Two hacked customers lose VND200 million in DongA Bank overnight

|

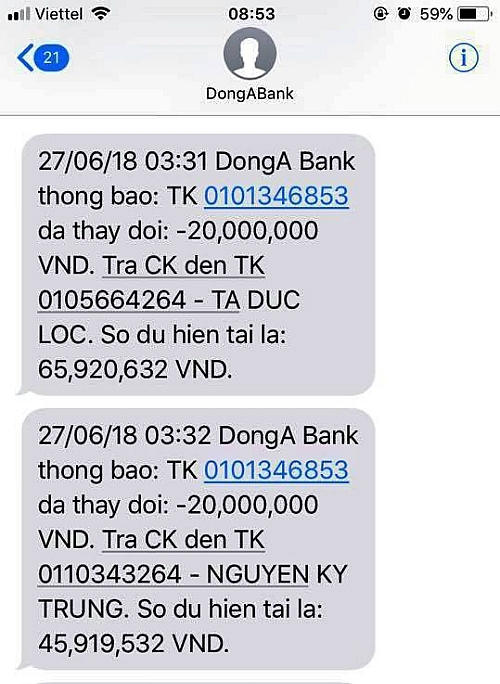

| A series of messages of withdrawals Thuy received between 3.30 and 4 AM on June 27 causing a loss of VND85 million ($3,750) |

Nguyen Thi Phuong Thuy (District 12, Ho Chi Minh City) is a client of DongA Bank who had VND86 million ($3,790) withdrawn from her account through an ATM early on June 26.

Thuy said at around 3.30 AM on June 27, DongA Bank sent her several messages informing her that VND60 million ($2,640) has been transferred from her account to three others. A few minutes later, she was informed that another VND20 million ($880) was withdrawn in cash while she was still sleeping.

At 4 AM, another message showed that another VND5 million ($220) was withdrawn from her account. She woke up and found her ATM card in her bag. “I called DongA Bank’s hotline to freeze the account, but it was too late, only VND900,000 ($40) was left on it,” Thuy said.

In the morning, she went to DongA Bank to report the incident that lost her altogether VND85 million ($3,750). The bank told her that money was withdrawn at an ATM machine in Tan Phu district, Ho Chi Minh City, and that they will find out more within the next five days.

Thuy confirmed that she did not share her password with anybody. “A day before, I withdrew VND2 million ($88) from an ATM in Quang Trung Street. And I cannot tell for sure whether any device has been used to copy my information,” she added.

|

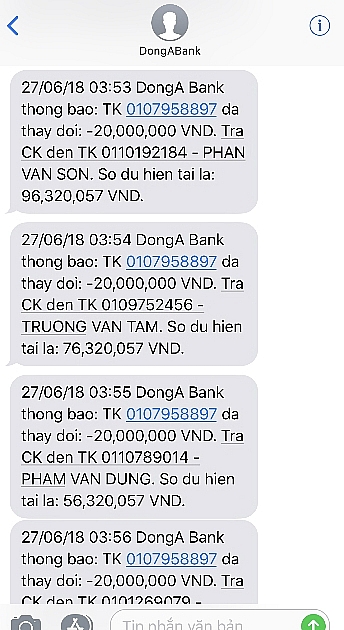

| A series of messages of withdrawals Duyen received around 3.55 AM on June 27 causing a loss of VND116 million ($5,110) |

In another case, Doan Thi Ngoc Duyen (District 12) reported to VnExpress.net that she also had money withdrawn from her account at around 3.55 AM on June 27. DongA Bank sent five messages to inform that VND96 million ($4,230) had been transferred (in five installments) to other accounts.

A few minutes later, Duyen received another messages about withdrawing an additional VND20 million ($880) in cash from her account. As a result, she lost a total of VND116 million ($5,110).

She was very worried and made sure that her card was still in her wallet. She called the hotline of DongA Bank to freeze the account, but she was too late as only VND320,000 ($14) was left on the account.

In the morning, she went to DongA Bank to report the incident. The bank identified that the same ATM was used at the same time to withdraw her and Thuy’s money.

The representative of DongA Bank told VnExpress.net that this bank is investigating the incident and is going to respond to the client as soon as possible. Against the trend of high technology crime increasing rapidly in Vietnam, the safety of cardholders is the priority, and the bank would do their utmost to strengthen security for them.

He said that in addition to using skimming devices to copy and forge fake cards, another leading cause of losing money is revealing card information to family members or friends. DongA Bank’s representative recommended customers to keep the PIN codes secret from everyone.

The Ministry of Public Security’s Department of Hi-Tech Crime (C50) showed several methods criminals use to hack bank accounts. The most popular measure is to steal data at ATMs. A set of skimming devices includes an ultra-small camera set up with a sighting on the ATM’s keypad, a card skimmer inserted into the card slot, and a keypad skimmer placed over the ATM’s keypad.

This equipment is used to appropriate the PIN code and card number of anyone using the ATM. Then the criminals create fake cards and will start stealing money via ATM withdrawals.

Another way is when criminals create websites and inform victims via Facebook, Zalo, Viber, and SMS that they won a valuable prize, asking them to sign in on the website and get their prize. Criminals may also act as bank officer to contact cardholders to ask them to provide information (PIN code, card number, OTP code). Thereby, customer should improve their knowledge and be vary of suspicious signs of hi-tech fraud.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Themes: Bank Scandals

Related Contents

Latest News

More News

- Cashless payments hit 28 times GDP in 2025 (February 04, 2026 | 18:09)

- SSIAM and DBJ launch Japan Vietnam Capital Fund (February 04, 2026 | 15:57)

- Banks target stronger profits, credit growth in 2026 (February 04, 2026 | 15:43)

- Vietnam on path to investment-grade rating (February 03, 2026 | 13:07)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Insurance market building the next chapter of protection (February 02, 2026 | 11:16)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- Corporate bond market poised for stronger growth cycle (January 28, 2026 | 17:13)

- Vietnam's IPO market on recovery trajectory (January 28, 2026 | 17:04)

Tag:

Tag:

Mobile Version

Mobile Version