Top firms dominate tax rankings

The launch at the National Convention Centre in Hanoi’s My Dinh area will be the second to recognise those businesses with outstanding business results and making the largest contributions to the state’s coffers while abiding to state regulations.

The ratings are based on corporate tax payment data from 2008 to 2010.

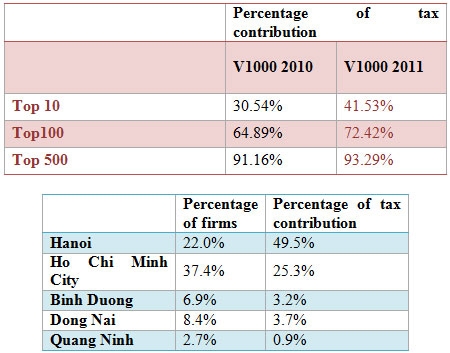

The V1000 figures for 2011 show the country’s top 10 businesses contributed up to 41.53 per cent of total tax payments despite only accounting for 1 per cent of all firms operating in this country,

The 500 businesses at the bottom of the rakings contributed less than 10 per cent of total payment. (See table below)

In respect to ownership type, state-owned enterprises (SOEs) accounted for a half of V1000 2011’s top 100 businesses. Foreign invested enterprises (FIEs) and private equity firms represented 29 per cent and 21 per cent, respectively.

SOEs also excelled in payment terms, making up 66.2 per cent of the total payment made by top 100 firms. FIE contribution was 22.4 per cent while private equity comprised 11.4 per cent.

Sector-wise, the mining industry and information communications industry though reporting the least number of firms were among the largest contributors by sector (33 per cent and 21 per cent, respectively). This was despite the relative small number of firms engaged in these fields (6 per cent and 5 per cent, respectively).

Businesses in the banking sector made up 21 per cent of firms and paid in 19 per cent of total tax payment.

Relative to percentage of contribution, SOEs including groups, corporations, holding and limited liability firms with over 50 per cent of chartered capital held by the state paid in 57.3 per cent of V1000’s total tax payment. Contributions from the FIE sector totalled 25 per cent and the private sector provided 17.7 per cent.

In the state sector, the number of businesses was not proportional with their percentage of tax contributions. The mining industry made up 8 per cent of firms among SOEs in V1000 but contributed 31 per cent of SOEs’ total tax amount in 2010. The corresponding figures for information communications sector were 1 per cent and 26 per cent, respectively.

This imbalance was lower in the foreign invested sector. For instance, the motorbike-automobile manufacturing industry and the banking sector made up 9 per cent and 6 per cent of total businesses in number and paid in 13 per cent and 11 per cent of the sector’s total tax contribution.

For the private sector, banking entities paid in 36 per cent of the sector’s total contribution though they were just 8 per cent of firms. The sector also witnessed the birth of three new segments: supermarket retail trading, medicine-pharmacy and iron-metal ware. Generally, the number of firms and their corresponding tax contributions were relatively balanced compared with the state and FDI sectors.

In terms of localities, the five leading localities in tax contribution in 2011’s V1000 were Hanoi, Ho Chi Minh City, Dong Nai, Binh Duong and Quang Ninh. Some 77.4 per cent of V1000 businesses were operating in these localities and they contributed 82 per cent of total tax payments.

Firms based in Vietnam’s two biggest cities made contributions far surpassing those in Binh Duong and Dong Nai. (See the table below)

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Japanese business outlook in Vietnam turns more optimistic (January 28, 2026 | 09:54)

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

Tag:

Tag:

Mobile Version

Mobile Version