Recon Technology, Ltd Reports Financial Year Results for Fiscal Year 2024

BEIJING, Oct. 30, 2024 /PRNewswire/ -- Recon Technology, Ltd (NASDAQ: RCON) ("Recon" or the "Company"), a China-based independent solutions integrator in the oilfield service and environmental protection, electric power and coal chemical industries, today announced its financial results for fiscal year 2024.

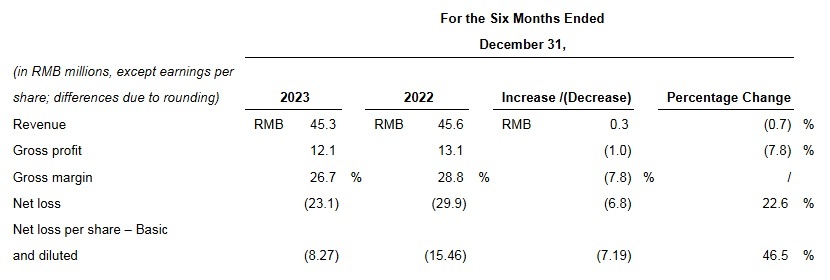

Fiscal Year Ended June 30, 2024 Financial Highlights:

- Total revenue increase by approximately RMB1.7 million ($0.2 million) or 2.6% to RMB68.8 million ($9.5 million) for the year ended June 30, 2024 from RMB67.1million ($9.2 million) for the same period in 2023.

- Gross profit increased to RMB20.9 million ($2.9 million) for the year ended June 30, 2024, from RMB18.9 million ($2.6 million) for the same period in 2023.

- Gross margin increased to 30.3% for the year ended June 30, 2024 from 28.1% for the same period in 2023.

- Net loss was RMB51.4 million ($7.1 million) for the year ended June 30, 2024, a decrease of RMB10.0 million ($1.4 million) from net loss of RMB61.4 million ($8.5 million) for the same period of 2023.

|

| Recon Technology, Ltd Reports Financial Year Results for Fiscal Year 2024 |

Management Commentary

Shenping Yin, Founder and CEO of Recon said, "Fiscal year ended 2024 was a year of change, challenge and opportunity for Recon. As the economy gradually recovers, our established business volume has gradually increased, leading to an overall rise in revenue by the end of fiscal year 2024.Our gross margins improved due to improved management efficiency and the expansion of new business with high gross margins.

We believe that China's investment and demand in the oil industry will not decrease in the near future, and we believe that there are still many opportunities for growth in the oil industry. Recon will continue to benefit from this trend. We expect a significant increase in the volume of business in the oilfield services segment in the coming year. We are also expanding our business focus from oilfield service segment to broader energy sectors, including carbon-zero opportunities and alternative materials for primary petroleum products. We are actively exploring the chemical recycling business of low-value plastics based on waste treatment and recycling, and have reached preliminary cooperation agreements and market expansion and sales intentions with key upstream and downstream customers. Our drive has always been to maximize the long-term benefits for our company and our shareholders based on our experience and resources in the petrochemical and energy industries."

Fiscal Year Ended 2024 Financial Results:

Revenue

Total revenues for the year ended June 30, 2024 were approximately RMB68.8 million ($9.5 million), an increase of approximately RMB1.7 million ($0.2 million) or 2.6% from RMB67.1 million ($9.2 million) for the same period in 2023.

- Revenue from automation product and software increased by RMB0.2 million ($0.03 million) or 0.8%. For the year ended June 30, 2024, affected by temporary changes in market participation requirements from electricity industry customers, our business in the electronic automation segment disrupted and revenue from non-oilfield customers decreased by RMB5.8 million ($0.8 million). However, due to the recovery of oilfield production, sales to oilfield customers increased by RMB6.0 million ($0.8 million). Thus, our revenue from automation product and software business increased slightly overall. We anticipate that revenue from the electronic business will resume and revenue will recover.

- Revenue from equipment and accessories increased by RMB4.2 million ($0.6million) or 26.0%. The increase in revenue was driven by the continued growth of our oilfield business and the successful expansion of our offshore oilfield services.

- Revenue from oilfield environmental protection decreased by RMB1.5 million ($0.2 million) or 8.1%. mainly due to a reduction in the volume of oily wastewater provided by customers as their production intensity decreased. In addition, Gansu BHD' s hazardous waste operation permit expired in July 26, 2023, and the renewal process took longer than expected due to changing government regulations. Production activates were not allowed during this period. As a result, revenue from oily sludge treatment was reduced.

- Revenue from platform outsourcing services decreased by RMB1.1 million ($0.2 million) or 22.4%. The decrease was mainly due to reduced demand from former gas station customers as they upgraded their own online systems and limited cooperation with third parties. During the period, we shifted our target market from gasoline users to diesel users and established partnerships with several major online freight platform customers. We expect the increase in revenue from this segment to gradually form a new business base for the Company.

- As of June 30, 2024, the factory for the chemical recycling is still under construction and has not started production and sales yet.

Cost of revenue

Cost of revenues decreased from RMB48.2 million for the year ended June 30, 2023 to RMB48.0 million ($6.6 million) for the same period in 2024.

For the years ended June 30, 2023 and 2024, cost of revenue from automation product and software was approximately RMB23.6 million ($3.2 million) and RMB23.9 million ($3.3 million), respectively, representing increase of approximately RMB0.3 million ($0.04 million) or 1.1%. The increase in cost of revenue from automation product and software was primarily attributable to increased revenue of automation products and software.

For the years ended June 30, 2023 and 2024, cost of revenue from equipment and accessories was approximately RMB8.9 million ($1.2 million) and RMB14.1 million ($1.9 million), respectively, representing an increase of approximately RMB5.2million ($0.7million) or 57.6%. The increase in cost of revenue from equipment and accessories was primarily attributable to increased revenue of equipment and accessories.

For the years ended June 30, 2023 and 2024, cost of revenue from oilfield environmental protection was approximately RMB14.0 million ($1.9 million) and RMB9.2 million ($1.3 million), respectively, representing a decrease of approximately RMB4.7 million ($0.6 million) or 33.8%. The decrease in the cost of revenue, mainly drawn from wastewater and oily sludge treatments, was in line with decrease in revenue related to our oily sludge treatment.

For the years ended June 30, 2023 and 2024, cost of revenue from platform outsourcing services was approximately RMB1.7 million ($0.2 million) and RMB0.6 million ($0.1 million), respectively, representing a decrease of approximately RMB1.1 million ($0.2 million) or 63.2%. The primary reasons for the decrease in cost of revenue are the company's efforts to reduce costs through staff layoffs and salary reductions, as well as the discontinuation of server leasing due to the transition from operational to maintenance services.

For the years ended June 30, 2023 and 2024, cost of revenue from chemical recycling was nil and RMB0.1 million ($0.02 million), which was business and sales related tax. As of June 30, 2024, the factory for the chemical recycling is still under construction and has not started production and sales yet.

Gross profit

Gross profit increased to RMB20.9 million ($2.9 million) for the year ended June 30, 2024 from RMB18.9 million ($2.6 million) for the same period in 2023. Our gross profit as a percentage of revenue increased to 30.3% for the year ended June 30, 2024 from 28.1% for the same period in 2023.

- For the years ended June 30, 2023 and 2024, our gross profit from automation product and software was approximately RMB3.0 million ($0.4 million) and RMB3.0 million ($0.4 million), respectively, representing a decrease in gross profit of approximately RMB0.1 million ($0.01million) or 1.7%. The gross margin for automation product and software has remained relatively stable in this period.

- For the years ended June 30, 2023 and 2024, gross profit from equipment and accessories was approximately RMB7.3 million ($1.0 million) and RMB6.4 million ($0.9 million), respectively, representing a slight decrease of approximately RMB0.9 million ($0.1 million) or 12.7%. The reason for the decrease in gross margin is that oilfield customers have adopted a low-cost operating model and tightly controlled budgets, which has narrowed the overall margins of the market. Consequently, we had to resort to lower margins to secure business.

- For the years ended June 30, 2023 and 2024, gross profit from oilfield environmental protection was approximately RMB5.2 million ($0.7 million) and RMB8.3 million ($1.1 million), respectively, representing an increase of RMB3.2 million ($0.4 million) or 61.5%. We have carried out the residual oil recovery service, The business line assists oilfield companies recover residual oils, including aged oil and spilled oil through our unique formula and equipment to enhance the profitability for oilfield companies. This business contributes a relatively high gross margin.

- For the years ended June 30, 2023 and 2024, gross profit from platform outsourcing services was approximately RMB3.4 million ($0.5 million) and RMB3.3 million ($0.5 million), respectively, representing a decrease of approximately RMB0.05 million ($0.01 million) or 1.5 %, The gross margin for platform outsourcing services has remained relatively stable in this period

For the years ended June 30, 2023 and 2024, gross profit losses from chemical recycling was nil and RMB0.1 million ($0.02 million), respectively. As of June 30, 2024, the factory for the chemical recycling remains under construction and has not started production and sales yet.

Operating expenses

Selling expenses decreased by 2.5%, or RMB0.3 million ($0.04 million), from RMB10.6 million ($1.5 million) in the year ended June 30, 2023 to RMB10.4 million ($1.4 million) in the same period of 2024.

General and administrative expenses decreased by 17.0%, or RMB13.0 million ($1.8 million), from RMB76.8 million ($10.6 million) in the year ended June 30, 2023 to RMB63.8 million ($8.8 million) in the same period of 2024.

Net recovery of credit losses of RMB9.0 million ($1.2 million) for the year ended June 30, 2023 as compared to net provision for credit losses of RMB4.1 million ($0.6 million) for the same period in 2024.

Research and development expenses remained relatively stable with an increase by 62.3%, or RMB5.5 million ($0.8 million) from RMB8.8 million ($1.2 million) for the year ended June 30, 2023 to RMB14.3 million ($2.0 million) for the same period of 2024.

Impairment loss of property and equipment and other long-lived assets decreased by100.0%, or RMB1.0 million ($0.1 million), from RMB1.0 million ($0.1 million) in the year ended June 30, 2023 to nil in the same period of 2024.

Loss from operations

Loss from operations was RMB71.6 million ($9.9 million) for the year ended June 30, 2024, compared to a loss of RMB69.3 million ($9.5 million) for the same period of 2023. This RMB2.3 million ($0.3 million) increase in loss from operations was primarily due to the increase in operating expense as discussed above.

Change in fair value changes of warrant liability

The Company classified the warrants issued in connection with common share offering as liabilities at their fair value and adjusted the warrant instrument to fair value at each reporting period. This liability is subject to re-measurement at each balance sheet date until exercised, and any change in fair value is recognized in our statement of operations. Gain in change in fair value of warrant liability was RMB6.1 million ($0.8 million) and RMB0.8 million ($0.1million) for the years ended June 30, 2023 and 2024, respectively. On December 14, 2023, we redeemed an aggregate of 17,953,269 (997,404 warrants post 2024 Reverse Split) warrants from the Sellers, and the difference between the repurchase price and fair value of the warrants, a difference of RMB1.7 million ($0.2 million), was recognized as loss in fair value changes of warrant liability. The aforementioned gain of RMB0.8 million ($0.1 million) from fair value changes of warrant liability and the loss of RMB1.7 million ($0.2 million) from fair value changes of warrant liability combine to result in a net loss of RMB0.9 million ($0.1 million) in fair value changes of warrant liability.

Impairment loss on goodwill and intangible assets

The Company recognized the excess of purchase price over the fair value of assets acquired and liabilities assumed of the business acquired was recorded as goodwill and fair value of identified intangible assets, which is customer relationship as a result of the step acquisition of FGS. In conjunction with the preparation of our consolidated financial statement for years ended June 30, 2023 and 2024, the management performed evaluation on the impairment of goodwill and intangible assets and recorded an impairment loss on goodwill and intangible assets of RMB10.0 million ($1.4 million) and nil for the years ended June 30, 2023 and 2024, respectively. As of June 30, 2023, goodwill and intangible assets of FGS had fully accrued for impairment. The impairment was mainly due to the decision of the major customers to develop their own autonomous unified system and to significantly reduce the procurement of third-party services. This change has had a significant and negative impact on FGS's business model and enterprise value. We are currently working to find new ways and channels of cooperation to enhance the FGS business.

Interest income

Net interest income was RMB21.8 million ($3.0 million) for the year ended June 30, 2024, compared to net interest income of RMB11.1 million ($1.5 million) for the same period of 2023. The RMB10.7 million ($1.5 million) increase in net interest income was primarily due to the increased interest-bearing loans to third parties and increased short-term investments we invested during the year ended June 30, 2024.

Other income (expenses), net.

Other net expenses was RMB0.7 million ($0.1 million) for the year ended June 30, 2024, compared to other net income of RMB0.7 million ($0.1 million) for the same period of 2023. The RMB1.3 million ($0.2 million) decrease other net income was primarily due to a decrease in subsidy income of RMB0.2 million. The decrease in other net income was also attributable to an increase in foreign exchange transaction loss of RMB1.1 million ($0.2 million) due to the fluctuation of exchange rate of RMB against US dollars during the year ended June 30, 2024 compared to the same period of 2023.

Net loss

As a result of the factors described above, net loss was RMB51.4 million ($7.1 million) for the year ended June 30, 2024, a decrease of RMB10.0 million ($1.4 million) from net loss of RMB61.4 million ($8.5 million) for the same period of 2023.

Cash and short-term investment

As of June 30, 2024, we had cash in the amount of approximately RMB110.0 million ($15.1million) and short-term investment in bank fixed income product of approximately RMB88.1 million ($12.1 million). As of June 30, 2023, we had cash in the amount of approximately RMB104.1 million ($14.3 million) and short-term investment in bank fixed income product of approximately RMB184.2 million ($25.3 million).

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Pavo Fitness Smart Reformer Raises Over $650,000 (February 10, 2026 | 00:34)

- Bitmo Lab Launches MeetSticker Tracking Technology (February 10, 2026 | 00:28)

- Abio Technologies Unveils Spark and Blaze Systems (February 10, 2026 | 00:24)

- American Eagle and Sydney Sweeney Ring NYSE Bell (February 09, 2026 | 21:12)

Tag:

Tag:

Mobile Version

Mobile Version