Firms to adhere to anti-dumping law

Anti-dumping regulations are among the important issues that Vietnamese and foreign businesses are interested in. Why is this the case, and what factors are involved in determining whether these regulations are being followed?

|

| Pham Duy Khuong, managing director of ASL Law |

Anti-dumping is one of the most important measures that domestic and foreign enterprises can take to ensure their rights and interests to competitors exporting identical or similar products.

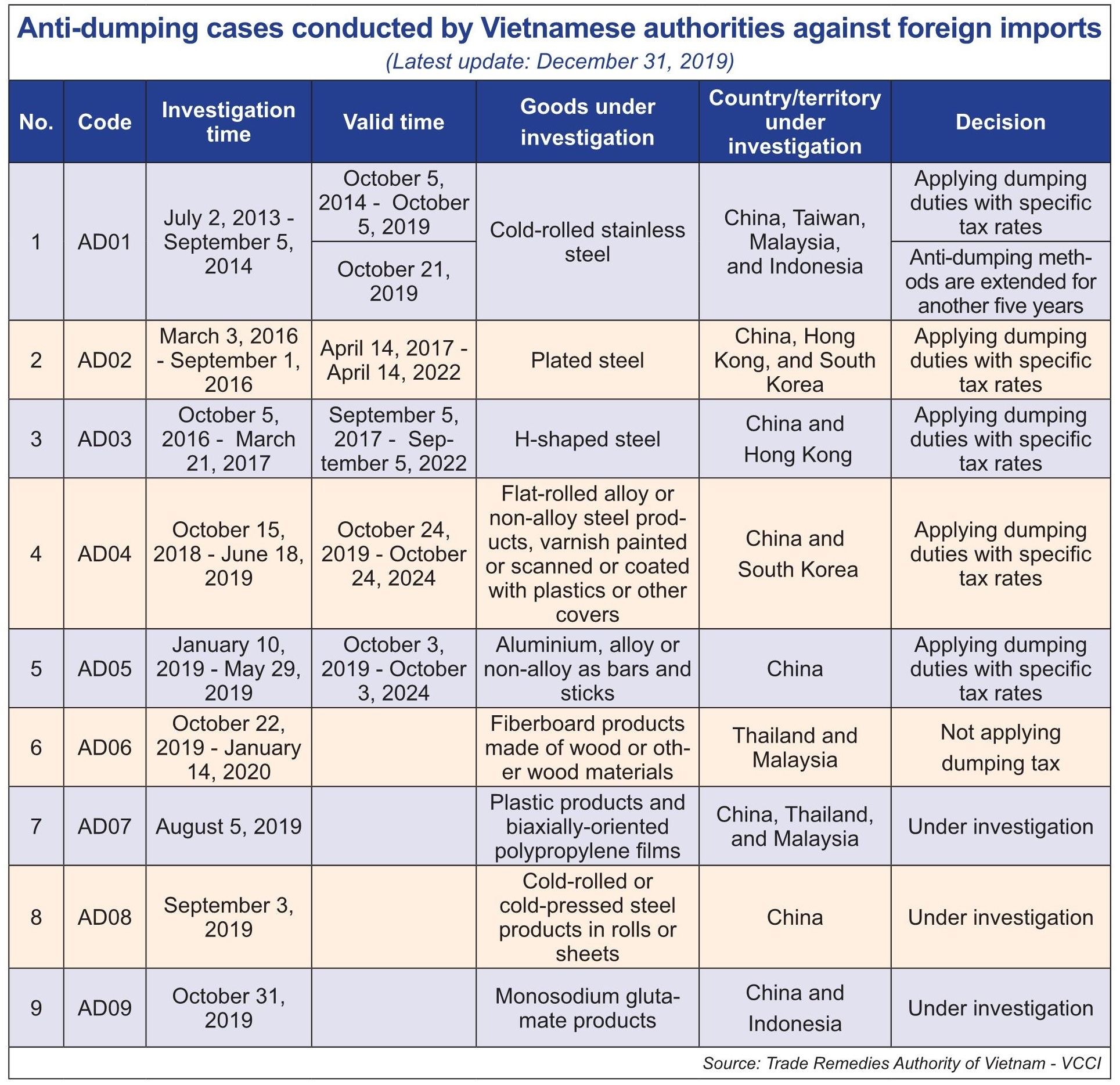

At the request of domestic enterprises, Vietnam has conducted anti-dumping investigations on many products imported from abroad. However, it is not always the case that Vietnamese enterprises have favourable conditions and get the desired results when using anti-dumping measures against overseas enterprises.

For example, through a directive last year Vietnamese businesses conducted an anti-dumping investigation on some wooden fibreboards and other wood-based materials originating from Thailand and Malaysia, in which ASL Law acted as lawyer for the fibreboard business from those countries. The requesting party was a representative of the domestic manufacturing industry.

In order to draw a final conclusion on whether dumping was involved here, the investigation agency had to consider a lot of factors.

First was assessing the impact of imported goods. Pursuant to Article 3.2 of the World Trade Organization’s (WTO) Antidumping Agreement, the investigating authority considered whether or not there had been a significant increase in imports or relative to output or consumption in the importing country.

In the case of fibreboard, the review of the proportion of imports from sources indicates that goods from Thailand and Malaysia increasingly take up a larger share. This shows that the impact from imported goods on the domestic industry, if any, mainly comes from those two nations.

Second was the price impact of investigated imported goods. The Article 3.2 provided, “With respect to the price effect of dumped imports, the investigating authority must consider whether there is a significant price difference between the selling price of the dumped imported goods and of similarly manufactured goods in the country, or consider whether the impact of the imported goods under investigation have caused the price pressure at a level or prevent price increases significantly, which should have happened. None of these factors can be decisive”.

Next, economic factors are considered when determining significant losses of a domestic manufacturing industry. Article 3.4 of the agreement explains that the investigating authority must consider the impact of dumped imports on the domestic manufacturing industry and state the factors to be assessed.

Factors and suitable economic indicators are related to the status of the industry, including the decline in actual and potential revenue, profits, output, market share, productivity, rate of return, labour and wages, and much more besides. In addition, the investigating authority may consider other factors and none of them will be decisive.

Last, evaluation is taken of the cause and effect relationship. The investigating agency said that the volume and price of imports from other countries were not the cause of the domestic industry’s losses. There is no basis for the cause of the loss in the domestic industry due to exports or poor labour productivity. Increasing production costs and the supply-demand relationship are the main reasons for the decline in the profits of the domestic manufacturing industry.

On that basis, and going by the Law on Foreign Trade Administration and its guiding documents, the investigation agency recommended the minister of Industry and Trade to issue a decision to terminate the investigation of the case and not take anti-dumping measures. Objectively, this is a great victory for the market in general and partly a victory for foreign enterprises.

Under the provisions of Vietnamese law, what cases will be considered for application of anti-dumping measures? Could you please tell us the provisions relating to anti-dumping?

|

The investigation of the application of anti-dumping measures shall be conducted on the basis of Vietnamese law provisions on trade remedies.

These include the Law on Foreign Trade Administration No.05/2017/QH14 dated June 2017; Decree No.10/2018/ND-CP dated January 2018 detailing a number of articles of the Law on Foreign Trade Administration on trade remedies measures; 2017’s Decree No.98/2017/ND-CP on defining the functions, tasks, powers, and organisational structure of the Ministry of Industry and Trade (MoIT); Circular No.06/2018/TT-BCT dated April 2018 of the MoIT detailing a number of contents on trade remedies; and the 2017 MoIT Decision No.3752/QD-BCT defining the functions and structure of the ministry’s Department of Trade Defense.

The investigation of the application of anti-dumping measures also complies with the international commitments which Vietnam has signed or acceded to, including the aforementioned WTO Anti-Dumping Agreement, and also the ASEAN Trade in Goods Agreement.

Vietnamese businesses can conduct anti-dumping investigations with foreign enterprises if the following conditions are met:

Occupying the majority rate: Clause 1, Article 69 of the Law on Foreign Trade Administration stipulates the following, “Domestic manufacturing industry means a collection of similar goods manufacturers within the territory of Vietnam, or their representatives account for a major proportion of the total output of that industry, that is domestically produced. If a domestic manufacturer directly imports investigated goods or has relationships with exporters or importers of investigated goods, this manufacturer may not be considered a domestic producer”.

Meanwhile clauses 1 and 2, Article 4 of Decree 10 stipulates, “The determination of domestic manufacturing industry shall comply with the provisions of Clause 1, Article 69 of the Law on Foreign Trade Administration”.

It also states, “The volume and quantity of manufactured goods account for at least 50 per cent of the total volume, and the quantity of similar goods or directly competitive goods produced domestically shall be regarded as a major proportion of the total output of goods of the domestic manufacturing industry, according to the provisions of clause 1, article 69 of the Law on Foreign Trade Administration.

The investigating authority may consider the lower rate if there is evidence that such percentage is sufficient to constitute a major proportion of the total production of goods of the domestic manufacturing industry”.

What do you recommend for foreign companies to consider when distributing products in Vietnam?

The way that foreign enterprises export their goods to Vietnam should comply with the provisions of domestic law, and avoid the application of measures that may be considered dumping in accordance with Vietnamese regulations. In addition, enterprises need to monitor the growth of this market as well as closely monitor the sudden increase in export volume to the country.

In case of encountering anti-dumping investigation requests from Vietnamese investigating bodies, foreign enterprises should actively participate in the investigation process to ensure the provision of legal evidence benefiting the business and thereby partly avoiding heavy fines from the authorities.

Are Vietnam’s anti-dumping regulations similar to those of other Southeast Asian countries, and what should Vietnamese enterprises be concerned about when they tap into this market?

Vietnam’s anti-dumping regulations, on the whole, have major similarities with other countries in the region. Vietnamese enterprises exporting goods abroad and encountering anti-dumping investigations should seek the support of Vietnamese representatives in the host country and actively involve in the investigation, in order to avoid the investigator deciding to use available data and draw adverse conclusions for their business.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Balance to find with overtime reform (March 24, 2022 | 11:33)

- ASL Law managing director among top 100 lawyers in Vietnam (March 12, 2022 | 15:42)

- The role of RCEP in economic recovery of the region (February 17, 2022 | 10:22)

- Supporting policies in Vietnam’s social insurance (September 27, 2021 | 17:12)

- PPP law builds on transparency and proper process (August 02, 2021 | 20:30)

- ASL Law introduces Legal Handbook amid COVID-19 times (July 17, 2021 | 09:47)

- Directions for FIEs and employees in benefits disputes (June 03, 2021 | 22:07)

- The keys to M&A attraction (April 28, 2021 | 16:22)

- Building regulations to secure workers’ rights and interests (April 05, 2021 | 14:27)

- Managing partner of ASL Law Firm ranked top 100 lawyers in Vietnam (March 09, 2021 | 10:34)

Tag:

Tag:

Mobile Version

Mobile Version