Consumption dip impedes inflation

|

According to the General Statistics Office (GSO), COVID-19 has led to slowed down consumption with markets, electronics stores, and much more halting operations for several months.

In the first nine months of this year, equipment and home appliances – one of 11 groups of items used to measure the consumer price index (CPI) in Vietnam – increased merely 0.56 per cent on-year. Other groups’ average CPI also increased around 1 per cent on-year, which is low.

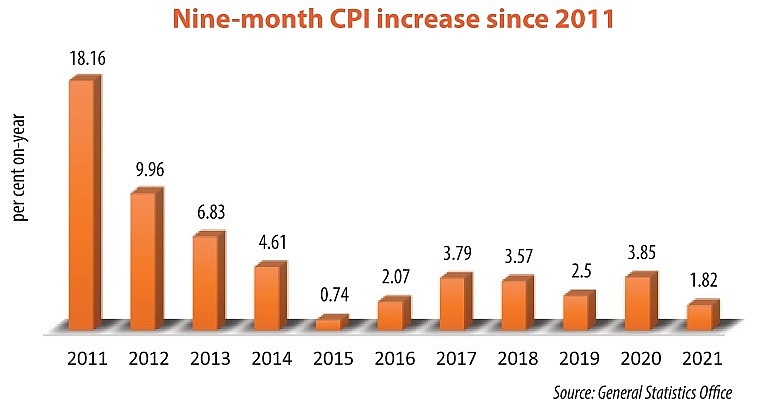

For example, the nine-month average price of some foodstuffs decreased 0.29 per cent on-year, leading to a 0.06 percentage in CPI, while prices of pork and chicken reduced 7.22 and 0.98 per cent on-year, according to a GSO report. The CPI climbed only 1.82 per cent on-year between January and September, the slowest nine-month hike since 2016.

GSO general director Nguyen Thi Huong largely attributed the low increase to global fuel price hikes; higher educational service costs (up 3.76 per cent on-year) resulting from a tuition fee increase for the 2020-2021 school year; higher domestic rice prices (6.47 per cent on-year) following higher prices of exported rice; stronger demand during the Lunar New Year holiday; and stockpiling during social distancing periods.

According to the GSO, so far this year the economy’s industrial performance remains feeble, pulling down the rise of inflation. Specifically, the added value of the industrial sector in Q3 reduced 3.5 per cent on-year, leading to a 4.45 per cent climb on-year for the sector in the first nine months.

Also, the consumption rate of processing and manufacturing – which creates 80 per cent of national GDP - increased only 2.08 per cent on-year, while the sector’s inventory rate at the end of September rose 28.2 per cent as compared to the same period last year. The sector’s average inventory rate in the first nine months stood at 81.1 per cent on-year.

Furthermore, Vietnam’s total nine-month revenue from retail and consumption services touched $146.42 billion, down 7.1 per cent on-year. With such a low on-year CPI rise of 1.82 per cent in the first nine months of this year, the government’s target of keeping inflation of about 4 per cent this year may be reachable, according to the GSO.

In Q4, though social distancing is being phased out gradually, demand for goods are expected to remain weak as people are concerned about more COVID-19 outbreaks. Moreover, business performance is still weak and will need time to rebound and grow stronger.

The Asian Development Bank (ADB) forecasted that Vietnam’s inflation will be muted overall this year and next, with the rate below earlier projections.

“The inflation rate forecast is also revised down, from 3.8 to 2.8 per cent for 2021, as subdued domestic demand has pushed the rate to its lowest level since 2016. The inflation rate is forecast at 3.5 per cent in 2022 as growth accelerates,” said the ADB in a new report on Vietnam’s economic outlook.

Meanwhile, the World Bank also said Vietnam’s inflation will remain subdued, with a forecast of 3.2 per cent this year, 3.6 per cent for next year, and 4 per cent in 2023.

“As the domestic economy recovers, monetary policy will unwind its accommodative policies, focusing more on the objective of stabilising inflation. Inflation is expected to remain below the 4 per cent policy rate set by the government,” said a World Bank report. “Increases in administrative prices and natural shocks to the food supply could lead to short-term price increases in food and specific services or utilities, but those are not expected to fundamentally change the dynamics of price expectations in the next few years.”

Global analysts FocusEconomics told VIR that Vietnam’s inflation is expected to moderate somewhat this year compared to 2020, before picking up again in 2022, in part due to stronger consumer spending.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

- Digital economy takes centre stage in Vietnam’s new growth model (January 28, 2026 | 11:43)

- EU Council president to visit Vietnam amid partnership upgrade (January 28, 2026 | 11:00)

Tag:

Tag:

Mobile Version

Mobile Version