FDI performance ends year on a high

Despite relatively poor performance in the first half of the year, foreign direct investment (FDI) figures were up by almost one-third for the whole of 2023.

|

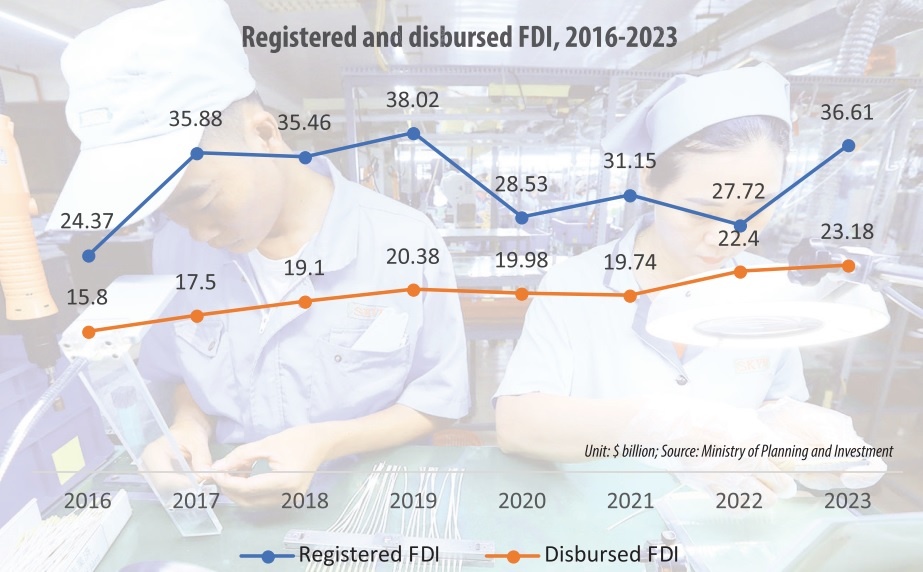

According to the Ministry of Planning and Investment, as much as $36.61 billion in FDI was registered as of December 20, up 32.1 per cent on-year. Realised FDI rose 3.5 per cent from a year ago to hit $23.18 billion, a record level.

Among this, newly registered capital surged by 62 per cent on-year to reach $20.2 billion. The number of newly registered projects was 3,188, up 56.6 per cent. There were just over 1,260 projects (up 14 per cent on-year) bringing in investment capital with total additional capital of $7.88 billion, down 22.1 per cent.

The value of capital contribution and share purchase deals, whose total number reached over 3,450, climbed by 65.7 per cent to $8.5 billion.

The results come from initiatives in investment promotion activity at the central level. In recent years during business trips to other countries, Minister of Planning and Investment Nguyen Chi Dung makes a point of visiting the headquarters of huge companies to carry out investment promotion directly.

“Countries are competing very fiercely. Therefore, to seize the shifting investment capital flows, we must closely work with every investor and every project, and drastically advance investment promotion to urge and motivate foreign investors to make decisions soon. Otherwise, they will miss out on the opportunities,” Minister Dung has said at various events.

At the end of December after a business trip to Japan with Prime Minister Pham Minh Chinh, Minister Dung travelled to South Korea to visit and work with Samsung at Samsung Digital City, and SK Group’s chip factories, liquefied hydrogen, and liquefied natural gas power plants.

During a trip by PM Chinh to the United States in September, numerous bilateral and investment promotion activities took place, and many cooperation agreements were signed with US tech giants. Particularly, the PM visited the HQ of semiconductor company Nvidia and invited its president Jensen Huang to Vietnam. Less than three months later, Huang arrived and opened up a new chapter in cooperation with Vietnam in AI and semiconductors, acknowledging that it would establish a legal entity in Vietnam soon.

At a local level, many localities focus on reforming administrative procedures to improve the quality of the business and investment environment, ensure healthy and equal competitiveness, and boost transparency. In particular, localities pay special attention to shortening handling time, simplifying dossier components, and standardising administrative procedures directly related to investment and business activities.

The northern province of Quang Ninh is one example. It has made an impression with investors thanks to speedy licensing for projects. In June last year, Foxconn’s two new projects in the province were granted investment certificates just 12 working hours after the company submitted an online application, instead of the typical two weeks.

These expansions raised the total number of its projects in the province to three, with the total registered capital of more than $383 million, accounting for about one-tenth of Foxconn’s investment scale in Vietnam.

Hoang Trung Kien, director of Quang Ninh Economic Zones Management Authority, said, “While preparing registration documents, the board and relevant departments also supported the investor. After the documents were completed, the issuance of certificates for the two projects was conducted quickly, creating confidence for Foxconn and other businesses who have chosen and will choose Quang Ninh to invest in,” Kien said.

Thanks to non-stop effort and initiative, many localities have attracted large-scale foreign investors to set up manufacturing hubs, and 2023 was the first year that Nghe An, Hai Duong, and Thai Binh provinces each attracted over $1 billion in investment.

| Gabor Fluit, chairman, European Chamber of Commerce Vietnam

European investment in Vietnam will likely increase in 2024, although at a slower pace than before 2020. A key indicator of European business sentiment in Vietnam is the Business Confidence Index from the European Chamber of Commerce Vietnam (EuroCham). This index increased from 43.5 in Q2 of 2023 to 45.1 in Q3 of 2023, suggesting confidence is on the rise. And despite ongoing uncertainty, Vietnam ranks highly among European investors - two-thirds of EuroCham members ranked it a top 10 global investment destination, while 31 per cent put it in their top three, and 16 per cent viewed it as their number one worldwide. Domestically, policy reforms will continue to draw in European investor interest, but regulation and permit uncertainties are our greatest obstacles. Yes, the positive improvements we see year after year are encouraging, and European businesses really feel the effects. Nevertheless, Vietnam should continue to address these issues through clear, streamlined policies and regulations specially designed for attracting capital to high-tech, high-quality, and high-value sectors. Looking ahead, a large amount of capital is expected to flow into green energy and green tech, as was demonstrated with the excitement around EuroCham’s Green Economy Forum in November. Nevertheless, for Vietnam’s clean energy economy to really take off at the required rate, the power grid must be modernised and regulations streamlined to facilitate both new energy projects and existing investments. A reliable power supply is necessary to support the types of industries that will help Vietnam climb the global value chain, and if this priority is not met, the money will simply flow elsewhere. We are very much looking forward to seeing how the implementation of the Just Energy Transition Partnership’s resource mobilisation plan and the further implementation of Power Development Plan VIII will help solve this issue by streamlining energy investments, especially in the grid, offshore wind and solar. However, Vietnam’s investment environment is highly diverse, so it is difficult to cover everything in such a limited amount of space. EuroCham’s 19 sector committees showcase the variety of prospects across industries, and each one eagerly anticipates Vietnam’s future. In particular, Vietnam offers extensive untapped potential in modernising digital infrastructure, expanding healthcare access, scaling domestic brands, upgrading key transport and logistics networks, and transforming major sectors like agriculture and manufacturing. Positive trends happening across demographic and socioeconomic factors, coupled with pro-growth policy reforms, will likely continue to stimulate broad economic development, and various industries stand ready to benefit from what the future holds. Since 1998, we have been serving as the representative voice for European businesses in Vietnam, supporting a range of sectors from small- and medium-sized enterprises to multinational corporations. EuroCham has been playing a pivotal role for European businesses eyeing the Vietnamese market and for Vietnamese firms aiming for European expansion, offering a bridge to benefits under the EU-Vietnam Free Trade Agreement. Fred Burke, vice chairman, HKBAV

Trade and investment relations between Vietnam and Hong Kong has a strong year in 2023, to the point where it might well be said that the prospects for a new phase of growth have rarely been better. Hong Kong has worked hard to set the stage for a big improvement in the trade relationship, including by means of a series of high-level delegations designed to boost the bilateral relationship. Each one involved numerous contacts with new and existing trade and investment counterparties. From the Vietnam side, a Ministry of Planning and Investment delegation participated in a belt and road summit, and a delegation from the Ministry of Natural Resources and Environment went to the HK Eco Expo. The Hong Kong Trade Development Council has helped to bring more than 1,200 companies to attend HK trade fairs and conferences in 2023 alone. The visits have helped ensure that Hong Kong remains one of Vietnam’s top trade and investment partners. Ranked fifth in value among foreign investors in Vietnam, Hong Kong’s total two-way trade is also in the top 10, ranking seventh in 2021 and 2022, and eighth for much of 2023. Signs are that this ranking will rise in 2024. Nobuyuki Matsumoto, chief representative Japan External Trade Organization Ho Chi Minh City

Overall foreign direct investment in Vietnam for most of 2023 increased by nearly 15 per cent, but investment from Japan decreased by 32.5 per cent. This is thought to be largely due to the impact of the global economic recession and the weak yen. In particular, the depreciation of the yen has had a significant impact, weakening the yen by 43 per cent compared to three years ago, greatly reducing desire to expand overseas. However, the number of investments increased 23.3 per pent and the number of visitors to our Ho Chi Minh City office continues to be high, suggesting that the interest in Vietnam of Japanese investors is still strong. According to our survey conducted in August, interest in Vietnam also remains high, with 56.7 per cent of firms indicating they plan to expand their business in the next 1-2 years. This is more than the ASEAN average of 47.5 per cent and second only to Laos (63.3 per cent). Based on such results, although it will depend on the speed of the global economic recovery and the degree to which the yen’s depreciation improves, it is expected that investment from Japan in 2024 will be focused on targeting domestic demand in Vietnam. Federico Vasoli, managing partner dMTV Global

In 2023, Vietnam’s foreign investment landscape encountered a notable lull, especially from my native Europe. The foremost stumbling block was the opaque legal framework, dissuading potential investors due to uncertainty in navigating the business landscape. Compounded by labyrinthine procedures, Vietnam posed hurdles that deterred prospective foreign funding. Additionally, Europe’s looming crisis cast a shadow, prompting businesses to adopt a cautious stance, impacting investment decisions globally. However, recent legislative strides signal a positive trajectory for foreign investment magnetism, and the government shows it cares about attracting overseas funding and listens to stakeholders. To bolster such allure, pivotal steps emerge. Clarity and consistency in the legal framework stand as linchpins for investor confidence, while simplified procedures and cost-effectiveness are requisites. Facilitating profit repatriation, expediting business visas and work permits, and expeditiously recognising and enforcing foreign judicial decisions, including arbitral awards, and intellectual property rights extension will fortify Vietnam’s appeal to prospective investors. Carlo Fabrizi, legal advisor, Hanoi Office D’Andrea and Partners Legal Counsel

Concerning the business situation of 2023, we saw an increase in investments, especially in the north of Vietnam, by Chinese counterparties that are establishing big-scale manufacturing plants in key provinces such as Bac Ninh. As for European businesses, we had the opportunity to perform the incorporation process of various subsidiaries of important Italian brands willing to choose Vietnam as their regional headquarters, in order to be able to distribute their products along the Asia-Pacific region in a more efficient way. As for 2024, the forecast still remains uncertain, as Vietnam has been experiencing both a financial and real estate crisis, just as has recently happened in some neighbouring countries. However, we believe that the Vietnamese government has been taking wise choices in the past year, such as the new visa exemption policy and other pieces of legislation, which are making immigration policies smoother and more structured. We think that new investments from China and European countries, along with a series of favourable and effective policies for foreign investment, will definitively contribute to the growth of Vietnam’s economy during the next year, and will support it to overcome the difficulties that its economy is now facing. Sami Kteily, executive chairman Pebsteel

It was a tough year for the construction industry in Vietnam. Several projects were put on hold and collection of our dues from ongoing projects faced long delays. Luckily, our overseas operations remained buoyant and helped compensate, if partially, for the drop in revenues from Vietnam. Overall, revenues fell by around 20 per cent, but thanks to the dip in steel prices during 2023 and our management controls, we finished the year with a nice profit to keep our shareholders happy. At Pebsteel, we have a 29-year record for profits every year and dividend distribution every year, and we strive to keep this record going from one year to another. Thanks to the Vietnamese government’s support for the construction industry, we noticed that starting Q3/2023 projects that were put on hold started moving again. The good news is that as we gear up to 2024 and our 30-year anniversary, we are starting the year with a very healthy backlog of jobs in hand, so we have increased our budgeted target for 2024. Ivan Lai, country manager Garmin

Despite the global economic recession and inflation in 2023, we are aiming at 45 per cent growth. In the context of Vietnam, we observe a thriving market, and in 2023, Garmin Vietnam has achieved noteworthy business outcomes. We have established 11 branded stores in Hanoi and Ho Chi Minh City and plan to expand our presence further by opening more brand stores in major cities and neighbouring provinces. Furthermore, we have extended the reach of Garmin Run Club, a scientific running training and community exchange platform, to both Hanoi and Danang. In 2024, our commitment is to introduce products that cater to the diverse needs of users. Our recent collaboration with VPBank led to the launch of the Garmin Pay application, and in the coming year, we plan to extend this service to various other banks to reach a broader customer base. Additionally, Garmin is actively investing in the health sector to contribute to development of insurance and corporate health. Dominic Scriven, chairman Dragon Capital

Amidst the global economic contraction, Vietnam’s position is closely aligned with China, indicating a rising trend in its economic cycle. Observing the US, where inflation is on a decline and job numbers are decreasing, yet interest rates remain high. Credit card defaults are on the rise, and a significant increase in business bankruptcies has been observed in the first nine months. However, actual interest rates in the US remain high due to substantial government spending and fiscal support packages, exceedingly even those in Vietnam. Globally, central banks, as of October, have seen more interest rate cuts than hikes, putting pressure on the US dollar’s strength and posing challenges for developing countries like Vietnam. Looking at Vietnam’s trade prospects, the global trend of increasing interest rates appears to have peaked, with the possibility of the US Federal Reserve cutting rates from May 2024. US rates are expected to remain high for a prolonged period, prompting developing countries like Vietnam to reduce their rates before the US. This could lead to a continued strengthening of the US dollar. Vietnam’s large exports have seen a decline in 2023, with a recent mild recovery focusing on consumer goods. Producers and wholesalers continue to reduce inventories. Additionally, international competition, particularly from Bangladesh in the garment and textile industry, is intensifying. Positively, the State Bank of Vietnam and commercial banks are noting significant reductions in interest rates for housing and vehicle loans in 2023, although credit growth remains unclear. Monetary cycle signs are positive, indicating a gradual decrease in interest rates in Vietnam. Inflation in Asia, including Vietnam, no longer poses significant challenges. Interest rates are expected to continue declining in 2024. Tharabodee, Serng-Adichaiwit general manager Bangkok Bank Vietnam

This year has been the most challenging of the decade thus far. All segments have been badly impacted by slow external demand and real estate issues, which caused people to have less confidence in job security and spend less. Many companies I know reported revenue drops of 20-80 per cent on-year. Most businesses now reduce their expenses at all costs, while postponing plans regarding new capital expenditure to ride out the situation. The Vietnamese government is doing everything it can to bring back momentum in terms of interest rate reductions, reducing VAT, and accelerating spending as well as tapping into new export markets. Thus, the situation now is just a little bit better than the beginning of 2023. However, the short term will be challenging. I am still very confident in Vietnam’s long-term prospects thanks to its strong fundamentals of healthy public debt, controllable inflation, and stable currency. Our bank just finished injecting $200 million more capital into our Vietnamese unit. With all the efforts of the government and improvements in the economy, 2024 will be better than 2023. Bui Van Huy, director, Ho Chi Minh City Branch DSC Securities Corporation

We wholeheartedly endorse every decision made by the State Securities Commission and the Ho Chi Minh Stock Exchange. We have full confidence that, with the concerted efforts of the regulatory agency and its member entities, including ourselves, that the new KRX technological infrastructure will soon become operational. KRX is anticipated to introduce a suite of innovative products and solutions to the Vietnamese stock market, including T+0 trading, short selling, and other advanced trading and settlement options. These developments are expected to address critical bottlenecks and pave the way for upgrading Vietnam’s market from a frontier to an emerging market status. This includes the implementation of central counterparty clearing and improving the quality of infrastructure, which are key steps in elevating Vietnam’s position in the global financial markets. This advancement, we believe, will attract significantly more capital from foreign funds and international investors to the Vietnamese stock market. Furthermore, the market will become more transparent and offer a greater variety of new products. Manoj Mishra, general manager, TBC-Ball Beverage Can Vietnam Limited

Despite global economic volatility in 2023, our company thrived, positioning us for substantial growth in 2024. We appreciate the government’s measures in cultivating an enabling business environment. Their steadfast commitment to sustainability, exemplified through circular economy principles and striving for net-zero emissions, aligns seamlessly with our corporate ethos, fortifying a stable platform for business expansion. The collaborative synergy between the private sector and the government in Vietnam is pivotal. This unified approach serves as the bedrock for advancing sustainability initiatives, laying the groundwork for a more environmentally conscious and economically resilient nation. Our resilience in overcoming challenges fuels our optimism. As we transition into 2024, driven by past successes and Vietnam’s promising economic trajectory, our dedication to growth, sustainability, and positive contributions to the business landscape remains unwavering. We deeply value the government’s collaborative efforts, which are integral in shaping a thriving future. Marko Walde, chief representative Delegation of German Industry and Commerce in Vietnam, Myanmar, Cambodia, and Laos

Amid ongoing global economic uncertainties, German businesses still consider Vietnam as one of the most potential developing markets in Asia. Today, about 500 companies from Germany have invested roughly $2.68 billion in Vietnam for 463 valid projects. German investors have created some 50,000 jobs, thereby continuing to make positive contributions to bilateral economic relations. These German projects include large corporations but mainly small- and medium-sized enterprises, which have chosen Vietnam as an investment destination, thereby continuing to make positive contribution to bilateral economic relations. In 2023, the investment situation from Germany to Vietnam has shown positive signs and reflects the growing confidence of German businesses in the Vietnamese market. According to the data provided by Vietnam’s Ministry of Planning and Investment, from January 1, 2023 to December 20, 2023, Germany has invested a total of $366.2 million in registered capital. In order to further improve investment in Vietnam and enhance its attractiveness as a destination for foreign investors, the government should continue its efforts to streamline administrative procedures, to invest in infrastructure development, particularly in transportation and logistics. Moreover, enhancing the competitiveness of local businesses, developing robust industry clusters, imparting specialised workforce training, adhering to international standards, and ensuring a stable electricity supply for sustainability are pivotal steps to enhance Vietnam’s investment appeal. Ranjit Thambyrajah, managing director Acuity Funding

Acuity Funding has made a strong commitment to be part of Vietnam’s growing economy for the long term. For us, 2023 has been a year marked by a number of landmark achievements, confirming our commitment to Vietnam. During our five years, we have strengthened our footprint here by opening a local branch. We have contributed to the guideline book publication about Vietnam’s outbound investment and attracted a large range of media attention in Vietnam, South Korea, the US, and Australia. We expanded our business and now take care of transactions in over 30 countries, including the US, Africa, and parts of the Middle East. In 2024, we expect to strengthen our already strong position in the market by building on what we have achieved in 2023. We intend to become the leading global private credit firm with funding reserves of over $600 billion, provide more specialised designed funding packages, including revitalising official development assistance for developing countries and providing large local currency loans. We will also expand activities in other emerging markets such as Cambodia, Bangladesh, Central Asia, and Africa, and make better use of our SWIFT code within the Vietnamese banking system. Nguyen Quynh Tram, country general manager Microsoft Vietnam

As 2023 nears its end, the widespread adoption of AI technology in Vietnam signifies a transformative shift across multiple sectors. This technology is increasingly utilised in everyday operations, from enhancing customer support to streamlining data management, thus elevating digital accessibility and improving life and financial inclusivity. Such developments underscore growing recognition that AI, while a transformative tool, is just the beginning of a larger journey. It is not an end in itself, but a facilitator for enhancing human-centric tasks. AI technologies are enabling more creative, interactive, and efficient workflows across various industries. This trend aligns with Microsoft’s ongoing mission to leverage technology in empowering individuals and organisations globally. Nguyen Do Quyen, coo FPT Retail

FPT Long Chau continuously grew in 2023, and reached the milestone of 1,600 pharmacies. To achieve this, we have focused on several main factors: digital transformation, application of AI, development of logistics infrastructure, and well-trained human resources, as well as cooperation with various domestic and foreign partners. In 2024, FPT Long Chau aims to continue to grow revenue by double digits. It will also focus on strengthening its position as the No.1 pharmacy, especially in prescription drugs, thus bringing customers the best choice at the most suitable prices in the market. In addition, we will introduce additional services, apply technology, and promote digital transformation into operation to bring the best experiences in consulting, shopping, delivery, and healthcare to customers. |

| Localities anticipate criteria framework to attract FDI Many localities are waiting for more specific criteria for the attraction of high-profile foreign-led initiatives. |

| FDI flows topped $36.61 billion in Vietnam in 2023 Vietnam continues to shine as an attractive business destination with foreign direct investment (FDI) surging in 2023. |

| Incentives abound for minimum tax adoption Vietnam has been urged to create more incentives for foreign investors following the country’s decision to apply a new international corporate income tax top-up. |

| Fitch Ratings forecasts Vietnam’s favourable medium-term growth Credit rating agency Fitch Ratings has forecast Vietnam’s growth in the medium term at around 7 per cent, with many favourable signs. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- SK Innovation-led consortium wins $2.3 billion LNG project in Nghe An (February 25, 2026 | 07:56)

- THACO opens $70 million manufacturing complex in Danang (February 25, 2026 | 07:54)

- Phu Quoc International Airport expansion approved to meet rising demand (February 24, 2026 | 10:00)

- Bac Giang International Logistics Centre faces land clearance barrier (February 24, 2026 | 08:00)

- Bright prospects abound in European investment (February 19, 2026 | 20:27)

- Internal strengths attest to commitment to progress (February 19, 2026 | 20:13)

- Vietnam, New Zealand seek level-up in ties (February 19, 2026 | 18:06)

- Untapped potential in relations with Indonesia (February 19, 2026 | 17:56)

- German strengths match Vietnamese aspirations (February 19, 2026 | 17:40)

- Kim Long Motor and AOJ Suzhou enter strategic partnership (February 16, 2026 | 13:27)

Tag:

Tag:

Mobile Version

Mobile Version