Creating bankability for PPP projects

|

| Le Net and Vu Thi Thinh from LNT & Partners |

In August the National Assembly began appraising a draft law with regards to public-private partnership (PPP), as submitted by the Ministry of Planning and Investment. This draft law is currently a hot issue for enterprises and investors as well as lawmakers because it takes a much bigger step than current regulations on PPP.

The governing law stipulated in Article 49 of the draft is a controversial issue as it severely influences bankability of the future projects.

One of the noticeable concerns involves the financing possibility from foreign lenders for the project in the case where the concession contract is governed by Vietnamese law.

Many believe that the application of Vietnamese law makes a PPP project less bankable. However, such worry is unfounded as governing law is not a determining factor of bankability.

There is no specific definition for bankability and, in fact, it is subjected to the risk appetite of each capital provider. However, in general, a “bankable project” can be understood as one where capital providers (debt and equity) are comfortable with the risk allocation and mitigation arrangements and willing to invest in the project.

The risks are allocated and mitigated if the bankers can control the cash flows possibly generated from the contract.

|

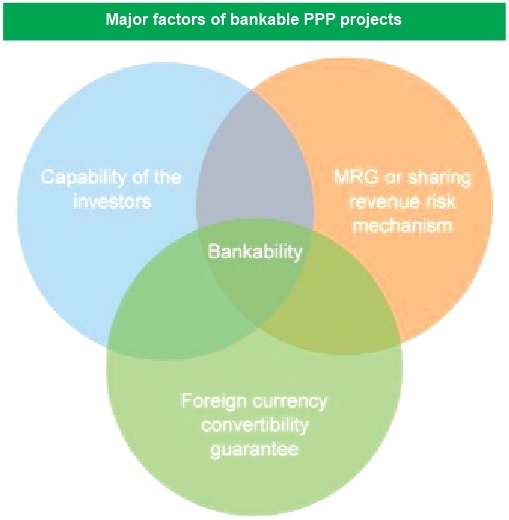

Focus areas

In practice, the determining factors of the bankability, among others, are categorised into the three main groups capability of investors, minimum revenue guarantee/sharing revenue risk mechanism, and foreign currency convertibility guarantee. The capability of the investors, including financial soundness, is always a consideration criterion as it secures the success of the project to a certain extent.

Despite the fact that these are project finance and limited recourse transactions, the projects often resort to the investors’ financial conditions to withstand difficult times.

The presence of an experienced investor in the sector and business is also assessed by the capital providers.

Infrastructure business is a multi-stakeholder game that needs complex maneuvering into the local bureaucratic and political maze, and an experienced partner can play magic.

Meanwhile, the minimum revenue guarantee/sharing revenue risk mechanism plays a vital role in a high-risk project. Basically, a concession contract can be divided into two types, which are contracts generating cash flow (such as electricity project with an official off-taker) and contracts whose cash flow is unclear and unstable (such as build-operate-transfer transportation projects, whose revenues are based on usage of citizens).

In the latter case, as PPP projects require enormous total investment, long payback period, and high failure risks, the major international lenders base the bankability assessment on the guarantees, which are the minimum revenue guarantee or the mechanism for sharing revenue risks.

According to the minimum revenue guarantee concept, a government grants to a private partner a minimum level of revenues for a concession period. Whenever a private partner does not reach the predetermined level of income as defined in negotiations, the government will pay him the difference between the predetermined level and the actual income.

The mechanism for sharing revenue risks is introduced into the draft law by the Ministry of Planning and Investment. Pursuant to Article 76 of the draft, the government decides to apply a sharing revenue risk mechanism for the qualified PPP projects.

The government commits to sharing with investors and project enterprises 50 per cent of the decrease between the actual revenue and the committed revenue in the contract. In exchange, the investors and project enterprises commit to sharing with the government half of the increase in revenue.

Both types of guarantee present a solution for the bankers to control the project’s cash flow, make the project less risky and ensure their financial revenue, thus forming a critical factor for the assessment of the project bankability.

Last but not least, the factor of foreign currency convertibility guarantee is a specific feature of projects involving foreign parties. In principle, the loan from the offshore entities must be paid in the foreign currency.

The currency convertibility can be affected if the money supply of the host state is insufficient due to incidents such as a commercial war or if the national economy recesses, resulting in the establishment of the barrier to trade with foreign countries who have no need for the domestic currency.

The capital providers undoubtedly want to ensure that they receive their domestic currency in spite of such market fluctuations. In the draft law, the government also guarantees up to 30 per cent project revenue in VND after subtracting the amount spent in the same currency.

The three factors mentioned infer that governing law is not of great significance when assessing the bankability of a project. In fact, the Vietnamese government acknowledges this analysis by arranging regulations of the specified guarantees to boost the bankability of a concession contract.

Governing law

Relevant to the analysis, the application of Vietnamese law as the governing law of the concession contract is reasonable and consistent with international practice.

Despite different opinions concerning the governing law of the concession contract, it is unarguable that the United Nations Commission on International Trade Law (UNCITRAL) as well as the World Bank recommends that PPP project contracts should be governed by the laws of the host country in order to avoid disputes.

In any event, whether a country is under a common law system or civil law system, it usually provides for the application of the laws of the host country by general reference to domestic law or by mentioning special statutory or regulatory texts that apply to the concession contract.

In some legal systems, there may be an implied submission to the laws of the host country, even in the absence of a statutory provision to that effect.

Therefore, the UNCITRAL guides parties to select the law of host countries to be applicable law of PPP contracts, and that foreign law should only be selected where there are substantial deficiencies with the governing law.

As Vietnamese law recognises freedom of contract as a fundamental principle, as long as the contract form contains common law concepts like liquidated damages or indemnity, they will be deemed acceptable.

Even if when the Vietnam Supreme Court has a different opinion as to whether liquidated damages are enforceable, then by applying foreign court is not a solution, because the choice of law does not negate mandatory rules of the host country.

Rather, the solution is for the Ministry of Planning and Investment to meet the Supreme Court and get a clear interpretation common law concepts.

The application of Vietnamese law to govern the concession contract has worried several practitioners and experts as to the negative impacts on the bankability of the PPP project.

However, the application of Vietnamese law as law of the host state is reasonable and consistent with international practice.

This opinion is open to discussion, and the National Assembly Economic Committee is still consulting widely with agencies, organisations, and enterprises as well as experienced domestic and foreign experts before officially submitting to the National Assembly for approval.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- IP alterations shape asset strategies for local investors (January 22, 2026 | 10:00)

- 14th National Party Congress: Vietnam - positive factor for peace, sustainable development (January 22, 2026 | 09:46)

- Japanese legislator confident in CPV's role in advancing Vietnam’s growth (January 22, 2026 | 09:30)

- 14th National Party Congress: France-based scholar singles out institutional reform as key breakthrough (January 21, 2026 | 09:59)

- 14th National Party Congress: Promoting OV's role in driving sustainable development (January 20, 2026 | 09:31)

- 14th National Party Congress affirms Party’s leadership role, Vietnam’s right to self-determined development (January 20, 2026 | 09:27)

- Direction ahead for low-carbon development finance in Vietnam (January 14, 2026 | 09:58)

- Vietnam opens arms wide to talent with high-tech nous (December 23, 2025 | 09:00)

- Why global standards matter in digital world (December 18, 2025 | 15:42)

- Opportunities reshaped by disciplined capital aspects (December 08, 2025 | 10:05)

Mobile Version

Mobile Version