Fresh credit scheme outlines BAC A BANK ambitions to assist clients with investment

In 2020, the economy grew 2.91 per cent, making Vietnam one of very few nations in the world with positive economic growth. The government is now boosting aggregate demand, and individual credits will also contribute to increasing this demand and spurring on economic growth.

To maximise the benefits of clients from grabbing business and production opportunities, BAC A BANK has just launched the “Receiving priorities and reaping success” individual credit programme, running until the end of the year with total loans worth VND3 trillion ($130.43 million) applicable to loans with guaranteed assets.

|

| Fresh credit scheme outlines BAC A BANK ambitions to assist clients with investment |

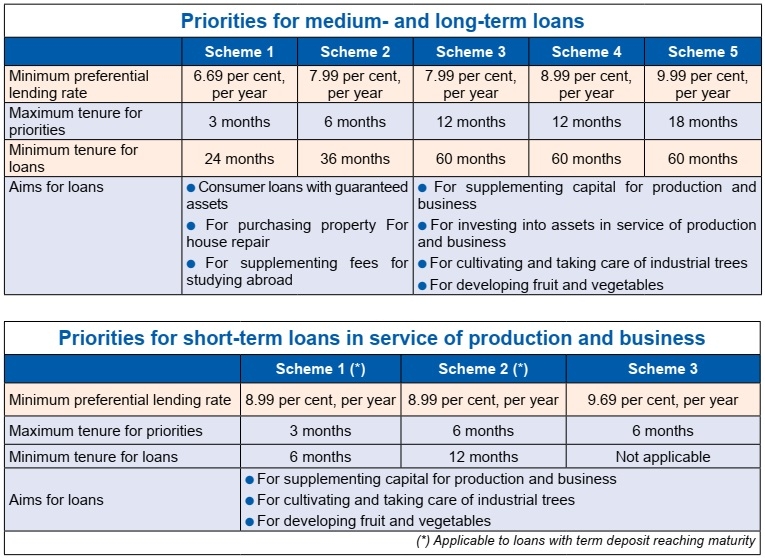

Once partaking in the programme, clients can select the time for them to enjoy the priorities with the lending rate responding to their financial health or production plans, as well as to their personal consumption and their families’ demand.

The loans will be for medium term or long term, subject to many categories such as house purchasing, property purchasing, house repair, consumption, studying abroad, capital supplementation, and investment into assets in service of production and business activities. The clients are entitled to a low lending annual rate at a minimum of 6.69 per cent.

If clients want to invest into their production and business in the short term, they can participate in production-oriented products from BAC A BANK for individuals, such as loans for supplementing working capital, taking care of industrial trees, and developing fruit and vegetables, with a lending rate of 8.99 per cent a year.

“Through its preferential credit programmes, BAC A BANK has accompanied and shared difficulties with its clients in 2020. The economy has been bouncing back strongly, and the bank is implementing this new programme in order to provide the best added value to clients,” said Vu Thanh Thuy, vice director of BAC A BANK’s Retail Bank Division.

Its experienced staff stand ready to provide professional consultancy for all clients and support them in completing all procedures in the simplest manner, with the quickest time for approving the loans. Thanks to the diversified forms of loans and flexible forms of debt payment, clients can take the initiative in balancing their financial resources so that the preferential loans from the bank can help them fulfil their performance plans for 2021.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Citi sharpens its focus on institutional banking (February 09, 2026 | 19:58)

- SSC steps up engagement with FTSE Russell on market reforms (February 09, 2026 | 17:33)

- IFC considers $50m trade finance guarantee facility for Nam A Bank (February 09, 2026 | 17:28)

- Hoa Phat Agricultural Development debuts shares on HSX (February 06, 2026 | 14:00)

- Vietcap’s VAD 2026 draws strong global investor turnout (February 06, 2026 | 13:30)

- New rules ease foreign access to Vietnam equities (February 05, 2026 | 17:29)

- 0.1 per cent tax proposed on each transfer of digital assets (February 05, 2026 | 17:27)

- Ministry of Finance tightens policy delivery at start of year (February 05, 2026 | 17:26)

- Vietnam steps up market reforms as FTSE Russell reviews upgrade progress (February 05, 2026 | 17:20)

- 2025 profits mixed amid strong energy and farming results (February 05, 2026 | 17:18)

Mobile Version

Mobile Version