Sustainability reports still underutilised

According to the State Securities Commission (SSC), while the issuance of a sustainability report is considered a tool that could improve enterprises’ awareness of new business risks and opportunities, such issuance has not been taken full advantage of. In the 2022 reporting season, only 19 companies issued a separate sustainability report.

|

| Sustainability reports still underutilised. Photo: shutterstock |

Ta Thanh Binh, head of Securities Market Development at the SSC, said the top-performing companies in general are those that go above and beyond common norms. For instance, they often work hard to create an impartial report on sustainable development that meets all applicable international norms. One example is Vinamilk – the only Vietnamese listed company to be included in the “ASEAN Asset Class” according to the ASEAN Corporate Governance Scorecard.

“Non-financial matters are placing their increasing importance into investors’ consideration. Progressive financiers do not only gauge a company’s success and performance by financial indicators like they did in the past,” Binh noted. “The concerted effort to launch a separate sustainability report, besides a sustainability section in an annual report, is an impetus, together with solid corporate governance.”

Nguyen Van Thang Long, senior lecturer of professional communication at RMIT University in Vietnam, assessed that in the midst of redundant corporate social responsibility (CSR) commitments from businesses, regular transparency reports will help businesses gain trust from customers.

“For many objective and subjective reasons, the implementation of CSR activities at many businesses only stops at sponsorship and charity. The majority of consumers do not fully trust businesses’ CSR implementation, and see them only as PR and branding efforts,” Long noted. “Therefore, maintaining the disclosure of regular transparency reports will help businesses demonstrate the transformation of commitments into practical actions.”

|

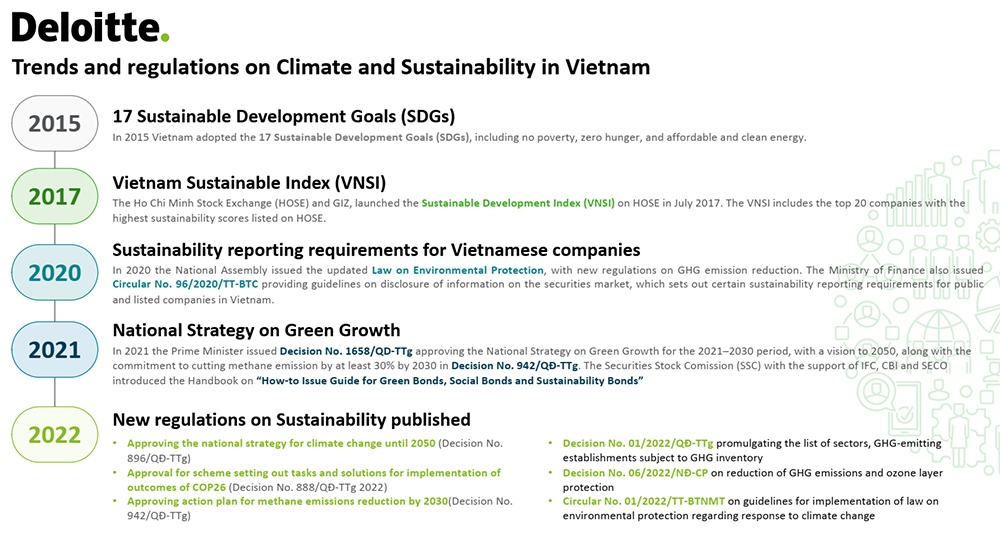

Last year marked 10 years that Vietnamese listed companies have published information on sustainable development. According to Nguyen Viet Thinh, head of the sustainability report scoring team at the Vietnam Listed Company Awards, disclosure of greenhouse gas (GHG) emissions in 2022 has been superior to previous years.

“Many businesses have kept pace with changes in legal regulations as well as trends in combating climate change in Vietnam and around the world. Quite a few enterprises have published information on total GHG emissions by different ranges, with most mentioned programmes to combat climate change,” Thinh assessed.

He added that the trend of shifting business models from a linear economy to a circular economy is more commonly described. If in the last three reporting seasons, there were only a few emerging names, businesses in the past year are increasingly improving themselves to be in the ranks of enterprises with good information disclosure on sustainable development.

“Sustainable development for 2022 is seen more broadly from the environmental, social, and governance (ESG) point of view. Many enterprises have established committees at the board level to direct and supervise ESG activities,” Thinh noted.

He further noted that although the disclosure of information on GHG emissions has clearly improved, the number of enterprises that publish standard information on the subject is still minimal.

According to the PwC Vietnam ESG readiness report 2022, Vietnamese companies lag global counterparts in seeking independent assurance on ESG disclosures.

“While 58 per cent of global companies obtain independent assurance on their ESG information, only 36 per cent confirmed in our report that their ESG reporting in Vietnam is audited or verified by external independent parties,” the report said. “On the other hand, while 53 per cent of Vietnamese business respondents indicate they have assessed the data required for external reporting, only 30 per cent have actioned on the ESG reporting/disclosure. This, once again, highlights the crucial role regulators can play in spurring action within the Vietnam business community.”

| Implement ESG criteria–or lose out on investment Why integrate ESG plans into business? Dealmaking potential ripe in Vietnam for ESG-minded groups |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Trung Nam-Sideros River consortium wins bid for LNG venture (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Envision Energy, REE Group partner on 128MW wind projects (January 30, 2026 | 10:58)

- Vingroup consults on carbon credits for electric vehicle charging network (January 28, 2026 | 11:04)

- Bac Ai Pumped Storage Hydropower Plant to enter peak construction phase (January 27, 2026 | 08:00)

- ASEAN could scale up sustainable aviation fuel by 2050 (January 24, 2026 | 10:19)

- 64,000 hectares of sea allocated for offshore wind surveys (January 22, 2026 | 20:23)

- EVN secures financing for Quang Trach II LNG power plant (January 17, 2026 | 15:55)

- PC1 teams up with DENZAI on regional wind projects (January 16, 2026 | 21:18)

- Innovation and ESG practices drive green transition in the digital era (January 16, 2026 | 16:51)

Tag:

Tag:

Mobile Version

Mobile Version