Vietnam's economic growth projected at 4.7 per cent in 2023

|

After the sharp slowdown in the first quarter of this year, Vietnam's economic growth has now picked up, with signs of increasing new orders and improving business confidence. However, the outlook for Vietnam’s economic growth in the near term remains fragile as the global economy is forecast to experience only moderate growth.

Inflationary pressure remains under control, thanks mainly to adequate domestic food production, temporary cuts of oil-related taxes, and administered prices. Consumer price inflation is expected to increase slightly to 3.3 per cent in 2023 and 3.4 per cent in 2024.

On the external front, the contraction of exports will be offset by import compression and rising income from tourism. Foreign direct investment (FDI) inflows remain strong amidst the reconfiguration of the global supply chain. Trade surpluses and resilient FDI inflows will be the key factors behind the overall balance of payments surplus.

AMRO's lead economist Sumio Ishikawa said, "The elevated headwinds from weakening global demand and the downturn in the local housing market call for the recalibration of the macroeconomic policy mix to support the economy and safeguard financial stability."

Accordingly, the government has implemented several measures to support growth, including the temporary reduction and deferral of land rent and some taxes, a 150 basis point cut to the operating interest rate, and credit support measures. In light of the financial distress in the residential property market, Ishikawa feels an appropriate policy mix should be employed to support growth while maintaining stability.

"With output still below its potential and some available fiscal space, policies should offer targeted support to micro, small, and medium-sized enterprises (MSMEs) and vulnerable households that are adversely affected by the country’s weak economic conditions. Expediting state capital investment would also boost growth," Ishikawa stated.

"Over the medium term, fiscal policy should focus on improving tax administration, broadening the tax base, enhancing spending efficiency, and strengthening social protection."

The accommodative monetary policy has eased the financial burden on vulnerable borrowers, and to some extent, bolstered business and consumer confidence. He argues that the monetary policy stance should be normalised once the economic recovery is on track. Modernising the monetary policy framework, including transitioning to a more market-based stance, would allow monetary policy to support the economy more effectively.

According to the AMRO, concerted efforts should be made to promote green, inclusive, and sustainable growth. Increasing MSMEs' access to financing through the expansion of credit guarantee funds could also be considered. More resources should be directed to increase the availability and quality of education and vocational training. Finally, amidst the intensifying climate risks, more attention should be paid to mitigation and adaptation.

| Vietnam's economy continues upward growth trajectory Compared to the first half of this year, noticeable improvements have been seen in terms of production activities in the third quarter. Nguyen Thi Mai Hanh, head of the System of National Accounts Department under the General Statistics Office, digs into the economic development highlights of the year to date. |

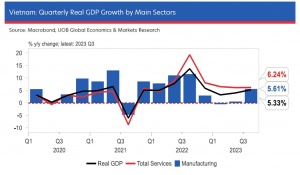

| UOB adjusts 2023 growth forecast for Vietnam UOB (United Overseas Bank) has adjusted its full-year growth forecast for Vietnam to 5 per cent from 5.2 per cent previously, with the assumption of further acceleration of real GDP growth in Q4 at 7 per cent on-year. |

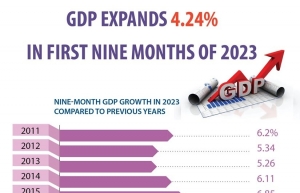

| Vietnam’s GDP grows 4.24 per cent in January-September Vietnam’s gross domestic product (GDP) increased by 4.24 per cent year-on-year in the first nine months of 2023. While the rate only exceeds the figures recorded in 2020 and 2021, which were significantly affected by COVID-19, it is still seen as a positive outcome, according to the General Statistics Office. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Masan Consumer names new deputy CEO to drive foods and beverages growth (February 23, 2026 | 20:52)

- Myriad risks ahead, but ones Vietnam can confront (February 20, 2026 | 15:02)

- Vietnam making the leap into AI and semiconductors (February 20, 2026 | 09:37)

- Funding must be activated for semiconductor success (February 20, 2026 | 09:20)

- Resilience as new benchmark for smarter infrastructure (February 19, 2026 | 20:35)

- A golden time to shine within ASEAN (February 19, 2026 | 20:22)

- Vietnam’s pivotal year for advancing sustainability (February 19, 2026 | 08:44)

- Strengthening the core role of industry and trade (February 19, 2026 | 08:35)

- Future orientations for healthcare improvements (February 19, 2026 | 08:29)

- Infrastructure orientations suitable for a new chapter (February 19, 2026 | 08:15)

Tag:

Tag:

Mobile Version

Mobile Version