AEC broadens its effects on Vietnam

|

Pranoto Soenarto, director of Indonesian coffee company PT Asia Mina Sejahtera, flew from Jakarta to Hanoi last month, with only one goal in mind: seeking Vietnamese partners to co-operate with in its potential coffee projects.

“We’re expanding production, and we need to seek more suppliers of input materials. Vietnam is our best market,” Soenarto said.

PT Asia Mina Sejahtera is among 16 Indonesian coffee firms which recently came to Vietnam for the first time to look for Vietnamese suppliers. They include big brands like Harro Coffee Group, PT Sabani Internasional, Gabungan Perusahaan Petani Indonesia, and PT Pamora Coffee Indonesia. They met with several Vietnamese firms, including Me Trang Coffee, Minh Tien Coffee, IDD Vietnam, Cuong Anh Import-Export, and Hapro Distribution. A number of deals were agreed on, without details revealed.

According to the Vietnam Coffee-Cocoa Association (Vicofa), Indonesian firms spent over $33 million importing coffee from Vietnam last year. It is expected that the figure could reach $40-45 million this year.

Before 2015, the turnover of Vietnam’s coffee exports to Indonesia was about $15-20 million a year. “One of the reasons Vietnam is now boosting its coffee exports to ASEAN markets, mostly to Indonesia, Malaysia, the Philippines, Singapore, and Thailand, aside from these nations’ growing coffee demand, is that import tariffs on the product have been reduced to 0 per cent,” said a Vicofa representative.

According to the General Statistics Office of Vietnam (GSO), coffee is just one among many boosted Vietnamese exports to ASEAN since the ASEAN Economic Community (AEC) was established in late 2015. This has also contributed to an overall increase in Vietnam’s exports to ASEAN.

On the rise

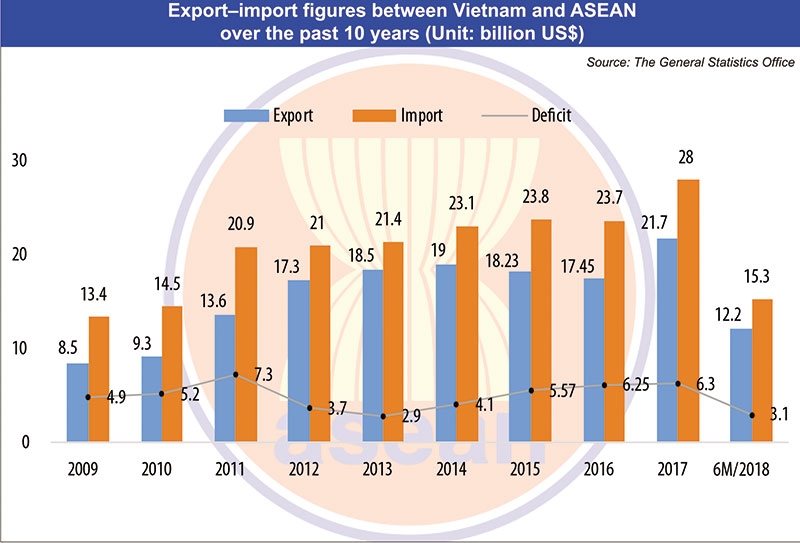

The GSO reported that ASEAN is now Vietnam’s fourth-largest export market, after the US, the EU, and China. Vietnam’s export turnover to ASEAN surged from less than $1 billion in 1995 to $18.23 billion in 2015.

In 2016, Vietnam’s export turnover to the ASEAN region was $17.45 billion, down 4.4 per cent on-year. However, the figure ascended to $21.7 billion in 2017, up 24.5 per cent on-year. In this year’s first six months, the figure hit $12.2 billion, up 17.4 per cent on-year.

“Vietnam’s exports to other ASEAN members have risen significantly. Not only foreign enterprises in Vietnam, but also Vietnamese firms have been boosting their exports to ASEAN markets,” said a representative from the Ministry of Industry and Trade (MoIT) at a recent cabinet meeting in Hanoi. “This is thanks to slashed import tariffs, in addition to the business community’s increased awareness about ASEAN markets.”

Key Vietnamese exports to ASEAN include farm produce like coffee, pepper, and cashews, mobile phones, computers, electronics, steel, machinery and equipment, vehicles, textiles and garments, and crude oil.

Nguyen Huu Truong, sales representative of Garmexi Trade JSC, a Vietnamese-Chinese joint venture company in the northern province of Bac Giang, told VIR that if his firm directly exported its garments from China to ASEAN, it would face an average import tax rate of 8-10 per cent; but when the company exports from Vietnam, it enjoys a far lower import tax rate of merely 2-3 per cent, which will be removed completely by the end of this year.

In this year’s first half, Garmexi exported to Malaysia and Singapore, with its turnover increasing by 18-20 per cent on-year. “We are planning to expand our exports to Thailand, Myanmar, the Philippines, and Indonesia in the future,” Truong said.

According to the General Department of Customs, during the first five months of this year, Vietnam earned $2.2 billion from exporting its goods to Thailand, $1.66 billion to Malaysia, $1.33 billion to Singapore, about $1.6 billion from exports to Indonesia, and $1.2 billion to the Philippines.

In 2017, Vietnam fetched $4.7 billion from exporting its goods to Thailand (up nearly 30 per cent on-year); $4.2 billion to Malaysia (up 31 per cent), about $3 billion to Singapore (up over 30 per cent), $2.5 billion to Indonesia, and $1.1 billion to the Philippines.

Tax slashes for a single market

The AEC is aimed to create a tariff-free zone with 0 per cent tariffs on all traded goods and services, while setting a timetable for removal of non-tariff barriers region-wide.

Nguyen Thi Quynh Nga, vice head of the MoIT’s Multilateral Trade Policy Department, said that the ASEAN-6 nations–the bloc’s most developed economies of Brunei, Indonesia, Malaysia, the Philippines, Singapore, and Thailand–erased 99 per cent of their import tariff lines by 2010. Meanwhile, the remaining nations–Cambodia, Laos, Myanmar, and Vietnam–removed 90 per cent of their import tariff lines in 2015.

“This year, another 7 per cent of tariff lines will be removed by Vietnam,” Nga said.

These numbers mean 669 tariff lines, which will be reduced to 0 per cent by the end of this year for such products as automobiles and their spare parts, steel, motorbikes and bikes and their spare parts, wine, beer, plastics, and paper.

The remaining 3 per cent, on sensitive agricultural items like poultry, eggs, sectioned fruit, rice, processed meat, and sugar, must be reduced to 0 per cent after 2018.

However, in order to benefit from such tariff reductions, goods must meet many conditions. For example, they have to have at least 40 per cent of their materials sourced from within ASEAN.

A bumpy road ahead

Nguyen Ton Quyen, chairman of the Timber and Forest Product Association of Vietnam, said local wood producers find it challenging to enter ASEAN. Despite the AEC tariff cuts, they cannot increase exports to ASEAN due to the low demand for Vietnamese wooden products. Meanwhile, the firms also import a large volume of materials, such as paints, nails, and chemicals, worth millions of US dollars a year from ASEAN.

“That’s why the whole economy in general is still suffering from a trade deficit with ASEAN,” Quyen said.

The GSO reported that in the first half of this year, while exports to ASEAN reached a turnover of $12.2 billion, a 17.4-per-cent increase, Vietnam’s import turnover from this market was $15.3 billion, up 11.8 per cent on-year, leaving a trade deficit of $3.1 billion, marginally lower than the $3.2 billion recorded in the same period last year.

Last year, the trade deficit was $6.3 billion, higher than 2016’s $6.25 billion. Vietnam also has a deficit with Thailand, Malaysia, Singapore, Indonesia, and the Philippines.

Vietnam is also a net importer of many items indispensable for local production from ASEAN, such as petrol, plastics, and components for computers, electronics, machinery, and steel.

However, according to the GSO, Vietnam imports these items for local production and then exports finished products to the world, including ASEAN. Thus, there should be no worry about the trade deficit between Vietnam and ASEAN.

Ibnu Hadi, Indonesian Ambassador to Vietnam, told VIR that in addition to exporting coffee to Indonesia, Vietnam also imports the same product from Indonesia for export-oriented processing.

“While Vietnam is the world’s second-largest coffee exporter and Indonesia is the world’s fourth-largest coffee exporter, and both nations are also ASEAN members and produce 80 per cent of global coffee volume, there is a need for further co-operation between both countries,” he said.

Overall, the two-way trade turnover between Indonesia and Vietnam rose from $5.58 billion in 2016 to $6.5 billion last year, including $3.63 billion worth of Indonesian exports, up 22.51 per cent on-year, and $2.87 billion worth of Indonesian imports, up 9.37 per cent on-year.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version