IFRS 17 to impact financial statements of insurance companies

|

| Tran Thi Thanh Truc, assurance partner at PwC Vietnam |

Three measurement models in IFRS 17

IFRS 17 introduces three measurement models for insurance contracts, namely the general measurement model, the premium allocation approach, and the variable fee approach.

The general measurement model is the standard measurement model that can be used for all insurance contracts. To apply this model, insurance companies (insurers) should first understand some important concepts.

The two new key concepts introduced by IFRS 17 are contractual service margin (CSM) and fulfilment cash flows. CSM is a component of the carrying amount of the asset or liability for a group of insurance contracts, representing the unearned profit the insurer will recognise as it provides services under the insurance contracts in the group. Meanwhile, the fulfilment cash flows is the present value of future cash flows, including a risk adjustment for non-financial risks.

In this model, the liability for remaining coverage (LRC) is the sum of CSM and fulfilment cash flows. Annually, insurers need to re-evaluate this liability by considering the impact of the variable factors and reflecting on the liability accordingly.

The premium allocation approach may be applied to insurance contracts with terms of less than one year. This model can also be applied to some insurance contracts where the measurement result of liabilities does not differ much from the result under the general model.

With this approach, LRC is calculated based on unearned premiums. This model is simpler than the general model because there is no need to consider factors such as time value, risk adjustment for non-financial risks, and CSM.

Finally, the variable fee approach is applied to insurance contracts that policyholders are entitled to earn profits and losses from the contract (also called insurance contract with direct participation features).

This approach is quite similar to the general measurement model. However, CSM is required to be adjusted by an additional factor, namely the profit and loss that the insurance company shares with policyholders.

In general, each measurement model will be suitable for a different group (or portfolio) of insurance contracts. Therefore, before selecting a model, insurers should first classify insurance contracts into the right portfolio, such as insurance contracts with terms of less than one year, insurance contracts with direct participation features, etc.

Impacts on financial statements

Compared to IFRS 4, IFRS 17’s measurement models will have different impacts on certain financial statement line items, mainly "premiums" and "insurance contract liabilities".

Premiums: the recognition is no longer based on due premiums or premiums received, but will mainly include changes in LRC and release of insurance acquisition cash flows.

Insurance contract liabilities: according to both IFRS 4 and IFRS 17, insurance contract liabilities include the liability for incurred claims and the LRC. The most striking difference in IFRS 17 is that the LRC includes CSM.

Thus, CSM can be seen as the key factor to reflect the current and future development of insurance companies through premiums and insurance contract liabilities.

Preparations needed by 2022

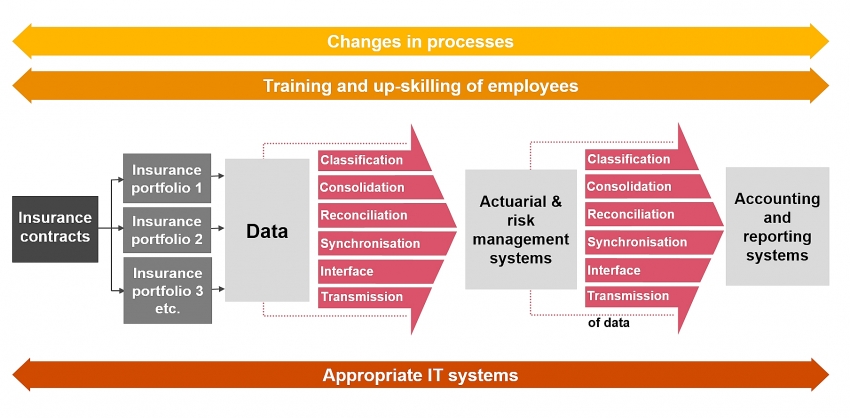

Understanding the measurement models only helps insurers solve some of the challenges that IFRS 17 brings along. In order to build a solid foundation for IFRS 17, insurers should prioritise innovations in data, systems, processes, and people.

|

| IFRS 17 will bring a number of changes to how companies deal with insurance contracts |

Having consistent and detailed data is essential for the data reconciliation and analysis required by IFRS 17. The requirements for improving the data quality of each insurance company will vary depending on its size and complexity. In addition, more attention should be paid to data management and data security.

IFRS 17 promotes comprehensive innovation for insurance systems (premiums, commissions, evaluation, and tracking of investments), as well as the actuarial system and the accounting system. Insurers should do more to automate the synchronisation, consolidation, and extraction of data while strengthening the interface between systems.

Changes in data and systems will lead to changes in related processes and internal control procedures. In addition, people are indirectly affected by these three factors. Advanced technical training should be conducted properly in order to ensure that processes, systems, and use of data are effective and compliant with requirements.

IFRS 17 brings many challenges to insurance companies. Each challenge requires insurance companies to assess their current situation and select the most appropriate method to improve or innovate their business. However, the changes are also opportunities that insurers can leverage to integrate with the world.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

- Proposed changes to interest deductibility rules may be welcomed by taxpayers (January 22, 2025 | 09:23)

Mobile Version

Mobile Version