Dealmaking potential ripe in Vietnam for ESG-minded groups

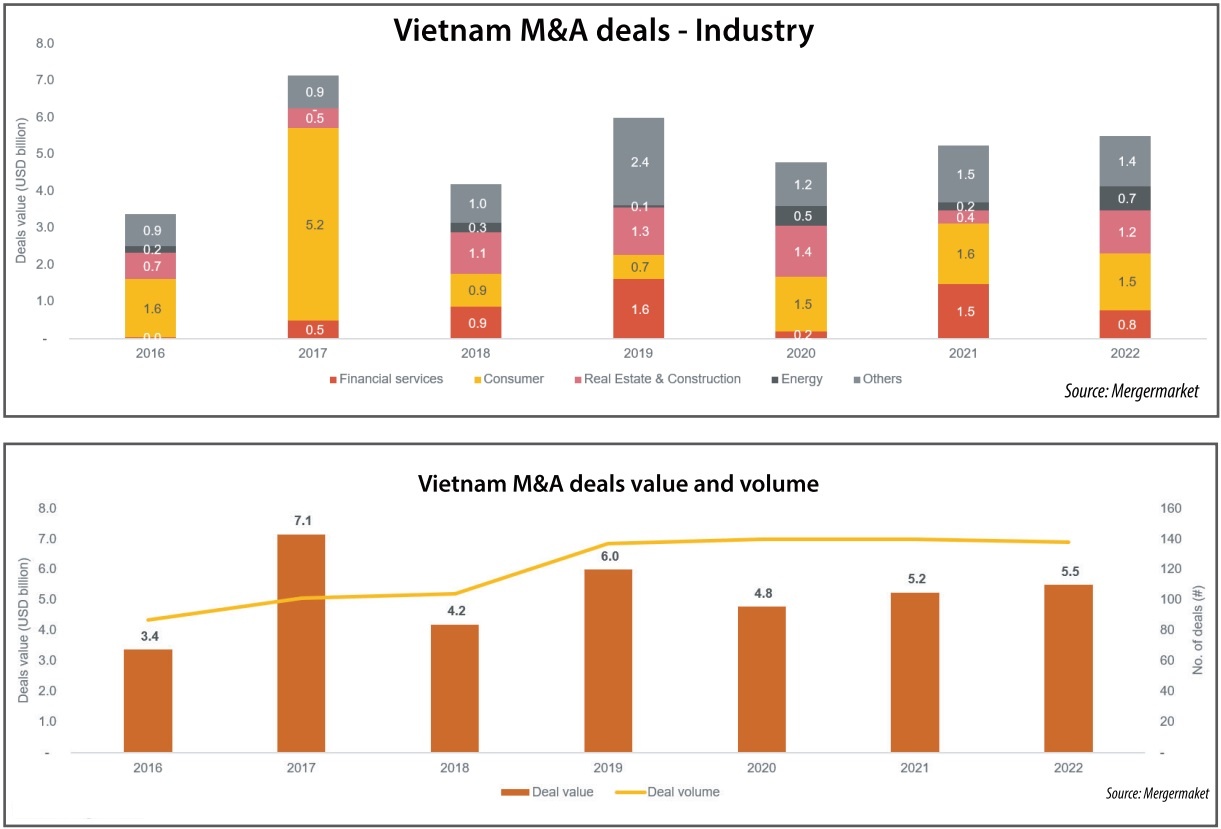

The year 2022 continued M&A momentum in Vietnam with 138 announced deals reaching more than $5.5 billion. The year’s largest transaction was the sale of Coca-Cola Beverages Vietnam to John Swire & Sons for around $1 billion.

|

| Gregory Bournet-Partner, PwC Vietnam & Malaysia and Angela Yang-Partner, PwC Vietnam |

While mergers and acquisitions (M&A) have been the preferred channel for foreign investors to establish a presence in Vietnam, domestic buyers are increasingly considering them as a way to expand their businesses and accelerate their growth. In 2022, there were a number of large deals between Vietnamese companies. For example, Tasco bought SVC Holdings for $430 million, Techcombank bought a 5.4 per cent stake in Techcom Securities for more than $410 million, and Masan Group snapped up 65 per cent in Phuc Long Heritage for more than $260 million.

Since 2016, retail and consumer goods, real estate and construction, and financial services have been industries that captured the highest level of M&A activity, according to Mergermarket. Each of these industries saw landmark deals with transaction values greater than $1 billion, with the SABECO deal remaining the largest M&A deal ever recorded in Vietnam, followed by SMBC Consumer Finance’s acquisition of almost half of consumer finance provider FE Credit, and Central Group’s acquisition of supermarket operator Big C Vietnam.

The M&A market in Vietnam is expected to remain active in 2023. High economic growth and a stable investment environment in Vietnam are the main driving forces behind the related activities of domestic and foreign financiers. Despite the challenges posed by global economic headwinds, Vietnam will remain one of the fastest-growing economies in the region in the coming years.

According to the Economic Intelligence Unit, Vietnam’s annual real GDP growth rate would reach 6.7 per cent in 2023 and up to 6.8 per cent for the period of 2023-2027. In terms of the business climate, multinational manufacturing companies will continue to find attractive conditions in the form of relatively low labour salaries, foreign investment incentives, and favourable trade connections. Furthermore, the supply chain shift away from China, as well as a high level of dry powder held by private equity investors, will also boost M&A transactions in Vietnam.

|

Capitalising on growth

In 2022 there was an apparent change in the Vietnam macroeconomic environment compared to the previous period. The impact of the US Federal Reserve’s aggressive increase in the federal funds rate this year has prompted the State Bank of Vietnam (SBV) to raise the policy rate in order to stabilise VND. In September and October, the SBV hiked the policy rate twice by 100 basis points each, causing deposits and lending rates at commercial banks to rise accordingly.

On the other hand, the Vietnamese bond market saw increased regulation with the issuance of a September decree that placed further restrictions on the corporate issuer as well as the criteria for eligible individual investors. This immediately caused the total value of bonds issued in Q3/2022 to only reach around $2.58 million, a fall of 68 per cent compared on-quarter from the previous year, according to the Vietnam Bond Market Association.

To capitalise on market growth while mitigating potential liquidity pressures from higher interest rates and a slowing bond market, many local enterprises are shifting their attention to restructuring ownership and capital structure, with M&A transactions being one of the viable options.

The key M&A sectors of the previous years, such as banking and consumer, will continue to attract significant interest in 2023. The new laws on insurance business, which include regulations confirming that foreign funders can own up to 100 per cent of the charter capital of insurance enterprises and reinsurance enterprises, will further promote M&A activities in the insurance sector.

In addition, the consumer finance industry will continue attracting significant foreign interest, given its strong growth prospects in the coming years.

Regarding the consumer goods and retail industry, there were increased deal activities in the past few years. Highlight deals include the $90 million from Quadria into the fast-growing mothercare retail network Con Cung in 2022 to support its expansion plans; and a consortium of investors, including SK and TPG, pumping money into supermarket operator The Crown X in 2021.

Vietnam’s large, youthful and growing population with rising household income and a growing middle class will offer high growth opportunities for consumer goods and retail investors in the coming years.

Importance of ESG

Outside traditional sectors, renewable energy and agriculture are also becoming active M&A industries due to their close link to environmental, social, and governance (ESG) factors.

In recent years, ESG has gained prominence in Vietnam, driven by the government’s efforts to promote related practices and growing demand for sustainable funding. An increasing number of ESG-motivated deals are pursued explicitly to advance the agenda and have extensive assessment during the dealmaking process.

ESG-motivated deals are prevalent in the energy sector, where investors use M&As to reposition their portfolios toward sustainable energy alternatives more quickly than they could develop by themselves. A prime example is Leader Energy’s recent acquisition of Vinh Hao 6 Power. The acquisition of a 50MW solar power plant further adds to Leader Energy’s portfolio of over 1,000MW power generation, reinforcing the company’s position as one of the leading green energy players in the high-growth market of Southeast Asia.

Due to an increasing focus on sustainable food production and reduction of environmental impact, ESG-linked deals are also visible in the agriculture industry. An example is the $52 million fund-raising by Mavin Group from International Finance Corporation (IFC). This funding will support the expansion of Mavin’s genetic pig breeding stock and breeding farms in Vietnam as part of IFC’s crisis response to the impacts of the highly contagious African swine fever on the regional pork sector.

To prepare for increasingly ESG-oriented investing, sellers and target companies could incorporate it into the overall strategy to create economic value, improve their valuations, and satisfy the requirements.

To get started, companies could get support from leadership, create an ESG committee, develop measurable metrics, and track these metrics. Further steps include tying the compensation of senior management to related metrics, and reporting ESG targets and progress to all stakeholders via annual reports, internal corporate communications, and annual sustainability reports.

Overall, Vietnam is well-positioned to experience significant M&A activities in 2023 due to the positive sentiment of foreign investors about the Vietnam market and the high potential in key growth sectors. Other than financial services, consumer retail, and real estate – historically the most active M&A sectors – renewable energy and agriculture are expected to be the next active grounds for such transactions due to increasing investors’ focus on ESG-oriented activities.

| ESG promises must be backed up by genuine progress The importance of environmental, social, and governance criteria (ESG) factors to businesses has been extensively acknowledged. Andrew Chan, Sustainability Strategy & Transformation leader at PwC Asia-Pacific’s Sustainability Centre of Excellence, explained to VIR’s Celine Luu how to address ESG concerns across a broad spectrum of industries. |

| Stepping up ESG for socioeconomic gains Both businesses and financial institutions in Vietnam are stepping up their journey in environmental, social, and governance (ESG) criteria, and reinforcing commitments to foster sustainability. A fresh PwC ESG Readiness Report for 2022 shows significantly upbeat figures about how businesses in Vietnam are approaching these matters. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- ESG seen as key to Vietnam’s business credibility and capital attraction (September 29, 2025 | 18:38)

- From compliance to strategy: ESG criteria gaining ground (September 29, 2025 | 15:47)

- Vietnamese firms step up ESG game (September 23, 2025 | 15:26)

- Vietnam tax and legal changes set to shape foreign investment landscape (September 16, 2025 | 13:46)

- Vietnamese businesses navigate US tariffs (June 25, 2025 | 12:14)

- The impact of cloud, AI, and data on financial services (April 14, 2025 | 11:20)

- Vietnam 2025 M&A outlook: trends, deals, and opportunities (March 21, 2025 | 08:54)

- Vietnam's M&A landscape mirrors global trends (February 18, 2025 | 17:13)

- Asia-Pacific CEOs enter 2025 with optimism and caution (February 06, 2025 | 17:16)

- Proposed changes to interest deductibility rules may be welcomed by taxpayers (January 22, 2025 | 09:23)

Tag:

Tag:

Mobile Version

Mobile Version