could disrupt this trajectory. |

| Denmark and Vietnam strengthen cooperation in agri-food The Danish Agriculture and Food Delegation to Hanoi and Ho Chi Minh City from August 16-19 exchange opportunities for cooperation with their Vietnamese partners. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Latest News

More News

- The PAN Group acquires $56 million in after-tax profit in 2025 (February 03, 2026 | 13:06)

- Young entrepreneurs community to accelerate admin reform (February 03, 2026 | 13:04)

- Spring Fair 2026 launches national fair series (January 30, 2026 | 16:17)

- SnP celebrates 10th anniversary with new brand identity (January 30, 2026 | 14:41)

- Sci-tech sector sees January revenue growth of 23 per cent (January 30, 2026 | 11:20)

- Vietnam–Singapore partnership strengthens board leadership (January 30, 2026 | 11:02)

- DIGI-TEXX expands footprint with new hub in Ho Chi Minh City (January 30, 2026 | 09:04)

- Vietnamese spend $2.1 billion on food delivery apps in 2025 (January 29, 2026 | 15:14)

- Japan's NTT DATA signs agreement with CMC Global (January 29, 2026 | 15:03)

- Japfa Vietnam hosts annual customer conference (January 29, 2026 | 12:07)

Mobile Version

Mobile Version