Steep decline in manufacturing output amid COVID-19 outbreak

|

| IHS Markit has reported far-reaching disruptions in manufacturing due to COVID-19 |

Disruption was also felt in supply chains, with delivery times lengthening to the greatest extent in more than 10 years of data collection. The rate of input cost inflation accelerated sharply, but efforts to secure orders meant that firms raised their selling prices at a relatively modest pace.

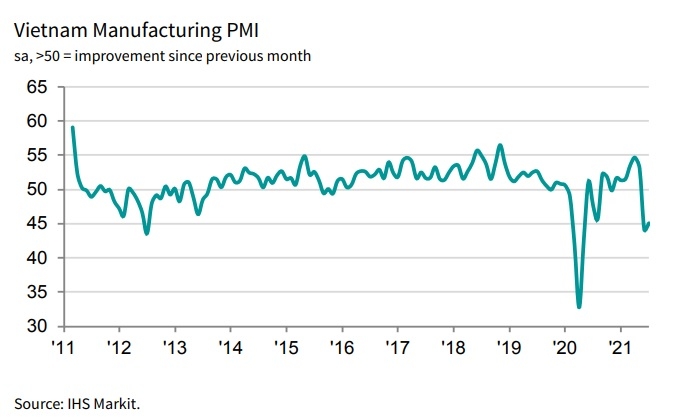

The Vietnam Manufacturing Purchasing Managers' Index (PMI) ticked up to 45.1 in July from June's reading of 44.1. That said, the latest figure signalled a marked deterioration in business conditions across the sector for the second month in a row.

|

Anecdotal evidence from manufacturers highlighted the impact that the latest COVID-19 outbreak has had on operations. Some firms have been forced to close temporarily, while others are having to operate with reduced capacity due to social distancing measures.

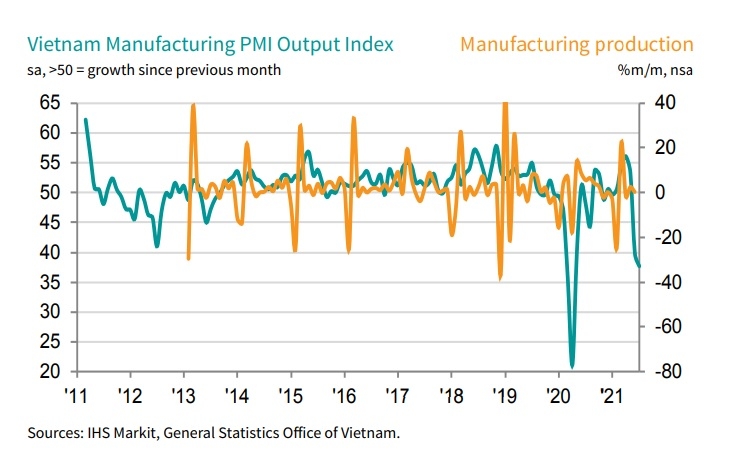

These effects, alongside a marked drop in new orders, resulted in a further sharp reduction in manufacturing production at the start of the third quarter. The decline in output was softer only than those seen following the initial outbreak of the COVID-19 pandemic in March and April last year.

|

Alongside lower total new orders, new business from abroad was also down. That said, the reduction in exports was softer than that seen for total new business amid some reports of improving demand in international markets.

Lower workloads, temporary closures, and limits on staff numbers due to social distancing requirements meant that employment decreased markedly for the second month running.

While disruption to operations led backlogs of work to build up at some firms, this was outweighed by a sharp drop in new orders. Overall, outstanding business decreased moderately.

Severe disruption to supply chains was noted in July, with the extent of delivery delays the most marked since the survey began more than a decade ago. Panellists linked longer lead times to difficulties with transportation both domestically and internationally due to the pandemic, as well as raw material shortages.

Manufacturers were also faced with surging input costs. The rate of input price inflation accelerated to the fastest since April 2011. Higher costs for raw materials such as iron and steel, products imported from China and freight charges were all reported by respondents.

While some firms passed on these higher cost burdens to clients, others were reluctant to do so given a weak demand environment. As a result, the rate of output price inflation was much softer than that seen for input costs, suggesting pressure on profit margins.

Concerns around the ongoing impact of the pandemic meant that business confidence remained below the series average in July, although firms remained optimistic overall of output growth over the coming year.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Tag:

Tag:

Related Contents

Latest News

More News

- Foreign leaders extend congratulations to Party General Secretary To Lam (January 25, 2026 | 10:01)

- 14th National Party Congress wraps up with success (January 25, 2026 | 09:49)

- Congratulations from VFF Central Committee's int’l partners to 14th National Party Congress (January 25, 2026 | 09:46)

- 14th Party Central Committee unanimously elects To Lam as General Secretary (January 23, 2026 | 16:22)

- Worldwide congratulations underscore confidence in Vietnam’s 14th Party Congress (January 23, 2026 | 09:02)

- Political parties, organisations, int’l friends send congratulations to 14th National Party Congress (January 22, 2026 | 09:33)

- Press release on second working day of 14th National Party Congress (January 22, 2026 | 09:19)

- 14th National Party Congress: Japanese media highlight Vietnam’s growth targets (January 21, 2026 | 09:46)

- 14th National Party Congress: Driving force for Vietnam to continue renewal, innovation, breakthroughs (January 21, 2026 | 09:42)

- Vietnam remains spiritual support for progressive forces: Colombian party leader (January 21, 2026 | 08:00)

Mobile Version

Mobile Version