Businesses must bravely make bolder moves in order to reach growth goals

In recent times, surging inflation, dim economic prospects, and rising interest rates have slowed spending on consumer goods in many sectors. For consumer product companies, growth has largely come from pricing rather than volume. In Southeast Asia, consumers have cut their spending in the short term. But the good news is that long-term growth is still attainable.

For brands that are already present in Southeast Asia and those that are exploring a meaningful presence here, having a playbook on the rules of the game and the trends that are shaping the region’s consumer categories is key.

With that goal in mind, in Q3 2023, Bain & Company partnered with Meta and DSG Consumer Partners to conduct a survey with consumer product company senior executives and 9,000 consumers from across Southeast Asia to gain insights into issues likely to drive the region’s consumer products expansion over the next five years. The results are captured in our recently released SYNC Southeast Asia report on the region’s next wave of consumer growth.

The report uncovers several traits defining consumer behaviours – chief among them their current, value-conscious spending habits – while underscoring that the region includes a diverse set of countries and cultures, each with its market preferences that brands must recognise and engage.

Representing the third most populous region in the world, with more than 700 million residents, and the third-fastest growing large economy in the world, Southeast Asia’s status as a market block has long been well-established. In the coming years, however, its market influence is expected to grow even more, particularly as private equity and venture capital funding continue flooding the region and companies look to de-risk their supply chain footprint.

As a whole, the region’s expected typical GDP growth rate is projected to well exceed the global average of 2-3 per cent, with some Southeast Asian countries doubling it. This economic upswing and its related boost to the region’s high- and upper-middle-class populations is expected to usher in new levels of consumer spending, particularly for previously untapped markets, including luxury goods.

Already, certain categories, such as beauty products and branded apparel, are shifting in consumers’ minds from “wants” to “needs.” This mindset reflects Southeast Asian shoppers’ growing willingness to pay for elevated goods that once might have seemed like extravagances, so long as their value is apparent.

Our report also emphasises the future power of Gen Z – representing shoppers currently between the ages of 17 and 27 – in expanding and shaping the Southeast Asian marketplace, particularly in their preference for online shopping and products that align with their generation’s sense of individuality, authenticity, sustainability, and identity.

Interestingly, however, older consumers were not far behind Gen Z in their reported daily use of online shopping channels and digital tech, including even new technologies, such as AR/VR electronics. The takeaway is clear: to build successful market growth, companies must consider nuanced/personalised marketing and offerings that engage all Southeast Asian age demographics.

Companies can also build successful market share with SKUs targeting members of the solo economy, another emerging Southeast Asian demographic that will shape consumer preferences and spending habits in the decade ahead. Already, small and single households represent half of the total population in the region, with the percentage of single-person homes growing at 2.4 per cent annually.

|

| Businesses must bravely make bolder moves in order to reach growth goals |

Approaches to win

To gain market leadership in the region, companies must first recognise Southeast Asia as “same-same, but different.” Each market, channel, or consumer segment must be won separately, requiring ruthless prioritisation and sequencing to allocate resources effectively. Once the “where to win” is clear, companies may want to move to “how to win.”

Brands can look to “insurgent disruptors,” companies that are effectively stealing market shares from incumbents, for inspiration on how to profitably and quickly grow in the region. These brands report finding success – taking share away from incumbent brands, leading to a much higher share volatility in the last five years than the five years preceding them – by deploying several strategies.

Such strategies include a localised traditional approach, where specialised or localised products are priced for the masses; a high-end, digital first approach, with purpose-driven, digitally enabled operations at premium pricing; low-cost champion approach, which targets consumers from lower- to mid-income levels; a retail copycat approach, using retail-branded products that mimic the look and feel of high-end branded goods; and a shapeshifter approach, focused on products delivering new solutions for unmet needs.

Significantly, our survey found the region’s consumers to be more concerned about their wellbeing than US and European consumers. Overall, Southeast Asian shoppers report a strong willingness to pay for wellness goods, including sports nutrition, fitness wearables, and vitamins or supplements. Still, these products’ high costs and limited availability prevent their larger market adoption.

Additionally, savvy shoppers throughout the region report a growing preference for products that are customised or personalised to fit their unique needs, from wellness and childcare products to beauty products and electronics. Because personalisation strategies are expensive and difficult to execute at scale, many companies are embracing AI to explore bringing production and delivery costs down.

In addition to the personalisation of actual products, consumers show a strong preference for personalised content/marketing. When marketing reach is personalised, shoppers are more likely to spend more on a product or brand (63 per cent) and recommend it (66 per cent).

AI has become an important tool for businesses to meet these expectations at scale and across the full customer journey. With the Southeast Asian consumer increasingly embracing AI and use cases growing, the region is well suited for AI to take off at pace.

A targeted playbook for growth

For brands ready to make a bold move in Southeast Asian markets, our report suggests a four-step action model for success. The first is to prioritise, sequence, and fund your Southeast Asian ambition. Brands should base their top priorities in the region on future-facing opportunities there, and seek funding.

At the same time, companies must strategically choose which markets, channels, and consumers to target, whether low-end consumers, consumers across all incomes, or high-end luxury consumers only. Brands that avoid a one-size-fits-all model and effectively discern where to go deep versus broad in their marketing approach will net the greatest profit gains.

Second is to build an obsession with the local consumer. Companies must have an exhaustive understanding of their target consumers’ preferences and buying habits to cater to them effectively. This involves meeting and engaging consumers where they are – including well-allocated spending across various marketing channels – and choosing routes to market that meet consumer needs.

Thirdly, evolve your business models and consumer engagement. Future winning models in Southeast Asia are markedly different from historically winning ones. We predict the greatest success for companies that target one or more of the following approaches: top-line growth and environmental, social, and governance prioritisation, fully local product specialisation, a flexible approach to asset ownership, and investments in disruptive or innovative marketing platforms, including those driven by AI-powered data analytics.

Finally, become a “scale insurgent disruptor.” Companies primed for success in the region must engage the best approaches from the insurgent and incumbent mindset. By finding a middle ground that walks the line between deriving scale advantages, prioritising stable returns, and using models that can pivot and respond innovatively to local consumer needs, brands can maximise their growth and profit potential in the region.

Southeast Asia is primed for growth. For companies ready to move, the region presents a opportunity to expand brand loyalty and reach in previously untapped markets within one of the fastest-growing consumer segments on the globe.

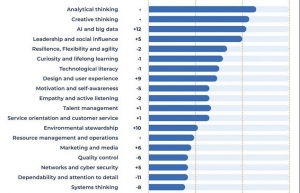

| Businesses urged to adapt with reskilling opportunities The future of the labour market is still difficult to predict, and experts do not agree on its ability to recover in the short term. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Middle East conflict raises risks for global coffee market (March 10, 2026 | 15:07)

- Resilient Vietnam economy faces Middle East headwinds (March 10, 2026 | 12:16)

- Fuel import tariffs temporarily cut to zero until April 30 (March 10, 2026 | 10:53)

- TVS invests $4 million in Dat Bike (March 09, 2026 | 14:38)

- Women face growing workforce gap as AI reshapes industries (March 07, 2026 | 11:55)

- Over 64,000 businesses enter market in first two months (March 07, 2026 | 10:00)

- Honda Vietnam marks 30-year milestone (March 07, 2026 | 08:00)

- Palm oil perspectives from nutrition experts (March 06, 2026 | 09:00)

- Global surge in critical minerals stockpiling: a strategic edge for Vietnam (March 05, 2026 | 17:21)

- Iran war to modestly impact Vietnam (March 05, 2026 | 08:00)

Mobile Version

Mobile Version