Land law considerations for foreigners

|

| Pham Duy Khuong, managing director of ASL Law |

In the decade since the Law on Land 2013 (LoL)was implemented, thanks to the resolution of difficulties and the establishment of a more fair environment for foreign investors to utilise real estate, Vietnam is gradually becoming an ideal destination for overseas investment through the development and planning of industrial parks (IPs) and economic zones (EZs) across the country, making a significant contribution to the state budget revenue and the country’s development as well as creating countless work opportunities.

Through the LoL, many businesses from abroad have encountered multiple problems in real estate while investing in Vietnam, particularly in IPs and EZs. Vietnam must fix them and establish a more equitable environment for foreign financiers to flourish, and institutionalise international agreements in order to make Vietnam an attractive destination for funding.

Thorny issues

The first challenge comes from the LoL’s definition of foreign-invested enterprise (FIE) which contrasts with the current regulation’s only listing nature, which includes FIEs, joint venture businesses, and Vietnamese businesses in which foreign investors purchase shares, merge with, or repurchase in compliance with the laws on investment. This regulation became outdated and is no longer consistent with current regulations, particularly the Law on Investment (LoI) 2020.

As a result, the land law cannot cover all cases where there are economic organisations, such as cooperatives with foreign investors. When it comes to defining “foreign-invested economic organisations”, the LoI 2020 offers a more comprehensive and meaningful definition.

This results in an overlap in applicability, which confuses foreign investors when they fund real estate projects where they do not fall under the cases indicated in the LoL but do fall under the circumstances provided in the LoI.

Secondly, another major issue for investors is the sale of land use rights. Several issues have arisen in recent years. These include the determination of the starting price of land use rights for sale, which is still very different from the market price; speculation and profiteering by some organisations and individuals in the auction of land use rights continue to occur; some cases participate in auctions and bid very high, then put down the deposit; and some cases of winning the auction but failing to fulfill the payment obligation.

This has had a negative impact on the market and has resulted in wasted opportunities for investors with the capacity to carry out the project.

Thirdly, because the land price now prescribed by the state is relatively low and not in line with market pricing, making the compensation price too low, the laws on land prices are no longer compatible with reality when the state allocates and leases land.

As a result, many investors who have been allocated land encounter multiple challenges during site clearance, delaying project implementation, wasting valuable land resources, and decreasing the effectiveness of funding, production, and business operations of FIEs after having pumped in significant amounts of capital.

Project termination is the fourth challenge. Cases where the investment registration authority terminates or partially terminates the operation of a project are governed by Clause 2, Article 48 of the LoI. However, this Article’s Clause 5 states the following: “The settlement of the rights to use land and property on land upon the termination of the investment project shall comply with the law on land and other relevant regulations of law.”

There have been inadequacies when dealing with land use rights under the LoL when a project is terminated or partially terminated because investors are unable to coordinate or come to an agreement on prices, which makes it difficult to determine the value of the assets invested on the land. This will cause the project to be delayed for a very long period, squandering valuable land resources and denying other investors the opportunity to acquire land when there is a need to use land.

|

| Vietnam is required to establish a more equitable environment for foreign financiers interested in new developments, photo Le Toan |

Impacts from amended law

Firstly, the draft LoL has included Clause 6, Article 6, with the following text: “Economic organisations with foreign investment capital are subject to processes as defined for foreign investors in line with the LoI. Thus, the list of foreign-invested economic organisations in Clause 6 of Article 6 no longer specifically lists “enterprises with 100 per cent foreign ownership, joint venture companies, and Vietnamese companies with foreign investors that purchase shares, combine, or repurchase.”

The definition of a foreign-invested economic organisation as stated in the draft has been broadened as a result of not using the inductive technique, as was the case with the LoL, and overlap inapplicability has been eliminated.

Secondly, giving foreign-invested economic organisations more land access rights. As a result, the draft amended LoL has reviewed and amended a number of contents related to the right to access land. It also clarifies that when economic organisations are authorised to rent land for an annual fee, they are also authorised to lease and transfer the lease right in the land lease contract. As a result, domestic and foreign-invested economic groups are granted the same rights.

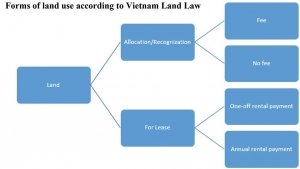

Thirdly, the “base and time for determining land use fee and land rent” are specified in detail in Article 126 of the draft, along with other very significant grounds for foreign investors to determine the land use fee. When allocating land, the land usage levy is collected, and the land rent is determined when allocating land leases with annual/one-time rental payments.

The land price for determining land use levy and land rent must be recorded in the decision on land allocation, land lease, permission to change land use purpose, recognition of winning results at auction of land use rights and bidding results for projects using land for recognition of land use rights, an extension of land use terms, change of land use form, adjustment of land allocation, and land lease decisions.

In addition, the determination of land prices for the determination of land use levies and land rents must be organised before the time of deciding on land allocation or land lease, permission to change land use purpose, recognition of land use rights, and recognition of land use rights. The term of land use, change of land use form, adjustment of the decision on land allocation or land lease must not exceed six months.

In addition, Article 168 of the draft LoL for IPs, clusters, and export processing zones (EPZs) has added new content.

Firstly, in the case of investment projects on construction and business of infrastructure of clusters in regions with difficult socioeconomic conditions, in addition to the subjects entitled to lease land as prescribed in this clause, the state allocates or leases land to public non-business units for investment in the construction and business of infrastructure of IPs, clusters, and EPZs.

Next, investors who have leased land by the state to fund the construction and business of infrastructure of IPs, clusters, or EPZs in the form of annual land rental payment may change to the lease form. Land with a one-time payment for the entire lease period for the whole or part of the business land area.

Also, if the term of the project is longer than the remaining land use term of the IPs, clusters, or EPZs, the economic organisation shall fund the construction and business of infrastructure of the IP. For EPZs and clusters, they must seek permission from a competent state agency for permission to adjust the land use term accordingly, but the total land use term must not exceed 70 years and must pay a land use levy or land rent for the extended land area.

Additionally, the primary method of allocating and leasing land is through the auctioning of land use rights and the bidding process for projects that require land. The objective is to generate income while maintaining clear criteria for assigning and leasing land through the auction of land use rights, bidding for projects using land without an auction, or both.

For important initiatives, such as fostering transparency for foreign investors when putting money into IPs and EZs, the state budget and social resources should be mobilised.

| Government proposes delay to submission of draft amended Land Law to NA The Government has proposed a delay to a submission of the draft Law on Land (amended) to the National Assembly (NA) until the Party Central Committee issues directions on reforms of land-related policies and laws. |

| Advantages of amending Law on Land Land is the most valuable asset of each person, business, and country, and thus a major goal is to unleash the potential of land use. Le Net and Tran Thai Binh, lawyers at LNT & Partners, propose amendments to the current legislation regarding the land. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- ASL Law branches out services for wider regional ambitions (September 14, 2022 | 08:00)

- ASL LAW successfully defends in lawsuit against circumvention of trade remedies (August 03, 2022 | 15:09)

- IDOs in Vietnam – a novel fundraising approach (July 11, 2022 | 08:00)

- Cleaning up legislation for NFT success in Vietnam (April 21, 2022 | 09:00)

- The status of franchising when withdrawing from markets (April 07, 2022 | 13:08)

- Balance to find with overtime reform (March 24, 2022 | 11:33)

- ASL Law managing director among top 100 lawyers in Vietnam (March 12, 2022 | 15:42)

- The role of RCEP in economic recovery of the region (February 17, 2022 | 10:22)

- Supporting policies in Vietnam’s social insurance (September 27, 2021 | 17:12)

- PPP law builds on transparency and proper process (August 02, 2021 | 20:30)

Tag:

Tag:

Mobile Version

Mobile Version