Standard Chartered forecasts 7 per cent growth rate for Vietnam in H2

|

Standard Chartered has provided an optimistic outlook for Vietnam's economy, predicting a rebound in the second half of the year and a growth rate of 7 per cent on-year – compared to the modest 3.7 per cent seen in the first half.

The bank attributes this positive trend to sustained improvements in trade data since the beginning of 2023, indicating a clearer recovery in the latter part of the year.

Tim Leelahaphan, economist at Standard Chartered Bank covering Thailand and Vietnam, highlights Vietnam's economic openness and stability as key factors supporting the country's promising medium-term outlook. He further notes that a continued recovery of tourist arrivals will help strengthen the services balance.

However, despite these positive developments, macroeconomic indicators still indicate relative weakness. The trade contraction has had a deep impact, leading to subdued manufacturing and economic activity.

Although there was a trade surplus in the second quarter, exports declined on a yearly basis. Overall, Vietnam's trade surplus for the first half of the year surpassed the levels seen in 2022, primarily driven by softer imports due to lower energy prices.

In light of the weaker-than-expected data and a gloomier global outlook, Standard Chartered has revised down its GDP growth forecast for Vietnam in 2023 from 6.5 per cent to 5.4 per cent.

The bank also emphasises that sustained investment inflows may require an improved global backdrop and government efforts. To attract foreign direct investment, Vietnam needs to achieve rapid GDP growth and develop its infrastructure. Robust infrastructure, particularly in the logistics sector, could incentivise more manufacturers to relocate their operations to the nation.

In terms of monetary policy, Standard Chartered forecasts that the State Bank of Vietnam (SBV) will further cut the benchmark refinancing rate by 50 basis points to 4.0 per cent in the third quarter, bringing it to the same level seen during the pandemic. The bank expects the SBV to maintain this rate until the end of 2025.

In addition to rate cuts, the SBV has implemented measures such as delaying loan repayments and providing rate waivers to support businesses. However, there are concerns about developers' ability to meet their financial obligations, including interest and principal payments on bonds, as well as funding for working capital and projects.

The property market may require further liquidity support, as the measures implemented so far have only alleviated short-term repayment pressures.

Leelahaphan noted that the SBV has adopted a pro-recovery stance since the beginning of 2023, prioritising growth amidst easing price pressures. However, concerns about inflation and financial instability may limit the scope for additional rate cuts beyond the 50 basis points already anticipated.

According to the bank, risks to the VND foreign exchange outlook are evenly balanced. The bank forecasts that the USD and VND will trade at 23,400 from the end of 2023 through to Q3-2024. Precautionary reserve rebuilding should cap the VND in the near term, and higher US Fed terminal rates and a weaker CNY will also weigh on it.

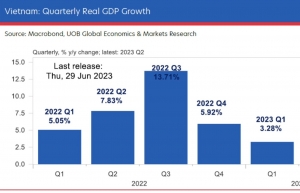

| Full-year GDP growth projection of Vietnam to 5.2 per cent: UOB United Overseas Bank (UOB) has just revised its full-year growth projection down to 5.2 per cent in view of the challenges ahead, particularly for the fourth quarter of 2023 with its high base (in value terms) a year earlier. |

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- State corporations poised to drive 2026 growth (February 03, 2026 | 13:58)

- Why high-tech talent will define Vietnam’s growth (February 02, 2026 | 10:47)

- FMCG resilience amid varying storms (February 02, 2026 | 10:00)

- Customs reforms strengthen business confidence, support trade growth (February 01, 2026 | 08:20)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- Digital publishing emerges as key growth driver in Vietnam (January 30, 2026 | 10:59)

- EVN signs key contract for Tri An hydropower expansion (January 30, 2026 | 10:57)

- Vietnam to lead trade growth in ASEAN (January 29, 2026 | 15:08)

- Carlsberg Vietnam delivers Lunar New Year support in central region (January 28, 2026 | 17:19)

- TikTok penalised $35,000 in Vietnam for consumer protection violations (January 28, 2026 | 17:15)

Tag:

Tag:

Mobile Version

Mobile Version