Time to roll out the “green carpet” for foreign investors

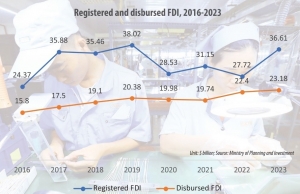

According to the Foreign Investment Agency under the Ministry of Planning and Investment, Vietnam cumulatively has attracted approximately $469 billion in registered foreign direct investment (with more than $287 billion executed) as of December 20, making the country a top investment destination in ASEAN.

|

| Huong Vu, general director, EY Consulting Vietnam |

The red carpet approach, which emphasises tax incentives, infrastructure support, post-investment assistance, and other policies to reduce investment costs, however, is encountering challenges.

The first hurdle is the global common rules that Vietnam must adhere to, such as the global minimum tax, which diminishes the appeal and attractiveness of Vietnam’s current tax incentives, necessitating Vietnam to implement far-reaching changes.

Another challenge results from internal economic changes, such as the waning advantages of a young workforce and affordable labour costs. Vietnam is also shifting its focus towards attracting higher-quality foreign investment to climb up the global supply chain.

Moreover, the impacts of climate change and increasing consumer concerns over environmental issues are gradually altering their consuming behaviours. The EY Future Consumer Index, released in November 2023 and involving over 22,000 participants from 28 countries, including Vietnam, shows that 46 per cent of consumers extremely concerned about climate change.

The percentage of consumers that have already started to buy products that protect them from the climate impact is also high, at 25 per cent. These shifts compel manufacturers in Vietnam and globally to integrate sustainable development to meet these green consumer demands.

Being heavily impacted by climate change, Vietnam has implemented substantial policy reforms to attract investments and actively participates in global initiatives to promote and pursue sustainable development strategy. Additionally, Vietnam has pledged to achieve net-zero emissions by 2050.

With that, the “green carpet” approach is one that aims to promote sustainable policies and solutions to draw in high-quality investments, enabling Vietnam to maintain and enhance its investment attraction status while preparing for new investment opportunities. This approach prioritises innovative and knowledge-based industries over traditional ones like manufacturing or resource extraction.

The country’s foreign investment cooperation strategy for this decade emphasises the attraction of high-tech, modern management projects with significant value-addition and positive impacts on the global supply chain. To achieve this goal, Vietnam must implement specific solutions to meet investors’ urgent needs and align with sustainable development goals, in addition to general solutions such as macroeconomic stability, infrastructure improvement, and human resource quality.

Electricity supply is a major concern for investors, with stability and integration of renewable energy sources being critical factors. To achieve a carbon-neutral power grid by 2040, many major investors have joined RE100 and committed to using 100 per cent renewable energy in their production activities. Several prominent foreign investors in Vietnam are part of this list and have established specific implementation timelines.

Vietnam must quickly finalise regulations to support investors in meeting their renewable energy commitments. Implementation of the direct power purchase agreement, which allows customers to purchase electricity directly from renewable energy projects, is strongly recommended. This will enable investors to access and consume green energy, rather than solely relying on purchasing emission reduction certificates to fulfill their commitments.

Furthermore, Vietnam should encourage the development of green industrial parks (IPs). The government has taken steps towards new models of IPs through a 2022 decree that includes provisions pertaining to new models, contributing to policy enhancement and fostering investor confidence in constructing eco-IPs, thereby promoting sustainable development. Additionally, it encourages the conversion of existing parks into eco-IPs.

To enact the policy, it is recommended that local authorities actively attract reputable investors who can help develop successful green IP models in Vietnam. Such development should prioritise connecting and enhancing social responsibility towards workers and surrounding communities.

In addition, the government should continue to coordinate with domestic and international professional organisations to promote, build, and recommend or issue a comprehensive set of environmental, social, and governance standards, as well as mandatory reporting requirements for diverse types of businesses.

The presence of multiple standards, each with their own set of criteria from various organisations, has posed challenges and confusion for businesses when it comes to selecting and implementing them.

Latest trends and robust transformations of the global economy exert significant pressure on the shift of Vietnam’s economy and foreign investment attraction policy. Therefore, the Vietnamese government should be flexible and adaptive in their policies to stay competitive in the new game.

*The views reflected in this article are the views of the author, and do not necessarily reflect the views of the global EY organisation or its member firms.

| Incentives abound for minimum tax adoption Vietnam has been urged to create more incentives for foreign investors following the country’s decision to apply a new international corporate income tax top-up. |

| Fitch Ratings forecasts Vietnam’s favourable medium-term growth Credit rating agency Fitch Ratings has forecast Vietnam’s growth in the medium term at around 7 per cent, with many favourable signs. |

| FDI performance ends year on a high Vietnam was able to report strong foreign investment attraction results for the whole 2023 on the back of efforts to improve the domestic investment climate. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version