Southern hub firms urged to act now

CBRE office analyst Greg Ohan said: “Occupiers of 500 square metre or over areas with a lease expiring in 2012 need to think fast and act quickly to secure a stunning deal. The window is now closing, your landlords are ready and willing, but will not be waiting too much longer.”

Ohan said in 2012 landlords scrambled to secure occupancy in light of economic uncertainties and fears of increasing supply. According to a CBRE report, since the final quarter of 2011, landlords have changed their mentality and are increasingly flexible.

Vincom even offered tenants an attractive leasing contract with rents ranging from around $24-$30 per square metre. Bitexco Financial Tower has ever accepted the lowest office rent of $30 per sqm and some other key buildings in Ho Chi Minh City offered not only free rent during the first few months, but also helped fit out offices.

As a result, many tenants in less desirable areas are setting sights on Grade A options.

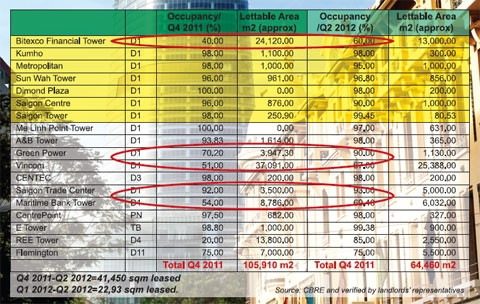

Absorption rates in 2012’s first quarter were approximately 50 per cent greater than the quarterly average alone. Of the CBRE office transactions since the beginning of 2012 to date, 94 per cent were CBD transactions and 39 per cent were completed in the Vincom Centre and Bitexco Financial Tower.

Besides, delays in future supply means Grade A rents may be approaching a short-term bottom.

Previously, it was expected that Grade A buildings such as the 9,100sqm President Place, the 40,000sqm Saigon One, the 12,704sqm Time Square and the 9,125sqm Le Meridien would come online in 2012.

However, only President Place at No.93 Nguyen Du will be handed over by August 2012. Even the construction of Vietcombank Tower on Ton Duc Thang street and BIDV Tower on Nguyen Hue street are at a standstill.

“If we continue at this rate, with companies continuing to grow and new supply significantly delayed, we are approaching a short-term bottom in the market and who is to say if supply is further delayed, prices may begin to rise again until further new supply comes on line. If we look at absorption of 20,000 on average per quarter recently, within three quarters, the current available office space in the key buildings CBRE tracks will be completely absorbed,” said Ohan.

Despite the delays, to date Ho Chi Minh City has approximately 64,000sqm of office space available in the 18 key office buildings.

Ohan said before Centec and Kumho came online in 2009, the five mature Grade A buildings were at almost 100 per cent occupancy which was why rentals hit their peak. Then, when the buildings came online, prices began to level out and drop.

Ohan said the southern hub office market would be determined by the new wave of supply and when it came online. “Having supply is healthy. If we do not have sufficient supply, we will see Ho Chi Minh City remain as the second most expensive city after Singapore for a long time to come for office space in Southeast Asia,” added Ohan.

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Dong Nai experiences shifting expectations and new industrial cycle (January 28, 2026 | 09:00)

- An Phat 5 Industrial Park targets ESG-driven investors in Hai Phong (January 26, 2026 | 08:30)

- Decree opens incentives for green urban development (January 24, 2026 | 11:18)

- Public investment is reshaping real estate’s role in Vietnam (January 21, 2026 | 10:04)

- Ho Chi Minh City seeks investor to revive Binh Quoi–Thanh Da project (January 19, 2026 | 11:58)

- Sun Group launches construction of Rach Chiec sports complex (January 16, 2026 | 16:17)

- CEO Group breaks ground on first industrial park in Haiphong Free Trade Zone (January 15, 2026 | 15:47)

- BRIGHTPARK Entertainment Complex opens in Ninh Binh (January 12, 2026 | 14:27)

- Ho Chi Minh City's industrial parks top $5.3 billion investment in 2025 (January 06, 2026 | 08:38)

- Why Vietnam must build a global strategy for its construction industry (December 31, 2025 | 18:57)

Tag:

Tag:

Mobile Version

Mobile Version