Greener industrial parks a manufacturing prerequisite

|

| Various developers have set up plans to build industrial parks before the end of the decade, photo Le Toan |

According to Thanh Pham, associate director, Research and Consulting at CBRE, there has not been clear evidence of rental differences at industrial projects certified as ‘green’ in Vietnam, but tenants have started to give preference to projects developed sustainably and focusing on renewable energy.

As of the beginning of July, many industrial real estate projects had registered for LEED certification, a set of international standards for building energy-saving and environmental-friendly buildings.

These included the Core5 system in Haiphong, Logos in Bac Ninh, a ready-built warehouse (RBW) at Phu Tan Industrial Park (IP) in Binh Duong province, and another at Xuyen A IP in Long An province, which also borders Ho Chi Minh City.

Meanwhile, Frasers Property Vietnam announced in July that its Eco Logistics Centre was the first LEED-certified RBW in Vietnam awarded the status by the US Green Building Council (USGBC).

The certification recognises the Binh Duong province-situated development for its sustainability credentials under the LEED v4 Building Design and Construction: Warehouses and Distribution Centres rating system.

Edwin Tan, deputy CEO at Frasers Property Vietnam, said that achieving the first LEED-certified RBW in Vietnam not only validates the company’s asset strategy but contributes to the country’s advancements in sustainability.

“We are committed to embedding sustainability across the lifecycle of our assets, with efforts entailing green building certification and retrofitting existing buildings to higher standards. These are important aspects in our value-creation for our partners, tenants and customers,” said Tan.

Optimising performance

Developed by USGBC, LEED is the world’s most widely used green building rating system and provides a framework for healthy, efficient, and cost-saving green buildings. The Eco Logistics Centre’s design and construction phases were carried out in accordance with the rating system.

These comprise the implementation of practical, measurable strategies and solutions in its industrial warehouse estates including designs that optimise energy performance expecting saving of up to 25 per cent from similar properties; energy- and water-efficient equipment; advanced commissioning; and sustainable materials selection and construction.

Owned by Chuong Duong Beverages JSC and managed by Frasers Property Vietnam, the Eco Logistics Centre sits on more than 7.5 hectares providing warehousing space to sustainability-minded tenants.

The certification marks Frasers Property Vietnam’s first step in progressively certifying all its owned and managed industrial facilities across the country. The company is targeting LEED certification for a total of over 1 million sq.m of international-grade industrial facilities across more than 180 ha of industrial land in both north and south Vietnam.

According to Jeerasage Puranasamriddhi, chief supply officer at Pandora Thailand, most of the retailers are requesting their buildings and factories reach the qualification of LEED, therefore buildings and IP owners must adapt the green and environmental protection criteria into their projects, so then they can draw in qualified tenants.

“Pandora’s very first project in Vietnam is based in Vietnam-Singapore Industrial Park (VSIP) 3 in the southern province of Binh Duong. It is certified with LEED Gold qualification and it uses 100 per cent of recycled energy,” Puranasamriddhi said.

The Pandora factory in Binh Duong will create more than 6,000 jobs and provide an annual capacity of 60 million products to the market. Pandora’s products are now exported to more than 100 countries, with more than 6,800 outlets.

In the same province, Lego Group is also in the process of building its first carbon-neutral factory, worth over $1 billion in investment.

Decarbonisation answers

As part of the green and sustainable development trend, earlier this year, Singapore’s Sembcorp Industries and Vietnamese industrial developer Becamex announced plans to establish five new VSIPs with an approximate investment of $1 billion.

The new projects will feature decarbonisation solutions such as rooftop solar systems, solar farms where feasible, and green-certified buildings. These parks are envisioned as smart and sustainable with a low carbon footprint. Real-time tracking devices will remotely monitor and manage energy, water and waste use, as well as traffic and security, to allow for enhanced visibility over operations, Sembcorp said.

Grasping the trend of green transformation in the industrial arena, in March, the Management Board of Export Processing and Industrial Zones in Ho Chi Minh City unveiled a plan to develop such zones between now and 2030.

Accordingly, the first five – Tan Thuan, Tan Binh, Cat Lai, Hiep Phuoc and Binh Chieu – will be piloted for conversion towards green criteria in 2023 and 2024. The remainder will be converted in 2025-2030.

According to a survey completed by the Ministry of Construction early this year, the majority of green projects are industrial projects, while 55 per cent of green buildings in Vietnam are from the industrial sector.

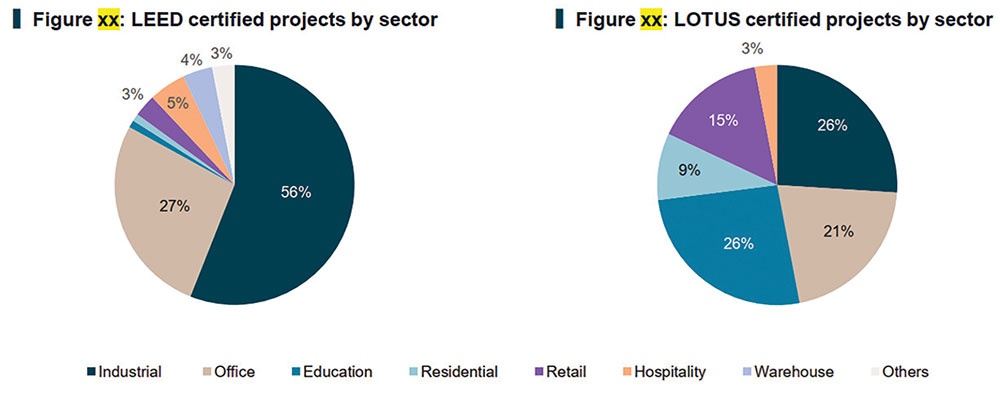

This survey also released data on LEED-certified projects showed that 56 per cent of certified projects are factories or offices located in IPs and 4 per cent in warehouses. Meanwhile, 26 per cent of LOTUS-certified projects are in the industrial sector.

“There will be increasing demand from foreign investors for green initiatives and sustainable development of future industrial real estate projects in Vietnam. The commitment of multinationals to sustainability is also forcing landlords to develop sustainable projects to be able to capture these high-profile tenants,” said Trang Le, head of Research and Consulting at JLL Vietnam.

|

| Source: JLL Vietnam |

| Vietnam Industrial Property Forum 2023 The third annual Vietnam Industrial Property Forum, organised by VIR under the auspice of the Ministry of Planning and Investment, will be held at Mai House Saigon Hotel in Ho Chi Minh City on Thursday, August 24. Themed “Grasping opportunities from new capital inflows,” the forum will focus on assessing new capital potential into Vietnam, the development of specialised real estate products, and analysing bottlenecks in policy, infrastructure, and land shortages, which may affect market growth prospects. In addition, it will cover concerns raised by domestic and foreign investors, such as the impact of the upcoming global minimum tax, Vietnam’s policy adjustments related to foreign direct investment to compensate for tax incentive limitations, and challenges raised in meeting environmental, social, and governance standards. |

| Interest persists in industrial property Vietnam’s industrial property market is witnessing interest from global manufacturers, demonstrating its potential to become a production hub in electronics, technology, and high-value industries. |

| The benefits of industrial property with built-in seaports in DEEP C Many coastal localities in Vietnam are contemplating luring investment into establishing industrial zones connected with seaports. However, apart from a suitable location, constructing a new terminal can require up to five years. |

| Supply shortages remain in industrial property frame New supply in the industrial real estate market will slow in the second half due to the influence of legal procedures as well as a decrease in demand from the manufacturing industries. |

| Indochina Kajima continues rollout of world-class industrial property in Vietnam Core5 Industrial Partners is counting up the successes after a year in Vietnam. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Saigon Centre gains LEED platinum and gold certifications (February 12, 2026 | 16:37)

- Construction firms poised for growth on public investment and capital market support (February 11, 2026 | 11:38)

- Mitsubishi acquires Thuan An 1 residential development from PDR (February 09, 2026 | 08:00)

- Frasers Property and GELEX Infrastructure propose new joint venture (February 07, 2026 | 15:00)

- Sun Group led consortium selected as investor for new urban area (February 06, 2026 | 15:20)

- Vietnam breaks into Top 10 countries and regions for LEED outside the US (February 05, 2026 | 17:56)

- Fairmont opens first Vietnam property in Hanoi (February 04, 2026 | 16:09)

- Real estate investment trusts pivotal for long-term success (February 02, 2026 | 11:09)

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

Tag:

Tag:

Mobile Version

Mobile Version