System crafted for ASEAN attraction

|

At the 24th ASEAN Investment Area Council Meeting under the ASEAN Economic Ministers’ Meeting last week, an investment facilitation framework (AIFF) was announced based on initiatives and implementation of regional members in mobilising foreign direct investment (FDI) as a key priority for the post-pandemic period.

The AIFF points out some practical recommendations for ASEAN country members. In the opinion of Secretary General of ASEAN Lim Jock Hoi, improving investment facilitation processes and procedures is the most important target, which includes improving transparency and predictability of investment measures, streaming and speeding up administrative procedures and requirements, and strengthening coordination and cooperation, especially on cross-border issues.

“The movement of people and capital should be focused on enhancing talent mobility within the region and from outside the region, as well as providing necessary regulations/ framework for movement of people and capital,” said the secretary general.

Digitalisation, a modern economy, and sustainability are also on the radar of the bloc through smarter incentives for sectors contributing to sustainable development and leveraging new technologies to attract new economies.

“The role of FDI for economic recovery is quite important, focusing on liberalisation and protection, but less attention on promotion and facilitation, which are the things that the AIFF aims to do,” said Hoi.

Several initiatives have been carried out in ASEAN member states to improve FDI mobilisation. Countries such as Cambodia, Laos, and Vietnam have built public-private dialogue mechanisms, established business support centres and one-stop online services, and amended numerous laws and regulations related to business and trade.

Elsewhere, in addition to updating legal provisions, Myanmar is interested in infrastructural development as a key factor in the comprehensive economic recovery plan, which will be approved at the end of this month, and considered as momentum for growth.

And in Indonesia, its investment ministry believes mining will be the country’s key industry once it recovers from the global health crisis, hoped to be by early 2022.

FDI flows into ASEAN in 2020 fell by 25 per cent to $137 billion from an all-time high of $182 billion in 2019 due to the COVID-19 pandemic. Despite the decline, ASEAN remained an attractive investment destination, with its share of global FDI rising from 11.9 per cent in 2019 to 13.7 per cent in 2020. The United States is currently the biggest investor in ASEAN with the proportion of more than 30 per cent, even higher than intra-regional FDI. This is followed by Hong Kong (8.7 per cent), Japan, China, South Korea, and Canada.

Seeing the challenges that the COVID-19 is bringing to all economies around the world, Vietnam’s Deputy Minister of Planning and Investment Nguyen Thi Bich Ngoc noted some opportunities that the health crisis has opened for Vietnam and its neighbours such as investment relocation and joining more supply chains.

“I recommend that the AIFF should provide some assessment on the recent pandemic outbreaks in ASEAN and its impacts on regional and global supply chains, as well as the moving trend of FDI. Some facilitation solutions involving transport and immigration are quite necessary in this context,” said Ngoc.

In the ASEAN Investment Surveillance Report 2020, the growth of the bloc’s real GDP in 2020 was estimated at -3.3 per cent, dropping from 4.7-6.2 per cent over the last decade. It is forecasted to recover to 4 per cent in 2021 and 5.2 per cent in 2022.

“However, these forecasts are not all that concrete because of the emergence of new COVID-19 variants and low coverage of vaccinations in some member countries,” said ASEAN Secretary General Hoi.

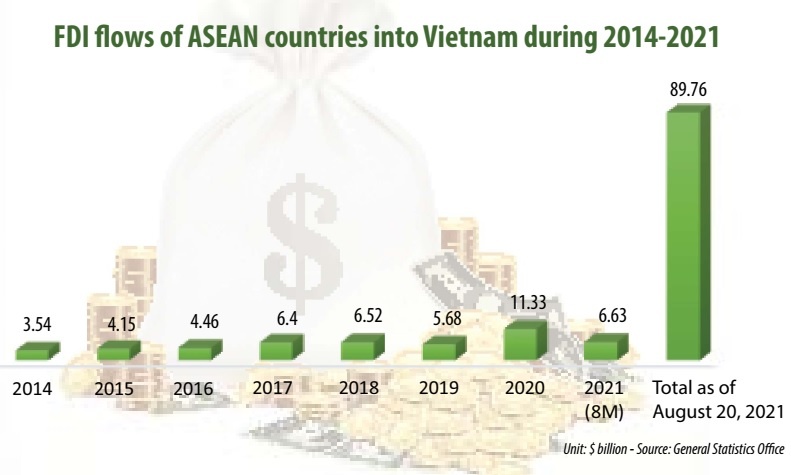

Compared to some other ASEAN nations, Vietnam is still expected retain positive growth in 2021. Registered FDI into the country last year decreased by 15 per cent, albeit stronger than the average drop of 31 per cent in ASEAN as a whole. Registered FDI in the first eight months of the year remained good despite a decline of 2 per cent on-year only.

Over the last decade, Vietnam has been an attractive destination for overseas funding thanks to the impressive registered FDI growth between 10.4 per cent in 2013 and the peak of 81 per cent in 2019, while Singapore reported a growth at 63 per cent over the previous six years and Thailand and Malaysia confirmed a fall in FDI.

| Economic impacts in ASEAN since emergence of COVID-19 According to the Asia-Pacific Trade and Investment Trends 2020-2021 of the United Nations Conference on Trade and Development, ASEAN member states were one of the largest subregional sources of intraregional investments in both 2019 and 2020, contributing 35 per cent and 20 per cent of the total in each of the respective years. While intraregional investment from this subregion remained stable at around $48 billion in 2018 and 2019, it has nonetheless significantly dropped off in the first eight months of 2020 to just below $10 billion. Major disruptions in supply chains along with postponed and cancelled investment projects due to lockdown measures have largely been responsible for this considerable slowdown. Singapore and Thailand were the largest sources of intraregional FDI from ASEAN in both 2019 and 2020, with Singapore responsible for 26 per cent of total intraregional investment emanating from ASEAN in 2019 and 85 per cent thus far in 2020; and Thailand responsible for 17 per cent in 2019 and 13 per cent in 2020. Intraregional investments as a whole have slowed in 2020 and 2021 due to the pandemic. Although intraregional investments are not expected to rebound before 2022, the recent signing of the Regional Comprehensive Economic Partnership (RCEP) is expected to strengthen flows and lift investment prospects. Despite large increases in 2019, inflows into ASEAN have significantly tapered off in 2020 in large part due to the pandemic. In particular, as these economies are highly integrated into regional and global value chains in the manufacturing sector, lockdown measures that temporarily halted production have contributed to slowing investment levels. For instance, Mazda, and Nissan all halted production in Thailand, Ford temporarily slowed production in Thailand and Vietnam, while Toyota temporarily stopped production in Indonesia and Thailand. Similar production shutdowns also occurred in several other sectors, including most notably the textile and apparel sector. These temporary factory shutdowns are expected to translate into lower overall investment levels, particularly reinvested earnings and greenfield investment levels. Although the crisis has caused a downturn in investment in the subregion, prospects for recovery in the medium and long term remain strong because of the subregion’s well-established trade and supply chain networks, growing middle class, and young and educated workforce. The dual pressure of increased automation and widespread demand and supply shocks to global value chains caused by the pandemic has intensified pressure on lead businesses to rethink supply chain dependencies and ways to make them more resilient. Looking ahead, this may prompt more lead corporations to re-shore or nearshore critical parts and equipment in the short- and medium-term. This will have important consequences for value chain-linked FDI in the subregion’s economies as well as more broadly for the subregion’s small- and medium-sized enterprises which are both highly integrated into and dependent on value chain networks. Enhanced regional integration through both RCEP and the ASEAN Economic Community will therefore become even more important as it may present alternative and new opportunities for businesses to strengthen their competitiveness. Beyond this, new opportunities may emerge for businesses, with the support of a conducive policy environment, to leverage opportunities to strengthen their competitiveness in new and emerging value chains in digital technologies, such as AI, blockchain and 5G. Source: United Nations Conference on Trade and Development |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Hermes joins Long Thanh cargo terminal development (February 04, 2026 | 15:59)

- SCG enhances production and distribution in Vietnam (February 04, 2026 | 08:00)

- UNIVACCO strengthens Asia expansion with Vietnam facility (February 03, 2026 | 08:00)

- Cai Mep Ha Port project wins approval with $1.95bn investment (February 02, 2026 | 16:17)

- Repositioning Vietnam in Asia’s manufacturing race (February 02, 2026 | 16:00)

- Manufacturing growth remains solid in early 2026 (February 02, 2026 | 15:28)

- Navigating venture capital trends across the continent (February 02, 2026 | 14:00)

- Motivations to achieve high growth (February 02, 2026 | 11:00)

- Capacity and regulations among British areas of expertise in IFCs (February 02, 2026 | 09:09)

- Transition underway in German investment across Vietnam (February 02, 2026 | 08:00)

Tag:

Tag:

Mobile Version

Mobile Version