UOB and its growth in Vietnam

UOB’s relationship with Vietnam started in 1993, when it set up a representative office with just three people. In 1995, it was the first Singapore bank to set up a branch in Ho Chi Minh City.

|

| UOB has helped create more than 30,000 jobs over the years |

Fast-forward 30 years, and UOB now has successfully transformed from a branch to a foreign-owned subsidiary, while maintaining steady growth, even through the pandemic. The bank has supported more than 250 companies to invest in Vietnam, bringing in more than $4.2 billion in investment and creating more than 30,000 jobs.

“Over the course of our development, we have been steadfast in our commitment to support Vietnam’s economic growth as we connect our clients to investment opportunities in the country,” said CEO Victor Ngo in an exclusive interview with VIR.

In Vietnam, UOB was the first Singaporean bank to establish a foreign direct investment (FDI) advisory department in 2013, demonstrating its commitment to supporting trade and investment in the country. Through collaborations with the Vietnam Foreign Investment Agency, UOB Vietnam serves as a one-stop service for foreign companies entering the Vietnamese market, providing valuable insights, market-entry support, and comprehensive banking solutions.

Leveraging its extensive ASEAN network of 10 dedicated FDI centres across Asia, UOB Vietnam aims to facilitate seamless regional growth for its customers while actively supporting FDI inflows into Vietnam. In the next three years, the bank is set to facilitate a pipeline of $1.1 billion in potential investments from companies in sectors such as manufacturing, technology, and consumer goods.

Retail expansion

UOB is not content with solely catering to foreign-invested and corporate clients. Recognising the tremendous potential in the retail sector, the bank has strategically entered the retail market to serve a broader customer base. This expansion aligns with UOB’s long-term vision of becoming a top financial institution in ASEAN.

ASEAN’s middle-class boom is set to fuel a surge in consumer spending, with projections by the World Economic Forum indicating a doubling of total consumption to nearly $4 trillion by 2030.

UOB, bolstered by the Citigroup acquisition, is strategically positioned to capitalise on this growth, capturing cross-border payments and wealth flows.

The completion of UOB’s acquisition of Citigroup’s consumer banking businesses in Malaysia, Thailand, and Vietnam has already bolstered its regional retail customer count to over seven million as of March 31. With the upcoming acquisition in Indonesia by the end of 2023, these four markets are expected to contribute a significant $1 billion boost to the bank’s revenue on a full-year basis.

Building upon its expanded presence, UOB aims to reinforce its leading position in the consumer card space for Visa and consumer credit cards for Mastercard portfolios in terms of billings. The number of UOB cards in the region has already surged by more than 60 per cent on-year as the end of 2022. Additionally, regionwide credit card billings recorded remarkable growth of over 90 per cent in the fourth quarter of 2022 compared to the previous year, nearing 2019 levels.

The bank has identified key spending categories, such as travel, dining, and retail, to enhance its offerings, while over 40 strategic partnerships with renowned brands across the region provide exclusive rewards and privileges to customers, reinforcing its commitment to building a strong regional presence.

“So far, the performance has surpassed our expectations,” said Ngo. “Business is resilient. We diversified earnings across products and countries while creating significant cross-sell opportunities. The acquisition has also built stronger resilience in the business model with both geographical and revenue mix diversification.”

Particularly in Vietnam, the acquisition is envisaged to triple the retail customer base, double retail lending and deposit balance of UOB Vietnam, providing the bank a full suite of unsecured products, including credit card and unsecured personal loans, to complement its existing mortgage and auto loans.

Looking to the future

UOB is committed to expanding its franchise in Vietnam through strategic initiatives. The recent acquisition of Citigroup’s consumer banking business presents an opportunity to strengthen its market position and scale its retail business. The development strategy is based on three pillars: connectivity, personalisation, and sustainability.

For wholesale banking, UOB focuses on leveraging its Connectivity through an extensive ASEAN network to provide seamless regional support for customers, particularly in expanding supply chain opportunities.

In retail banking, the emphasis is on personalisation, understanding individual customer needs through data-driven insights and creating tailored solutions across the wealth continuum. UOB Vietnam will invest in digital capabilities and an omnichannel strategy to enhance the customer experience.

Sustainability is another key aspect, promoting responsible business practices, environmental impact mitigation, and social inclusiveness. UOB aims to attract quality FDI, generate meaningful employment, and collaborate with government agencies.

Investing in digital innovation is another priority, with S$500 million ($370 million) allocated for initiatives across ASEAN, including Vietnam. UOB FinLab, the digital transformation accelerator, will engage businesses and endorse digitalisation programmes for small- and medium-sized enterprises and startups.

Additionally, UOB supports the community, including the art community, through initiatives like the UOB Painting of the Year competition and partnering with Saigon Children Charity to empower underprivileged children through digital learning.

| Victor Ngo - CEO, UOB Vietnam

Over the past few years, Vietnam has benefited from the supply chain shift trends amid the US-China trade war and the pandemic thanks to a stable political foundation, favourable demographics, strong growth prospects and a conducive business environment. In 2022, the total registered FDI capital into Vietnam reached nearly $27.72 billion, and realised capital reached a record $22.4 billion, up 13.5 per cent over the same period in 2021, the highest performance in five years. Amid the global uncertainties caused by prolonged geopolitical tension, there will be challenges in attracting investments not only for Vietnam but also for any other countries. Prolonged geopolitical tension may make the companies and lawmakers look into the strategy to make supply chains more resilient by moving production home or to trusted countries. This will lead to an increasing trend of geo-economic fragmentation, causing intensifying competition to entice FDI from around the world. In addition, the global minimum tax (GMT), which will be applicable to 141 countries from 2024, will also pose a significant challenge for emerging markets in Southeast Asia, where tax incentives have been one of the most attractive points for foreign investors. However, over the past few years, Vietnam has been considered an attractive destination for foreign investors thanks to stable political foundations, strong growth prospects, and a conducive business environment. In addition, a strong and affordable labour force and a domestic market of nearly 100 million people with a rapidly growing middle class, are also attracting foreign investors. Vietnam is also one of Asia’s most dynamic destinations for business and investment, with the image of a country having clear direction and striving to realise strong commitments on attracting high-quality investments towards a carbon-neutral economy and green growth. Accordingly, Vietnam still has opportunities to draw more FDI by enhancing infrastructure, administrative procedures, the quality of the labour force, and regulatory requirements to effectively counter the GMT. |

| UOB Vietnam and UOBAM Vietnam launch sustainable investment solutions UOB Asset Management Vietnam (UOBAM Vietnam), strategic partner of UOB Vietnam (UOB Vietnam), has launched new investment solutions for customers in the Vietnamese market with an interest in sustainable investing. |

| UOB empowers Vietnamese SMEs to harness digital technologies UOB FinLab, an innovation accelerator, announced its official launch in Vietnam today, granting small- and- medium- sized enterprises access to digitalisation and sustainability programmes, matching of business solutions providers, mentorship, and valuable resources. |

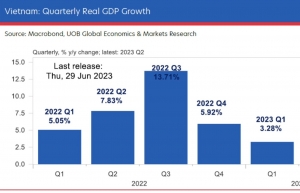

| Full-year GDP growth projection of Vietnam to 5.2 per cent: UOB United Overseas Bank (UOB) has just revised its full-year growth projection down to 5.2 per cent in view of the challenges ahead, particularly for the fourth quarter of 2023 with its high base (in value terms) a year earlier. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Raised ties reaffirm strategic trust (February 20, 2026 | 14:06)

- Sustained growth can translate into income gains (February 19, 2026 | 18:55)

- The vision to maintain a stable monetary policy (February 19, 2026 | 08:50)

- Banking sector faces data governance hurdles in AI transition (February 19, 2026 | 08:00)

- AI leading to shift in banking roles (February 18, 2026 | 19:54)

- Digital banking enters season of transformation (February 16, 2026 | 09:00)

- IFC to grant $150 million loan package for VPBank (February 13, 2026 | 09:00)

- Nam A Bank forms position as strategic member at VIFC through three key partnerships (February 12, 2026 | 16:39)

- Banks bolster risk buffers to safeguard asset quality amid credit expansion (February 12, 2026 | 11:00)

- VNPAY and NAPAS deepen cooperation on digital payments (February 11, 2026 | 18:21)

Mobile Version

Mobile Version