Hopes for recovery of coffee prices

|

| Nguyen Quang Binh |

Prices for derivatives at US stock exchanges dropped sharply, just to return to a balanced state after a few hours when traders regained their composure.

However, many commercial instruments for agricultural products increased – except for arabica and robusta coffee, which declined 4.14 and 5.01 per cent respectively.

Meanwhile, the US Dollar Index increased for the whole week while the Brazilian real dropped to a worrying level.

In turn, prices of coffee on both sides of the Atlantic plummeted, especially after Brazilian state agencies announced that a new crop is ready to be sold.

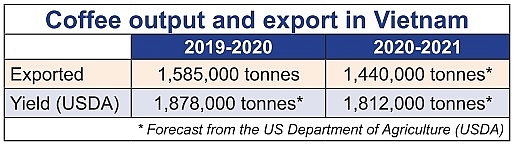

Last week, the International Coffee Organization (ICO) estimated that this crop year’s coffee surplus could amount to 1.54 million bags, with one bag equalling 60kgs – a large increase compared to the previous forecast of 952,000 bags, mostly due to a lowered demand amid the pandemic.

According to the ICO, global coffee consumption in this crop year is estimated at 167.81 million bags, down 0.5 per cent.

As global markets entered the new crop year 2020-2021 on October 1, traders have been concerned with several of the recent developments.

Firstly, while Brazil enjoyed a great harvest, global supply chains have been disrupted by the ongoing pandemic.

Secondly, consumer markets in many economies still suffer from social distancing measures.

Thirdly, as producing countries devalue their domestic currencies, strong selling pressure is created as prices increase.

Finally, many business lenders have closed their credit limits, leaving traders starving for cash amid high costs.

|

However, there is still a basis for prices to be recovered as expected. Decreasing inventories in consuming countries need to be filled as soon as the situation permits, and the amount of circulating cash on financial exchanges remains high thanks to stimulus packages by governments.

|

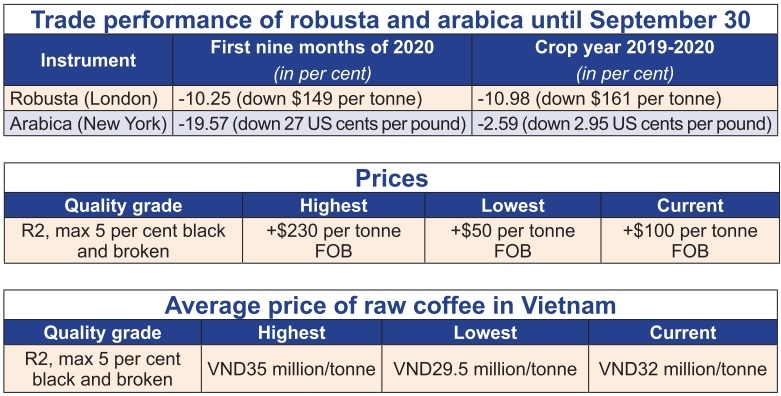

Last week, amid the transition between the two crop years, prices for robusta and arabica coffee derivatives plummeted despite already being on a rather low level.

The news about supply and demand from Brazil, together with the impact of currency developments, stimulated investment funds to sell off overbought volumes.

Accordingly, the trading positions of these funds on two exchanges showed that the amount of overbought contracts decreased as of September 29. Thus, surplus contracts for robusta at the London exchange stood at 13,500 contracts, down 3,000, while New York’s arabica contracts fell by 10,000 to 34,800.

By the end of that week, arabica prices decreased by 2.7 US cents for a pound, closing at 110.95 US cents per pound in the high-low range of 119.35-109.05. Meanwhile, robusta prices also decreased by 68 points at $1,290 per tonne.

Vietnam’s coffee prices in the transition week between the crop years stood at around VND32 million ($1,390) per tonne, around VND2.3 million ($100) lower than in the previous transition period.

With this position, hopes for increasing prices had little ground to become reality at the beginning of September and were outright impossible during the last week.

Nevertheless, for the rest of the year, three reasons might represent a silver lining for domestic coffee prices.

Firstly, exporters currently do not sell in massive quantities due to unpredictable price developments, meaning they also do not sell under much pressure.

Secondly, inventories in consuming countries are gradually running out while the possibility of finding a vaccine against COVID-19 nears.

Thirdly, at present, consuming countries, like in the EU and the US are still worried about the pandemic and its impact on their economies.

Once the outbreak has subsided, it is time to worry about replenishing coffee reserves. Thus, once the purchasing power regains traction, chances are that coffee prices at exchanges such as London and New York will increase.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version