Digital innovation key growth factor for bancassurance development

What do you see in the future for bancassurance in the Vietnamese market?

|

| Generali Vietnam CEO Tina Nguyen |

Insurance forms an integral part of any personal or family financial plans. Hence, it is easy to understand why bancassurance has been one of the main distribution channels for insurance products and a key fee income contributor for banks across the globe.

In Vietnam, while bancassurance has been in the market for 15 years, this distribution channel has only started to attract strong interest from both banks and insurers over the past five years. As a result, revenue from bancassurance for life insurance products has increased sharply since.

From just 5 per cent three years ago, bancassurance accounted for about 30 per cent of the life market’s total new premium revenue in the first nine months of 2019, and is expected to continue to increase as more banks and insurers invest strongly in this important distribution channel.

|

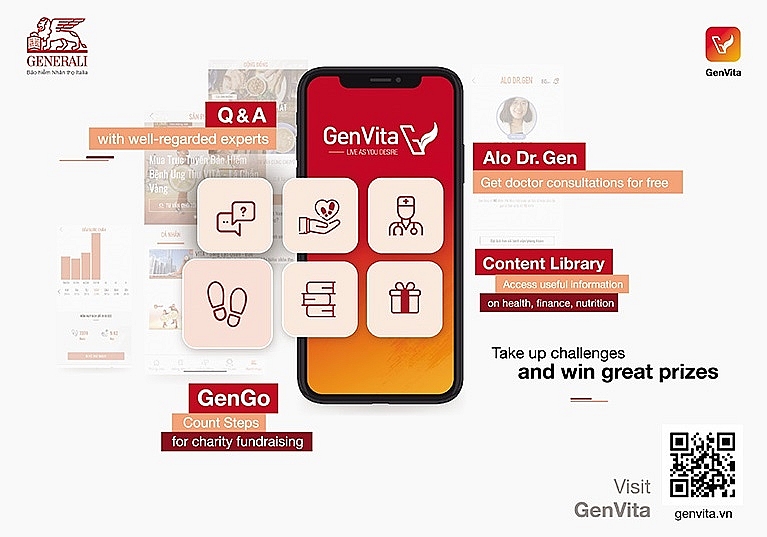

| Users can also speak directly with doctors, health and finance experts for advice using GenVita |

Generali Vietnam and Orient Commercial Joint Stock Bank (OCB) have officially signed a bancassurance agreement to last the next 15 years. What can you tell us about the strategy and your expectations from it?

Generali Vietnam and OCB started to co-operate in 2017 and have seen great results thanks to strong commitment and efforts by both parties. These achievements, coupled with a shared strategic vision and focus on customer centricity and digital innovation, were the determining factors in our decision to forge this long-term partnership.

Our partnership focuses on three main objectives: developing tailored financial and insurance solutions to best suit OCB’s various customer segments; enhancing knowledge and skills of bancassurrance staff while improving the customer experience; and growing business efficiencies through data analytics and digital innovation.

We expect that this partnership will continue contributing significantly to our growth ambition in the years to come.

|

| Generali’s parent company is the third-largest insurance business in the world |

Digital technology seems to be a core pillar of this partnership. What are some of the secret tech weapons Generali Vietnam has on hand in order to get ahead?

The digital revolution is changing all facets of life and business. An inevitable trend we can all see is customers are increasingly favouring online services over those that require travelling to physical locations, to make purchases or other types of transactions. Bancassurance, therefore, cannot stay out of this digital race. Digital technology plays a crucial role in improving almost every aspect of the insurance business from product consulting, policy issuance, and premium collection to addressing enquiries and settling claims, which ultimately enhances customer experience and improves operational efficiencies.

Generali Vietnam prides itself on being a pioneer in deploying advanced digital technologies in improving customer services. In recent years, we have successfully launched several customer-related applications such as GENPS, a world-class customer satisfaction survey app; GENOVA, a POS system which enables online benefits illustrations and application submission; and GENCLAIMS – an application which allows customers to submit claim requests via mobile devices and receive quick responses from Generali.

Last but not least, one of our biggest investments is GenVita – a one-stop digital ecosystem for existing and prospective customers. Apart from being an online information and service hub for policyholders, GenVita offers outstanding features to health-conscious users by allowing them to speak directly to our doctors, get advice from health and financial experts, and track their daily running or walking. Users can also learn more about our products and purchase them online via the system. We are very excited about integrating our systems, including many of GenVita’s interesting features, with OCB’s OMNI system, in order to offer the best customer experience.

However, while the significant role of technologies is undeniable, they are just tools at the end of the day. In order to gain and maintain customer trust, it is of utmost importance for everyone attached to OCB and Generali Vietnam to truly understand and pay close attention to each customer’s needs.

Therefore, our partnership’s top priority is to develop a business strategy with customer centricity at its core.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Private capital funds as cornerstone of IFC plans (February 20, 2026 | 14:38)

- Priorities for building credibility and momentum within Vietnamese IFCs (February 20, 2026 | 14:29)

- How Hong Kong can bridge critical financial centre gaps (February 20, 2026 | 14:22)

- All global experiences useful for Vietnam’s international financial hub (February 20, 2026 | 14:16)

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

Mobile Version

Mobile Version