Southeast Asia poised with more M&A opportunities in near-to-medium term

|

| Optimistic about business recovery, Southeast Asia is the epicentre for growth opportunities among corporates in the region |

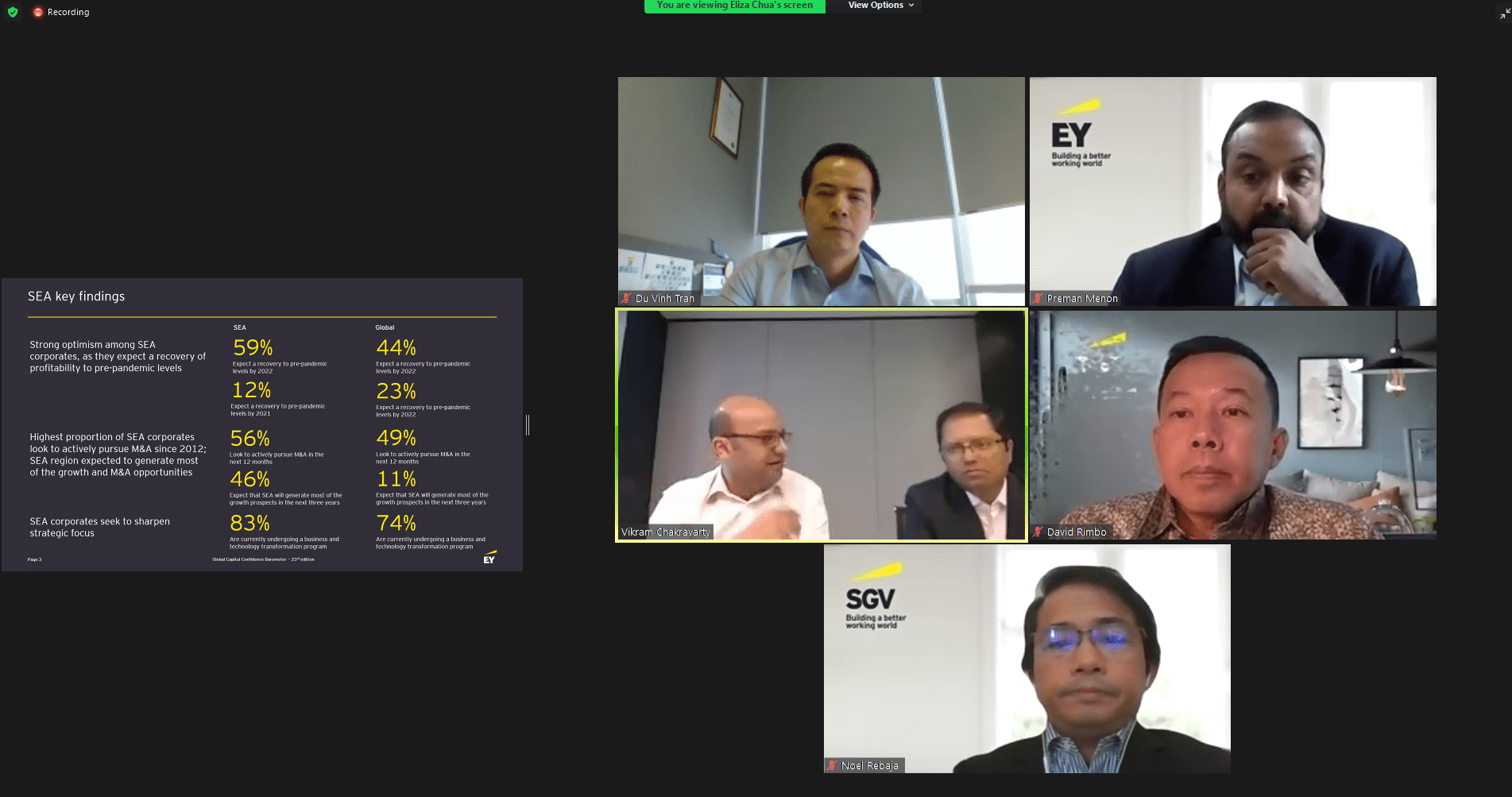

The survey of more than 2,400 executives in 52 countries, including 185 respondents across Southeast Asia (Indonesia, Malaysia, the Philippines, Singapore, Thailand, and Vietnam) found strong optimism among the surveyed business executives, as they expect a recovery in profitability to pre-pandemic levels by 2022 (59 per cent) or even 2021 (12 per cent).

Respondents believe that the key areas where their organisations have outperformed during the pandemic include operational stability (66 per cent); digital transformation (54 per cent); and engagement with local communities (53 per cent). Conversely, innovation of new products and services (54 per cent) scored the highest in underperformance.

With their optimism for business recovery, over half of corporates (56 per cent) are looking to actively pursue mergers and acquisitions (M&A) in the next 12 months – the highest since 2012 and beating the 11-year average of 44 per cent.

About half (46 per cent) of corporates expect that Southeast Asia will generate the most growth prospects and opportunities for their organisation in the next three years. Other geographic regions that are expected to generate growth opportunities are India (18 per cent), Japan (15 per cent), and Oceania (11 per cent).

The top investment destinations (cross-border and domestic) among Southeast Asian corporates are India, Singapore, Japan, Thailand, and China. Technology, advanced manufacturing, power and utilities, as well as consumer and financial services top the list of the most acquisitive sectors for Southeast Asia respondents. An overwhelming 95 per cent of respondents indicate that they are targeting cross-border deals.

Driving this acquisition appetite are concerns about tariffs and trade flows (24 per cent); strengthening of technology, talent and new capabilities (24 per cent); and growth into adjacent business sectors or activities (22 per cent). Luke Pais, EY Asean M&A and Private Equity leader said that, “Southeast Asia is an attractive region from a medium- to long-term growth perspective. Hence, it is no surprise that corporates are favouring the region. Further, conditions for M&A, including low interest rates, accommodative capital markets, and abundant private capital, remain highly supportive. Companies that are bold coming out of a crisis tend to generate far greater value over the long term.”

|

| Southeast Asian corporates seek to sharpen their strategic focus and are open to partnerships to succeed |

Respondents to the survey shared that their main strategic considerations currently are to identify and invest in talent (24 per cent), divest underperforming assets or businesses (22 per cent), and make strategic acquisitions (13 per cent). Key constraints to effective strategy implementation include a lack of leading technology (20 per cent), cost and capital constraints (16 per cent), and a lack of external advice (14 per cent).

A majority (83 per cent) of respondents are currently undergoing a significant business and technology transformation programme. Driving this is the impact of the pandemic (15 per cent), the current validity of purpose and strategic objectives (12 per cent), and changing stakeholder expectations (11 per cent).

Disruption is clearly a key concern, particularly heightened by the pandemic. To succeed, companies should look to better define their strategic focus and positioning in the ecosystem, have the right talent on board to achieve this, and be open to partner with new entrants.

Vikram Chakravarty, EY Global Strategy leader and EY Asean Strategy and Transactions leader said, “We know from history that companies that transformed and transacted after a crisis came out stronger, relative to their competitors. Hence, companies in Southeast Asia must act boldly and embrace digital transformation and M&A as a way to win in the post-pandemic world.”

What the stars mean:

★ Poor ★ ★ Promising ★★★ Good ★★★★ Very good ★★★★★ Exceptional

Related Contents

Latest News

More News

- Vietnamese businesses diversify amid global trade shifts (February 03, 2026 | 17:18)

- Consumer finance sector posts sharp profit growth (February 03, 2026 | 13:05)

- Vietnam and US to launch sixth trade negotiation round (January 30, 2026 | 15:19)

- NAB Innovation Centre underscores Vietnam’s appeal for tech investment (January 30, 2026 | 11:16)

- Vietnam moves towards market-based fuel management with E10 rollout (January 30, 2026 | 11:10)

- Vietnam startup funding enters a period of capital reset (January 30, 2026 | 11:06)

- Vietnam strengthens public debt management with World Bank and IMF (January 30, 2026 | 11:00)

- PM inspects APEC 2027 project progress in An Giang province (January 29, 2026 | 09:00)

- Vietnam among the world’s top 15 trading nations (January 28, 2026 | 17:12)

- Vietnam accelerates preparations for arbitration centre linked to new financial hub (January 28, 2026 | 17:09)

Tag:

Tag:

Mobile Version

Mobile Version