ASEAN poised to become global tech and startup hub

A Tech in Asia analysis found that the number of unicorns (startups valued at $1 billion or more) in Southeast Asia has increased across various industries, reaching 51 this year after almost doubling in 2021. Super apps like Grab, Gojek, and Lazada have even become decacorns by passing the $10 billion valuation mark.

|

| Vijay Eswaran, founder and executive chairman of the QI Group of companies |

This has generated a large amount of wealth and employment, positioning ASEAN as a major emerging power on the global tech map.

Preqin’s Territory Guide: ASEAN 2022 reports that 2021 saw record-breaking venture capital deal activities for ASEAN, both in the number of deals and the aggregate deal value – which was up almost 35 per cent from 2019 and 2020 levels combined, with a record peak of $20.4 billion.

According to the 2021 ASEAN Development Outlook and the International Monetary Fund, the region is projected to become the fourth-largest economy globally by 2030. With this exponential rise, ASEAN has gained the potential to brand itself in the global market as a nursery for successful startups.

Opportunities that exist in the ASEAN market

ASEAN’s potential as a global tech hub presents three key opportunities that businesses from around the world can tap into.

Digitalisation

An analysis by JP Morgan found that the spread of digitalisation in the region has increased exponentially. Statistics show ASEAN has increased in terms of both internet users and market penetration rates for online technology and services, driving significant growth in the e-commerce market. This indicates a wider change in taste and preferences, as more consumers go online to find the products, resources, and services they want.

Untapped human and natural resources

ASEAN has long been a well of untapped resources, particularly its natural resources, but increasingly also its skilled, young labour force. The region offers a cost-effective alternative for global manufacturers, providing access to labour, transportation, land, and the materials needed for production. It provides an attractive buffer against the geopolitical tensions and rising prices in traditional manufacturing hubs like China and India.

Hyundai, which has laid the groundwork for an extensive electric vehicle (EV) ecosystem in Indonesia, is one great example. As the largest producer of nickel ore, Indonesia is strategically suited to the manufacturing of lithium-ion batteries, a key component in EV production.

In early 2020, Hyundai began the construction of its first manufacturing plant in West Java, investing approximately $1.55 billion until 2030 and creating 23,000 direct and indirect jobs. Since then, they have even launched the Hyundai IONIQ EV in partnership with Grab to accelerate the adoption of EVs in Southeast Asia.

Favourable demographics as a fertile ground for innovation

The rapidly developing world creates an ever-growing number of new consumer demands that offer both local and global opportunities for new businesses. These openings are a clarion call for aspiring innovations and epoch-making solutions.

Enterprise SG suggests four key areas tech enterprises and startups can focus on including the middle-class consumer, the digital economy and disruptive tech, infrastructure, and intelligent systems, as well as manufacturing and Industry 4.0.

Shifting landscapes require solutions to be more creative and incorporate out-of-the-box thinking and ASEAN offers a fertile and competitive ground where these ideas can be nurtured, developed, and distributed to an eager global market.

What’s holding ASEAN back?

Indeed, while there exists an abundance of opportunities, one obstacle that ASEAN needs to overcome before it can fully realise its potential as a tech and startup hub is greater support for its talent.

The region’s burgeoning middle class is a powerful global and regional economic force and it is also becoming increasingly entrepreneurial. According to the World Economic Forum, just over a third of ASEAN professionals are either entrepreneurs or work for a startup. However, the lack of labour market mobility within the region could prove to be a major obstacle to ASEAN becoming a global tech hub.

The restrictive labour policies held by several Southeast Asian countries demonstrate the lack of political and public will to pursue increased labour mobility. Politicians, professional associations, and the public alike fear migrant workers swarming to richer countries and introducing increased competition and instability, while poorer countries fear losing their most educated in a brain-drain situation.

The dearth of effective labour mobility programmes is also a symptom of the need for regional standards regulating various industries. Establishing common guidelines across ASEAN could facilitate the growth of regional businesses and industries, build a larger and more qualified labour force, and promote interconnectivity.

The benefits of turning ASEAN into a tech and startup hub

Could ASEAN be the next Silicon Valley with its own MIT? The association created the ASEAN Guidelines on Fostering a Vibrant Ecosystem for Startups Across Southeast Asia to support the region’s efforts to attract the best global talent. Moreover, government-led initiatives like Thailand 4.0, Enterprise SG, and Vietnam’s Saigon Silicon City Centre continue to form the springboard for budding entrepreneurs.

Vietnam is, in fact, poised to emerge as a digital startup hub in the near future. The country has been in the thick of the tech startup scene from the beginning, but it only took off in 2016. The number of startups has shot up to around 3000, with 92 firms securing deals worth a record $292 million in 2017 alone. That represents an almost four-fold increase, with only 25 firms securing funding in 2013.

As both individual member states and a combined support network flourish, this creates a robust ecosystem within ASEAN to nurture startups for competition on the world stage. Furthermore, the region’s increased internet penetration and reach and data-sharing capabilities will facilitate even more co-learning among the countries, driving ASEAN to become the major force behind a new, global, tech, and startup economy.

| Vietnam stepping up global tech supply Amid stiffening competition, Vietnamese tech firms are strengthening their global footprints, contributing to increasing the position of local digital products and services in the global supply and value chain. |

| Vietnam rising as a global financial hub: why not? For many observers, Vietnam becoming a true financial hub seems an unrealistic vision. But why shouldn’t a bustling business metropolis like Ho Chi Minh City be able to develop into an international financial centre? |

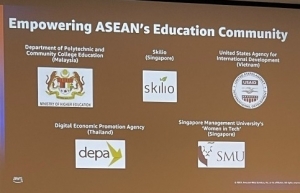

| ASEAN countries rush to address digital skills gap Amazon Web Services (AWS) has been cooperating with countries across ASEAN in upskilling to meet their digital transformation needs. |

| ASEAN countries betting on adoption of cloud services As ASEAN nations are quickening digital transformation to achieve their new missions for the digital age, various agencies and tech titans are building new plans to meet regional growing needs. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Digital shift reshaping Vietnam’s real estate brokerages (December 31, 2025 | 18:54)

- Allen & Gledhill recognised as Outstanding M&A Advisory Firm (December 18, 2025 | 14:19)

- Inside Lego Manufacturing Vietnam (December 18, 2025 | 11:45)

- The next leap in Cloud AI (December 11, 2025 | 18:19)

- Vietnam’s telecom industry: the next stage of growth (December 11, 2025 | 18:18)

- Five tech predictions for 2026 and beyond: new era of AI (December 11, 2025 | 18:16)

- CONINCO announces new chairman and CEO (December 10, 2025 | 11:00)

- How AWS is powering the next-gen data era (December 09, 2025 | 13:14)

- Outlook in M&A solid for Singapore (December 08, 2025 | 10:31)

- Vietnamese firms are resetting their strategy for global markets (December 05, 2025 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version